Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Knowing that you have a sustainable withdrawal rate from your retirement portfolio can take a lot of stress out of retirement. But how do you know what a safe withdrawal rate is?

And more importantly, how do you know know when your plan should be adjusted based on stock market performance?

There are other thumb rules you can follow like percent withdrawal rates, such as the 4% rule, that are better than nothing. But a more active approach, like our retirement guardrails, can let you comfortably spend more, and provide very clear guidelines for when annual withdrawals should be reduced.

This video and post below gives a short overview of how we use “guardrails” to manage a sustainable withdrawal strategy for a retiree. We give a longer, more detailed look at the strategy in our webinar: “Managing a Retirement Plan During a Stock Market Decline”

Many retirees who don’t want to purchase an annuity with their investments still want a stable lifetime income coming out of their retirement accounts.

A guardrail strategy is an effective way to manage your retirement income each year while reacting to the ups-and-downs of the market.

Here’s how it works:

First, we establish your spending goals for things like living expenses, vacations, car purchases and home projects. Suppose that amount is $100,000/year.

Second, we check this spending against your investment savings using a technique called Monte Carlo analysis, to make sure the amount is not too high for the entirety of your retirement. This will provide a first look at whether or not your current expenses are sustainable based on your assets.

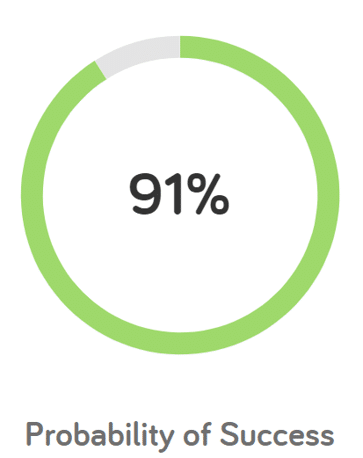

Remember, we want to make sure you can use your savings for retirement goals, but not run out of money. You’ll want to have a successful enough plan to start this process, something like 85%-95% likely to meet all your spending needs.

Finally, we check that amount of spending and savings each year to see whether you can take a raise, stay the same on your income, or need to cut back. This is effected by the market, and in most years, you shouldn’t have any adjustment. That means you’re within the guardrails.

If you need to make an adjustment up or down, we can determine a good estimate for how much that adjustment needs to be. It does not need to be a 10% decrease in spending if you see a 10% reduction in your portfolio.

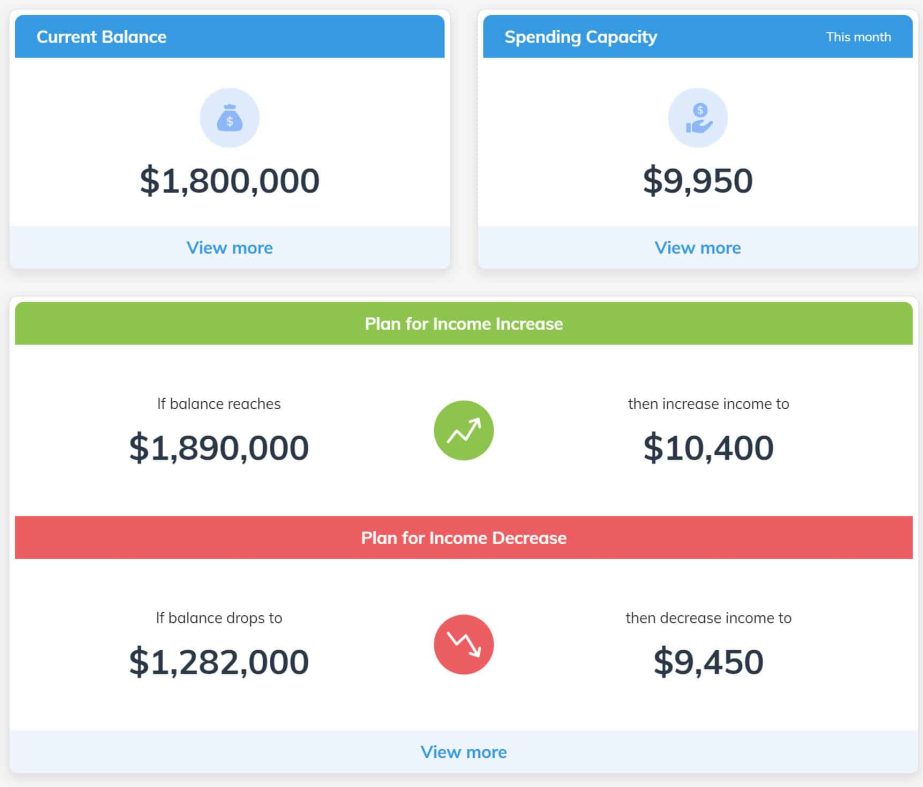

In practice this ends up looking something like this for a client:

The client is provided a sustainable spending amount today based on the initial value of their portfolio, and then shown clear retirement guardrails. These guardrails represent portfolio balances, that if reached, should result in a change in spending.

For example, a retirement portfolio of $1.8 million combined with Social Security income had a sustainable retirement spending amount of $9,950 per month.

Then, if the portfolio drops to a value of $1.2 million, the sustainable retirement withdrawal amount drops $500 per month. In this case, we would likely advise the client to reduce spending to reduce the risk of withdrawing to heavily on the investment portfolio.

Likewise, if the stock market rises and the value of their investments go up to $1.9 million, they may now safely and confidently increase spending to $10,400 per month.

These amounts above are only examples. These amount will vary based on your investment allocation, age, longevity, and other factors.