Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Determining when to do Roth conversions, or how much to convert, can be a daunting task. However, we find that the tax benefits are well worth the work involved in creating a Roth conversion plan. Here’s a few scenarios that retirees find themselves in where we see the biggest benefits for Roth conversions:

For our complete guide on Roth conversions (and to watch our webinar reply), see our post here: Complete Roth Conversion Guide

We find that retirees with more than $700,000 in pre-tax retirement savings, such as a 401(k) or traditional IRA, are typically able to reduce their future tax liability by performing Roth conversions early in retirement. Although that balance will depend on items like other sources of fixed income, desired spending in retirement, or plans to donate to charity, in general we find that this balance of savings leads to high taxes in retirement.

Why does this happen? As you age, the IRS will eventually require you to take withdrawals from your pre-tax retirement accounts. These required distributions, called required minimum distributions, or RMDs for short, force you to realize income and therefore income tax. These RMDs start small, but as you age increase. By late in your retirement, the IRS may require a significant portion of your account to be withdrawn in a single year.

From our experience, retirees who have been good savers will see their pre-tax retirement savings continue to grow through retirement, and if you begin retirement with a significant balance in your IRA, the RMDs eventually grow to become much more than you spend in a given year. This creates extra taxes for you that can be prevented by doing Roth conversions early in retirement.

Deciding whether or not to do Roth conversions depends on your future tax rate. If you believe you are in a lower tax bracket today than you will be in the future, Roth conversions can save you money.

Retirees with large pensions and Social Security benefits often find themselves in lower tax brackets early on in retirement, and then higher brackets over time as Social Security benefits begin and increase over time.

If you are in position to do Roth conversions before your Social Security benefits, or your pension begin, you have more room to take advantage of the lower tax brackets. Once your Social Security and pension begins, those lower tax brackets get filled up with your fixed income, and can cause all IRA or 401(k) withdrawals to be taxed at higher rates.

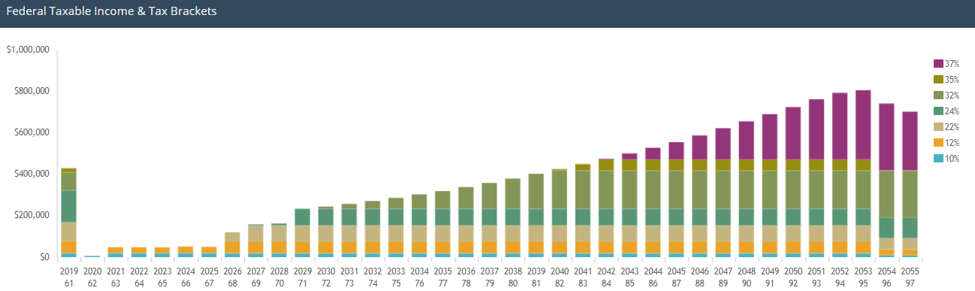

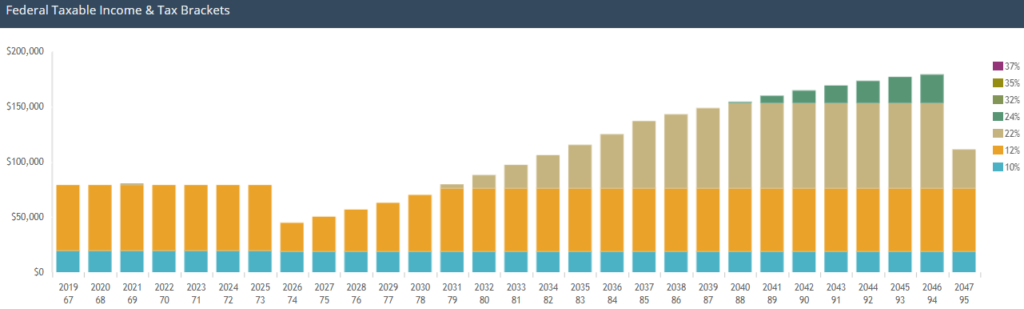

When we work with clients, we first begin by creating an estimate for their future tax liability. A typical analysis reveals a chart like this:

This chart shows rising tax liability over time. As this hypothetical couple retires and sees their RMDs increase and their Social Security and pension fill up lower tax brackets, they will find that much of their retirement income is taxed at higher rates like 32%, 35%, or 37% tax rates!

While doing Roth conversions does result in paying more taxes today, they may also result in paying much less later. In the example above, notice that this hypothetical retired couple could be performing Roth conversions in 2020 through 2025 at a tax rate of just 12%. In return for paying 12% tax rate today, they may be able to avoid a 37% tax rate on that same money later in retirement!

If it is likely that you will leave money to your heirs, Roth conversions may make a lot of sense.

If your spouse or children inherit an IRA or 401(k), all withdrawals from the account are treated as taxable income to them.

For children, that means these withdrawals are often at high tax rates since they usually have other sources of income from a job, or their own retirement benefits.

For your spouse, after you pass, your spouse will now be taxed at the individual tax rates. These rates are much more compact than married couples’ tax rates, and therefore these IRA withdrawals will be taxed at a higher rate than before.

In both of these scenarios, doing Roth conversions in retirement can save your family significantly in future tax liability.

While these 3 scenarios generally make Roth conversions worthwhile, every retiree’s situation is different.

Let us help you determine if a Roth conversion strategy makes sense for you, and help you execute it through your retirement.

The first step is to set up a free, no-obligation meeting with you to see how we can help. Get started here, and see how you could benefit from Roth conversions:

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.