Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

457 plans allow extra retirement savings on top of 401(k) or 403(b) contributions, with valuable tax deductions.

Withdrawals can be made penalty-free before age 59½, making 457s attractive for early retirement.

Tax planning is critical, since extra deferrals could increase future tax burdens if not balanced with strategies like Roth conversions.

A 457 retirement plan may be available to you if you work for a state or local government, or a non profit organization. You may have been notified if an account is available to you, and you may even be saving into a 457 plan already. But what is not always clear is the advantages and differences that a 457 plan offers you compared to the 403(b), or 401(k) retirement accounts that you might be more familiar with.

These deferred compensation plans have some very useful features for savers and investors.

457 plans offer you an additional way to save for retirement. Even if you are maximizing your contribution to your 403(b), you can contribute even more to a 457.

In addition, 457s may offer additional catch up contribution amounts if you are over age 50. If you are high income or looking to really save more for retirement, taking advantage of these added retirement savings amounts available to you in a 457 plan is important.

These plans can give you additional amounts to not only save for retirement, but also give you a tax deduction since contributions will reduce your taxable income. This can be incredibly valuable for high income households, particularly those with high income and are near to the end of their working careers (or at least working in a high income job).

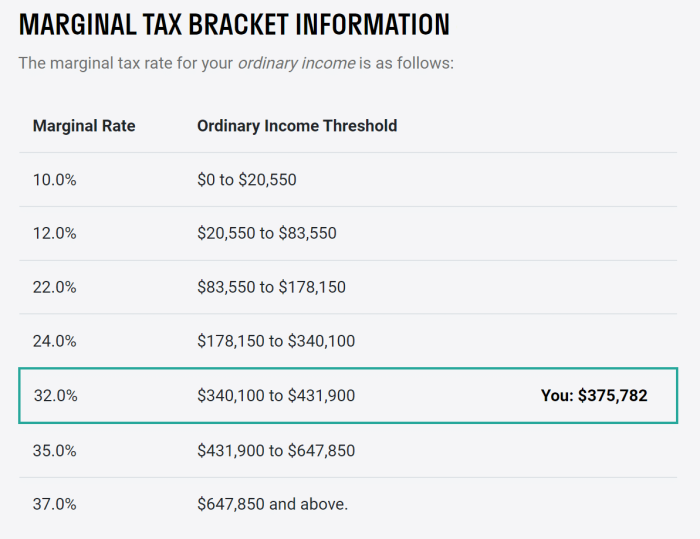

For example, here’s where a household with about $400,000 in income in 2022 tax year would find themselves in the Federal tax brackets, after the standard deduction:

This household had a 457 plan available to them. That allowed them to put nearly $30,000 into the plan, and reduce their taxable income in 2023 so that almost no income would fall into the 32% Federal tax bracket.

That’s a $10,000+ tax savings on their Federal income tax! And there could be state tax savings as well.

457 accounts also have another attractive benefit, and that is that money can withdrawn before age 59.5 without penalty.

This is a great advantage for those thinking of early retirement, or worried about locking up additional money into a traditional retirement account.

Where we help clients with their 457 plans is determining how much they need to save, which investment options to utilize in their 457 to take advantage of the tax benefits, and most important, make sure that a 457 plan makes sense for their retirement.

Because ultimately 457s may just lead to more tax deferral and tax paid if you are already in a position to need Roth conversions to reduce taxes in retirement. If you already have a sizeable retirement savings, there may be more tax efficient options available.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.