Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Choosing an investment adviser can be stressful – We know that.

But, finding the right financial adviser for you is one of the most important decisions you can make. So how do you go about finding the right financial adviser?

One of our favorite columnists and personal finance writers, Jason Zweig at the Wall Street Journal, came up with a list of questions to ask any prospective (or even your current!) financial adviser.

We think its pretty good – So we wanted to put our answers to his questions here for current clients and those interested in our services to see:

Yes, Arnold and Mote Wealth Management is a fiduciary. We are members of both XY Planning Network and NAPFA that require us to take a Fiduciary Oath. We will always act in the client’s best interest. All clients are given a signed fiduciary oath by us before we begin working together.

No. Arnold and Mote Wealth Management is a fee-only adviser. That means we accept no commission from any product we recommend. For example, if we determine you have a need for life insurance, we will help you shop for the best policy for you, but we get no commissions for doing so.

This is an important distinction from a “financial adviser” at a large insurance company, who stands to make thousands if they can push you into an expensive whole life policy. Can you really expect someone whose compensation relies on them selling you the most expensive insurance product to make a decision in your best interest?

No!

Yes. Our fees are straightforward and outlined in our ADV. We work with clients in 2 ways.

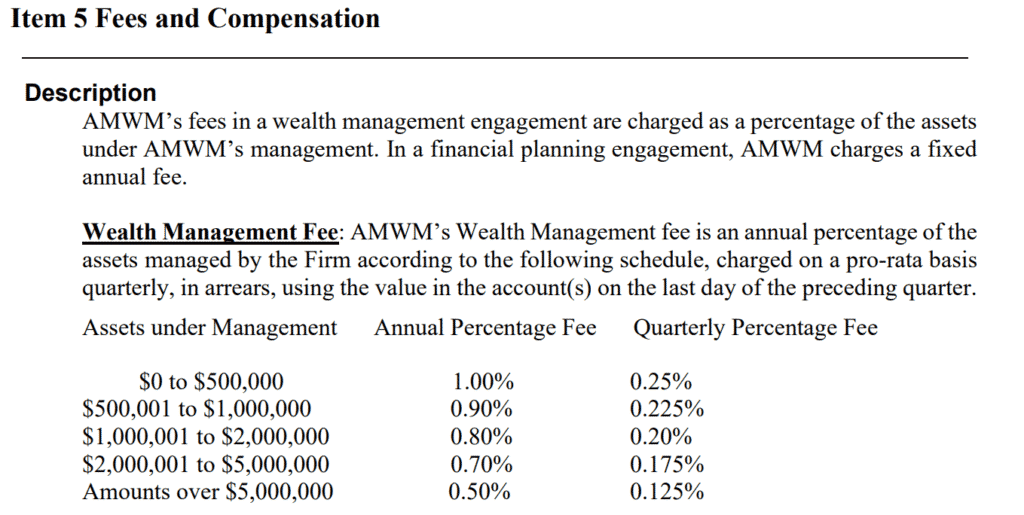

First, through our wealth management service. With this agreement, we manage your investments, place all buy and sell trades, rebalance the portfolio as needed, handle all withdrawals as needed, in addition to all of our other services. These fees for this service are based on a percentage of your invested assets:

In addition to wealth management, our holistic financial planning services charge a flat monthly fee that ranges between $200 and $500 per month based on complexity ($2,400 and $6,000 per year)

Yes.

Yes. See #4 above.

None. We accept no compensation besides what we collect from clients. Further, any associations we have are spelled out in our ADV:

No.

From our Form ADV Part 2:

We offer comprehensive financial planning for all clients that includes tax planning, retirement planning, budgeting, debt management, education savings plans/college planning, insurance planning, and estate planning all coupled with our investment management services.

See Our Services Page for more.

No.

We believe a successful long-term investment philosophy is centered around keeping fees low, and portfolio turnover to a minimum. We use low-cost, diversified, passively managed index funds for our clients.

Early in our relationship, we will have you fill out a risk questionnaire and we will develop an IPS, or investor policy statement that will detail how we allocate your investments and the types of funds used. We have you sign off on the IPS before we invest any savings for you.

No. We do not time the market or use technical analysis to decide on investments.

We do not aim to beat the market with our investment portfolios. Each client’s portfolio is created to be tailored to their risks, needs, goals, and plan. Conservatively managed portfolios (say, for a person who is near retirement or retired) will almost certainly underperform an all-stock index like the S&P 500 in years where the stock market rises.

We do not manage portfolios for absolute return. We manage portfolios to control risk and ensure your investments can grow to fund your long-term goals.

Although we have no set rules that limit the number of trades, historically, we have made very few changes to client portfolios. We routinely perform trades that rebalance client portfolios, but rarely perform trades that drastically change a client’s portfolio.

We view high portfolio turnover (that is – buying and selling of stocks) as one of the primary wealth destroyers for typical investors.

Investors can access their portfolio online at any time.

We provide performance reports as requested.

Eric Mote, Jean Mote, and Quinn Arnold use the designation of CERTIFIED FINANCIAL PLANNER™ (CFP®)

The CFP® designation identifies individuals who have completed the mandatory examination, education, experience, and ethics requirements mandated by the CFP® Board of Standards. Candidates must have at least three years of qualifying work experience that relates to financial planning. Candidates are required to hold a bachelors degree from an accredited university. CFP® candidates must pass a comprehensive 2- day, ten-hour examination that covers over 100 financial planning topics, which broadly include: general principles of financial planning, insurance planning and risk management, employee benefits planning, investment planning, income tax planning, retirement planning, and estate planning. Finally, candidates have annual continuing education and ongoing ethics requirements and oversight by the CFP® Board of Standards.

Performance expectations will depend on many things, such as your tax brackets, asset allocation, and risk tolerance.

We estimate long-term after-tax, inflation and fee equity performance based on long-term historical data. While we know any given year may offer volatile returns, over the long term we project returns to be similar to their historical averages.

We “eat our own cooking” here at Arnold and Mote Wealth Management.

For all employees of the firm, the majority of our invested assets are in the same types of securities we own for clients. While some assets may be more heavily weighted in our portfolios (say, a higher allocation to stocks) than some of our retired clients, the securities we use to construct the portfolios remains the same.

As Warren Buffett said in his early partnership letters:

“I can not guarantee you results, but I can guarantee that we have the same fate.”

Find out if we are right for you. Contact us today or set up a free, no obligation meeting here.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.