Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Health Savings Accounts (HSA) are one of the best types of accounts for retirement. They have more potential tax advantages and flexibility than any other retirement account.

For those who save diligently saved in HSAs and are now retirement age, creating a financial plan focused around using your HSA and other retirement accounts in a tax efficient manner can be incredibly beneficial.

There is a lot that goes into properly using these accounts though. When should you withdraw from an HSA vs a 401(k)? How do you document HSA withdrawals to ensure they are tax-free? What medical and dental expenses can be paid for with an HSA?

In this post we answer these questions and more to give you a view for how we develop tax-efficient retirement plans for our clients.

Health savings accounts are the only account that offer a “triple tax advantage”. Using an HSA to its maximum potential is key to help you save on retirement taxes. What are the 3 tax benefits of HSAs?

When you contributed to an HSA, you received a tax deduction for your contribution. This is similar to the deduction you receive for saving in your 401(k) or potentially a traditional IRA.

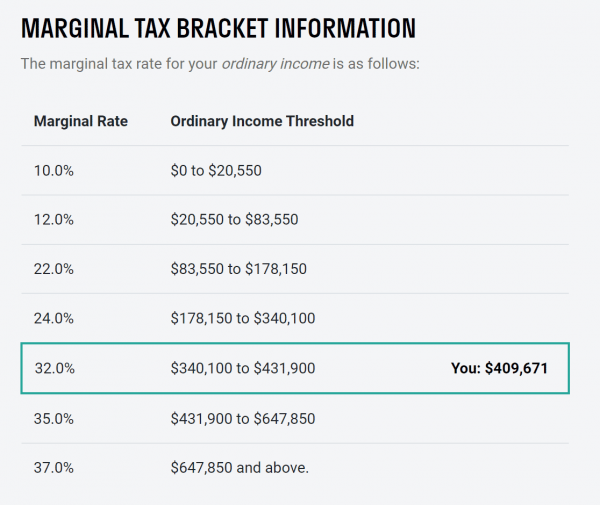

This deduction is valuable regardless of who you are, but is most significant for high income households. For example, a household in the 32% federal tax bracket and 5% state tax bracket who contributes $7,300 into a health savings account would receive a tax deduction worth more than $2,700!

This alone is valuable, but it gets better because HSAs also have:

Where retirement plans that use HSAs really shine is when contributions are not just saved, but then invested as well.

HSAs can be invested in mutual funds just like other retirement accounts. Any tax resulting from interest and dividends, along with any realized gains on the investments, is deferred (or potentially never paid at all – keep reading below!).

This is much better than a standard brokerage account, where gains are taxed at either short or long-term capital gains rates. The exact savings here will depend on many variables, but for example if you invest $7,300 into an HSA each year for 15 years and receive an 8% growth rate on that amount over that period, you would have more than $100,000 in gains.

With a brokerage account, you’d likely pay $15,000 or $20,000 in taxes on those gains when you sell. Plus taxes on interest and dividend each year along the way.

With an HSA, that tax bill would be $0.

**One important note with investing within HSAs. Because these accounts are so valuable to have in retirement, your investment strategy is of the utmost importance. Find low cost investment options, be diversified, and rebalance regularly to ensure your savings will be there when you need it!

One more tax benefit:

So far, you might be saying that the benefits of HSAs seem similar to a 401(k). But, where HSAs stand alone is for their tax-free distributions if used for qualified healthcare expenses.

Let’s say you have a large medical expense and have bills of qualified medical expenses of $10,000. If you were to withdraw that amount from your 401(k) to pay the bill, that $10,000 would be taxed at income. For a household in the 22% federal bracket and a 5% state income tax bracket, that’s $2,700 in taxes.

If you instead used an HSA, you’d pay $0, that’s $2,700 in tax savings even for this relatively small medical bill. Now consider the total benefit considering the average retiree has over $200,000 in medical costs throughout their retirement.

A lot of people know that Health Savings Accounts can be used to pay medical costs in retirement. What are some eligible expenses you can use HSAs for in retirement?

For the complete list, see IRS Publication 502.

There is one primary item that HSAs can not be used for: Paying the premium for your Medigap insurance premium.

What makes Health Savings Accounts so great in retirement is that they can help manage your retirement income.

Because you can withdraw money from an HSA tax free as long as you have qualified medical costs, and because there is no requirement for when the money must be withdrawn from an HSA, these accounts give retirees a ton of flexibility in managing their taxable income throughout retirement.

How does this work in practice? Let’s say in 2020 you had medical expenses of $5,000 that you paid out of pocket for. In 2021 you had another $3,000 in out of pocket medical costs.

Then, in 2022 you were age 60 and decided to do a Roth conversion and you need money from your retirement accounts for your living expenses.

If you withdrew from your 401(k), that withdrawal amount would be taxed, and likely at a high tax rate because of your Roth conversion.

But, if you had an HSA in retirement, you could withdraw $8,000 (from the 2020 and 2021 expenses that you never reimbursed yourself for), completely tax free – Saving potentially thousands of dollars in taxes!

– IRMAA, Medicare’s premium surtax

– Higher income tax brackets

– Higher tax rates on long term capital gains

– Additional taxes on Social Security

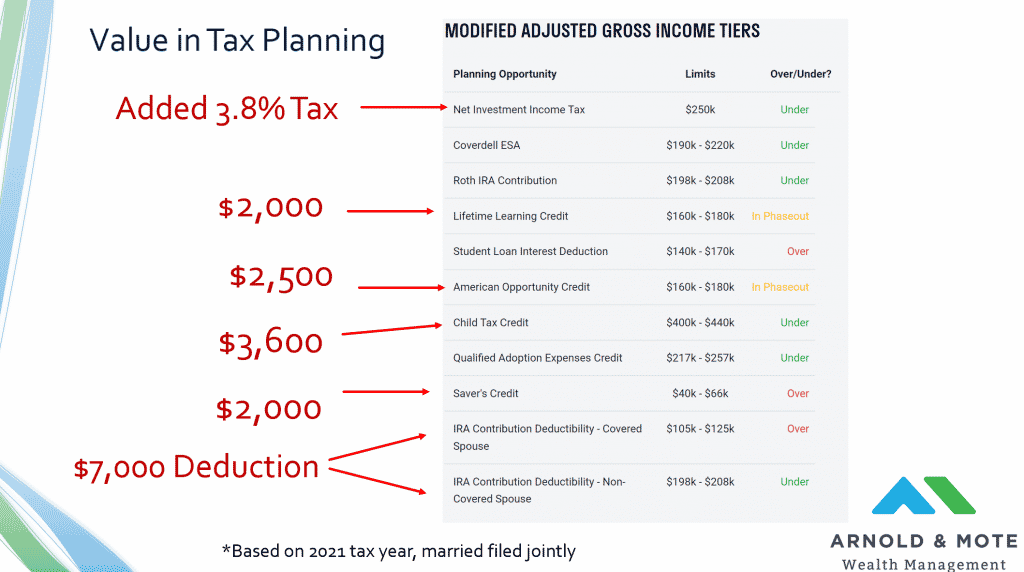

And more! Here’s a view of other common tax benefits, deductions, and credits that are income dependent and may be impacted by large retirement account withdrawals from a webinar we did on reviewing your Federal Tax Return:

What this means is that for a retiree with an HSA, it takes careful planning to use your balance in careful conjunction with your other retirement accounts. If you have a year with low expenses, you may want to delaying withdrawing from your HSA.

Likewise, if you have a year with very high income, or find yourself on the edge of an important tax bracket or income level, it may be very worthwhile to use an HSA for as much expenses as possible.

Are you creating a retirement plan and wondering how to manage retirement account withdrawals, taxes, Medicare, Social Security, and more? That’s where we come in. As financial planners, we help our clients develop tax efficient withdrawal strategies and create a plan to meet their retirement goals. See more about what we do here.

A few things change with regard to HSAs once you are age 65 or older.

Once you are enrolled in Medicare (which for many is at age 65), you are no longer eligible to make Health Savings Account contributions. You also can not roll any money from your IRA to your HSA.

You also are able to use your HSA for non-qualified expenses without penalty. However, taxes are still applied for non-qualified withdrawals. In a sense, an HSA can act just like a 401(k).

However, in general we think this is a bad use of HSA money. Since medical expenses make up one of the largest expenses in retirement, it makes sense to keep money in a health savings account until it can be used for qualified expenses.

As you can see from the examples above, you need to be organized when using an HSA in retirement.

You need to keep all records of medical expenses paid for out of pocket, so that you can reimburse yourself in retirement. Whether you use a shoebox fill of receipts, keep a careful digital record, or let your financial advisor help you, be sure you are staying on top of this!

For most families, we find that saving to an HSA is one of the highest priorities, even over a 401(k).

While there is no answer that is right for everyone, we find that every retiree has health care expenses and can therefore tax advantage of the added tax benefit that HSAs have for retirement savings over 401(k)s or traditional IRAs.

The IRS limits how much can be contributed per year into an HSA. The annual contribution limit is dependent on if you are single on a self-only plan or married under a family plan. And of course you must be in an eligible high-deductible health plan to be eligible to make HSA contributions.

But, the highest contribution allowed to an HSA is for a married couple in a family plan. This amount changes every year with inflation, but for 2022 is $8,300, or about $691 per month.

When you retire you can keep your HSA money. It does not have to go anywhere or be moved.

Yes, and this is one reason why HSAs are so great. Even if you have very high income you are eligible for a tax deduction with an HSA contribution. There is no income limit to receive a deduction on your Federal Income taxes for HSA contributions.

Yes. Roth IRAs must be funded with after-tax money. Health savings accounts can be funded with pre-tax dollars. Said another way, you can get a federal income tax deduction for your contributions to an HSA. This could be a big advantage over a Roth IRA.

An HSA is more tax-efficient than a 401(k). All withdrawals from a 401(k) are taxed like income. That means they contribute to where you stand in the Federal Income tax bracket, add to your Modified Adjusted Gross Income which can impact your Medicare premium (by way of the IRMAA surcharge or premium surtax) or Social Security tax, and may cause your capital gains tax rate to increase.

See our webinar replay on creating tax-efficient retirement plans here.

Distributions from HSAs used to reimburse you for qualified health care expenses are tax-free.

You may lose the ability to contribute the max amount to your HSA if you lose your job part way through the year. But, the money that is in your HSA will remain there and can stay invested. Unlike flexible spending accounts, unused funds in an HSA are never forfeited and can remain in the account forever.

Yes, in addition to the benefit of tax free withdrawals (see our answer to the question “401(k) vs HSA” above, HSAs also have a lot of added flexibility.

Money in an IRA is generally penalized if withdrawn before age 59 1/2. HSA money can be used before retirement for qualified medical expenses. This makes HSAs much more valuable whether you are young and still working, or fully retired.

Lastly, HSAs do not have required minimum distributions like IRAs. This is a big advantage for retirees that want to have money set aside for potentially large expenses later in retirement, like long term care.

Possibly. If you delay enrolling in Medicare (Parts B AND A) you may still be able to contribute to your HSA.

Even if you can’t contribute though, HSAs are still valuable after age 65. You can still access the money tax free if you have had qualified expenses in the past.