Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

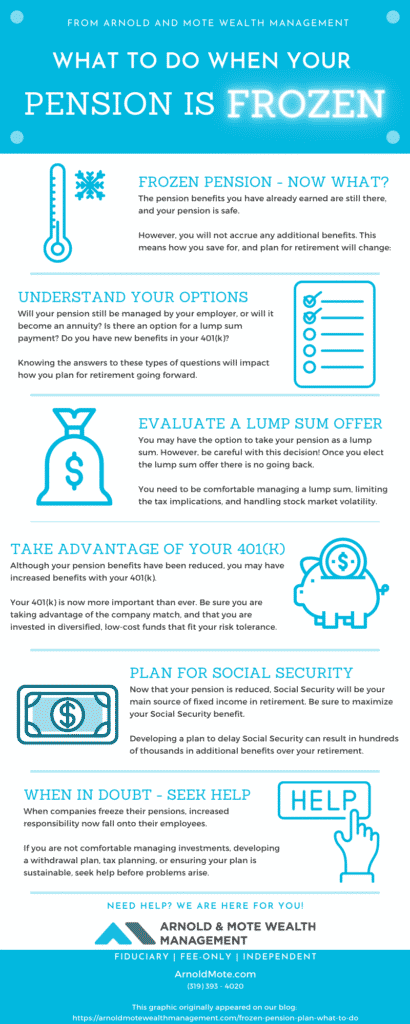

If your pension plan has been frozen, how you need to save and prepare for retirement has changed.

Before the freeze, the pension that you were planning to receive from your employer may have provided much of your income in retirement. Now, your investments that you manage will play a much larger role in your retirement.

First, know that you are not alone. 40% of large companies today have frozen pension plans. Many retirees have successfully navigated the changes to their pensions that you may be experiencing now.

There are lots of options available – But it is important to know what will change for you, and your retirement plan.

You likely received a letter from your employer notifying you that your pension plan has been frozen. What might not be clear to you is exactly what that means, and how your retirement may be impacted.

First, know that your money is safe. Benefits that you have earned up to this point are still there.

What will change going forward with a frozen pension is that you will no longer accrue additional pension benefits going forward. What you have earned already is still yours and will be available to you in retirement. But, that benefit will not increase over time even if you continue to work at your employer.

If a new pension estimate is not included in the paperwork notifying you of a freeze, human resources at your employer will be able to provide you a statement on your current pension benefits. This will now be your estimate for your pension benefits at retirement.

A pension freeze is not a cancellation of your pension. So, you still have the option to take your pension in retirement as your originally planned (likely at age 62 or 65). The monthly benefit may be lower, but you will still have the option.

Very often, when these pension freezes are announced, employees will also have the option to take their pension as a lump sum, instead of keeping the monthly payment through retirement.

And recently, with low interest rates and a stock market that has risen, it is more affordable for companies to offer these lump sum payouts. So even if you don’t have a lump sum offer right now, you might expect to see one in the future.

Taking a lump sum from your pension is a big decision, so make sure you understand the pros and cons to taking a lump sum from your pension.

Want help making the decision? We’re fiduciary financial advisers here to help! Schedule an introductory meeting with us.

The decision on whether to take a lump sum payment from your pension is a complicated one that can not be answered generally for everyone in a simple blog post. However, here are a few things to consider:

Many retirees are envious of those who have large pensions in retirement. Having a pension means not having to worry about the ups and downs of the stock market, timing your buying and selling of investment, tax implications of capital gains or IRA withdrawals, and more.

Cashing out your pension means that you will be investing that money on your own, usually in a traditional IRA. If the stock and bond investments you choose have good returns in the future, a lump sum can be advantageous for you. However, stock market returns are far from guaranteed, and the potential also exists to have low returns as well.

It can be a big change gong from a retirement based on a fixed income to one subject to the volatility of the stock market. Ensure you are going to be able to weather the market’s moves, and have the ability to choose appropriate investments for your situation.

Pensions are great as a source of guaranteed monthly income. However, they offer little in terms of flexibility. If you need money for a large one-time expenses, such as a new car or retirement home, you are unable to borrow from, or take excess distributions from your pension.

Before taking a lump sum from your pension, look at your other savings and assets you have available. Make sure you have assets that can be used to help pay for irregular expenses you will no doubt experience.

Every retiree is different. You pension that is frozen may be a small part of your retirement, or a very significant part. The decision to take a lump sum from your pension should also consider your other sources of safe, or fixed, income. This could be other pensions, annuities, or you and your spouse’s Social Security benefits.

Evaluate what your total amount of fixed income will be from other sources. If you have a large Social Security benefit and other sources of fixed income, you may consider taking a lump sum for the other benefits discussed in this post. If your pension would be your most significant source of fixed income, you may want to be very cautious before taking a lump sum.

Once you take a lump sum, the responsibility to invest and manage your lump sum payout is now on you.

If you know you don’t have the knowledge or confidence to do it yourself, seek help, or reconsider cashing out your pension.

At a minimum, you need to know how you will be investing the lump sum. Which funds will you choose and how will you allocate the savings between stocks, bonds, international companies, and other investments.

You need to understand tax law, and the consequences of withdrawing money from your various retirement accounts. Each type of account will have different tax impacts.

The decision to take a lump sum from your pension is not one to be made lightly. Be sure you understand the risks and added responsibility of doing so. Or get help from a fiduciary, fee-only financial adviser.

Now that your pension is frozen, and few things will change with your retirement. These may not necessarily be bad changes, but there are things you should know that will impact how you develop and execute your retirement plan now.

Typically, a pension freeze also comes with changes to, or a brand new, 401(k) plan. If you are continuing to work for many years, this will be your primary way to save for retirement now. Now, you must build up savings that will produce the income that you lost with the freezing of your pension.

And with that change comes more responsibility for you. Here’s a few things you will have to do right away:

Each paycheck, a portion of your pay will go towards your 401(k). You need to select how that will be invested, so that it can grow in the future.

Every 401(k) has a limited selection of funds available. You need to evaluate not only what each fund invests in, but also consider things like fund expenses (management fees, expense ratios, etc), and risk.

401(k)s, especially those from smaller companies, are notorious for poor investment choices. Take the time to make sure you are choosing the best options available.

This is a complicated topic that could be a blog post on its own.

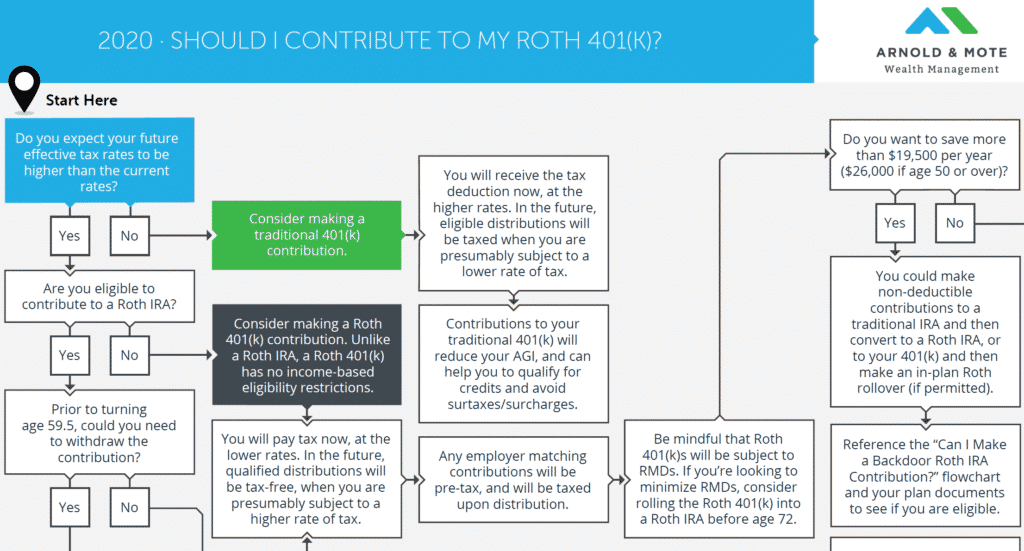

In fact, we have a post covering one aspect of Roth savings – Roth Conversions here if you are interested in seeing the analysis that goes into making these decisions.

But, know that you will have the choice to make after-tax savings in a Roth 401k if your employer plan allows it. This creates a very big difference in your tax liability in retirement.

Your pension would have been taxed like income, and a traditional 401(k) more closely recreates that same tax deferral in retirement. Many retirees initially believe the their tax rates will be low in retirement, so their income tax will be low. However, that is not always the case, especially if they have a pension.

Roth savings require that you pay taxes now, instead of later in retirement.

This is a sample of some of the questions you need to ask when determining whether or not to save in a Roth 401(k). For the complete flow chart, please contact us and mention this post

The decision is a very complex, but tremendously important one that has very long term implications.

Now that your pension is frozen, your Social Security benefits will be the primary source of fixed income for you in retirement.

That makes creating a Social Security plan more important than ever.

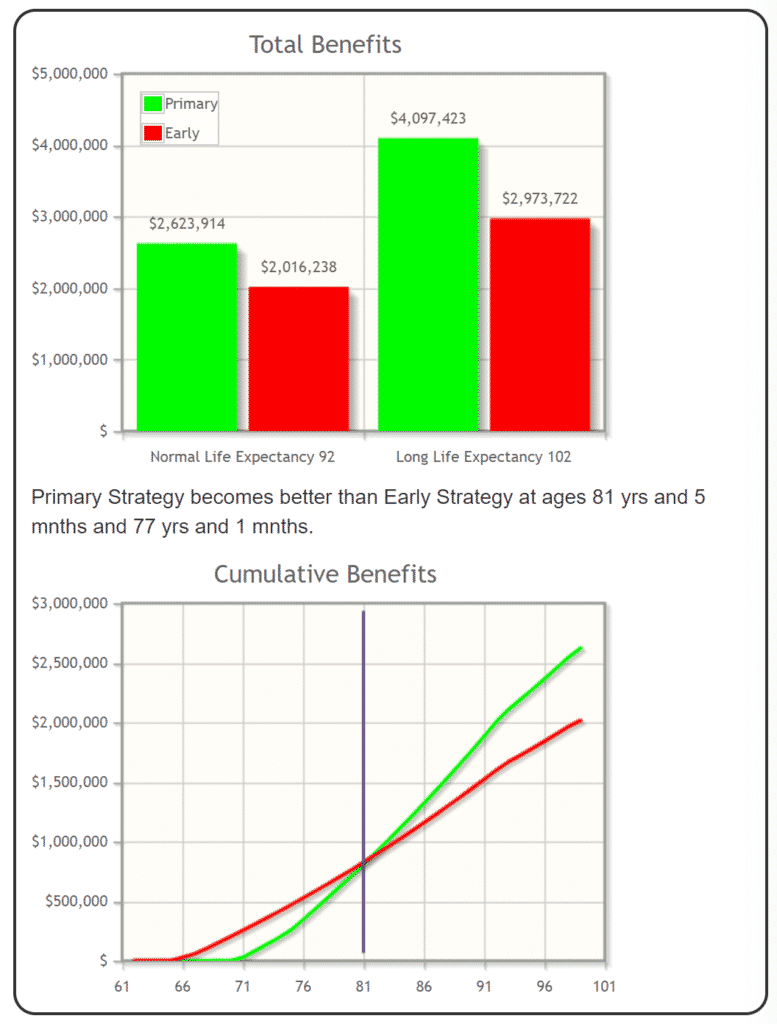

You may be tempted to begin Social Security as early as possible to receive early cash flow in retirement. But for most, that can be a costly mistake.

Delaying the start of your Social Security gives you a permanent increase in your benefits for the rest of your life. And unlike pensions, Social Security comes with an annual cost of living increase too. That makes the benefit of delaying Social Security even more substantial over time.

For many households, beginning Social Security early will result in hundreds of thousands in reduced benefits over the course of your retirement:

Now that your pension is frozen, the amount of fixed income you will have at retirement will be reduced. Don’t reduce it any further by beginning your Social Security benefits earlier than you have to.

Pensions are costly for employers, and can be very large liabilities on their balance sheet. A pension must be funded and managed to support retirees for their entire life.

On the other hand, 401(k)s and other defined contribution plans still provide retirement assets for employees. But, the responsibility and liability now belongs to the employee.

Now the day to day responsibilities of managing investments, determining how much to save, and creating income from those assets falls on you. For most, this is a huge change in their retirement plan, and a time when you need to carefully evaluate the change.

We help those like yourself who have had their pensions frozen evaluate their readiness for retirement, develop a plan for Social Security, and manage your investments.

And, we offer free initial consultations – schedule yours here.

Learn more about our services, and if you have questions about your retirement with the changes to your pension plan, please reach out to us for help.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.