Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Tax loss harvesting lets you sell investments at a loss to offset gains and reduce taxable income, potentially saving thousands over time.

The strategy can help you qualify for other tax benefits, lower Medicare premiums, or carry forward losses for future deductions.

It isn’t always the right move—your income level, tax bracket, and long-term goals determine whether harvesting losses helps or hurts.

Tax Loss Harvesting is one way that you can take advantage of stock market declines to strategically provide a tax deduction.

No one ever roots for their investments to go down in value, but of course it is inevitable to happen sometime if you are investing over decade long periods. And knowing how, and when, to tax loss harvest can provide you tens of thousands in tax deductions over your life.

Update: We recently hosted a webinar on tax loss harvesting, walking you through how to capture losses to get a tax deduction, along with the pros and cons (yes, there are cons!) of performing tax loss harvesting. Simply click play and enter your email below:

Tax loss harvesting can be technical – But we think it is important for you to see the potential value in performing the task, and its implications.

And also, we like to remind those reading that as clients of Arnold and Mote Wealth Management, this is just one of the many tasks we perform for you.

In this article, we’ll start with a quick overview of what tax loss harvesting is, and then move on to some financial planning strategies around tax loss harvesting, and then end on detailing some times when it would be a mistake to perform tax loss harvesting.

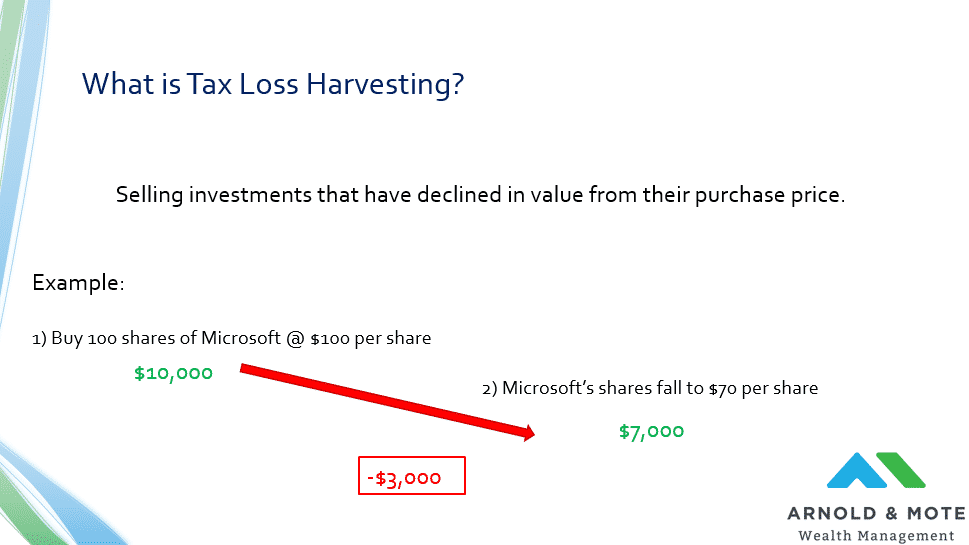

To start, just to make sure we are on the same page. What do we mean by tax loss harvesting?

Tax loss harvesting is purposely selling investments that have gone down in value to recognize a loss.

There is a common saying for investors: “Its not a loss until you sell” – And that is exactly what we are doing. We are deliberately trying to recognize a loss.

Just as a simple example. Let’s say you buy 100 shares of Microsoft for $100 per share, for a total of $10,000 invested.

But, lets say you made that purchase in January of 2020, and 2 months later, the stock had dropped down to $70 per share. So now, your $10,000 original investment is worth just $7,000. If you sell you would have a $3,000 loss.

It is important to note that this is just for taxable brokerage accounts. This is your SchwabOne brokerage account, designated beneficiary accounts, or trust accounts if you have your investments with us at Arnold and Mote. This does not apply to IRAs, 401ks, or Roth IRAs.

At this point, if we would think tax loss harvesting is beneficial to you, we might advise that you sell this investment and recognize this $3,000 loss.

Selling when your investments that fall in value is a little different advice than what you have heard us say in the past.

You have probably heard Eric, Quinn, or Matt talk about ignoring the volatility in the stock market, and not getting worked up about times the market goes down, and instead being a long term investor.

So, what is the difference between that advice of saying buy and hold, compared to now telling you to sell?

The difference is that there are certain benefits for recognizing a certain amount of loss at certain times.

The most important of which is a tax deduction.

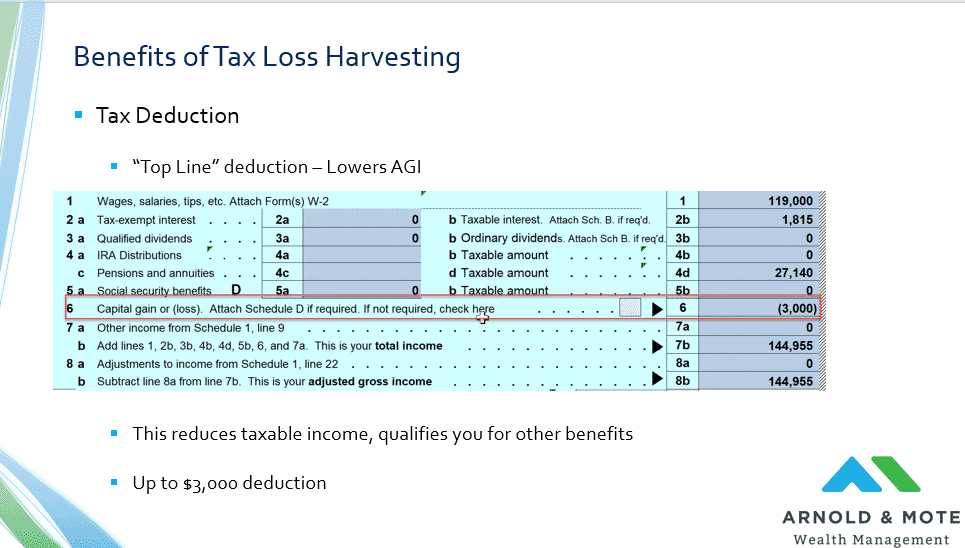

By taking that loss, you can take a deduction on your income for the year. And it is a very important deduction, called a top line or above the line deduction. This lowers your AGI, or adjusted gross income.

You can look for yourself how this plays out on line 6 of your 1040 on your tax return.

And this is important because your AGI is benchmarked to many other benefits, such as:

So, this is an important tax deduction. But of course it is not limitless. You are capped at taking a $3,000 deduction each year. You can not realize a $20,000 deduction in a single year, just for example.

While the deduction you can take is capped at $3,000, you can offset any amount of gains.

So for example, if you need to buy a car or make a down payment on a house and you sell $40,000 of your US stock holdings from your brokerage account, you will recognize gains if they have gone up in value since you purchased them.

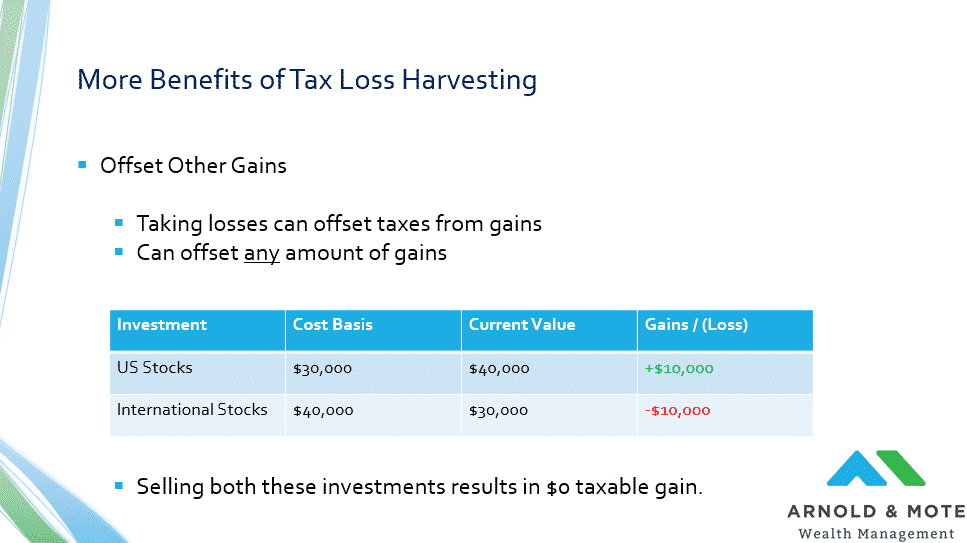

The price you originally paid for your investment is called your cost basis. Shown above is an example, maybe you originally purchased $30,000 of stocks that have now gone up in value and are now worth $40,000 today.

Normally these gains, $10,000 in this case, would be taxed as long term capital gains, which are taxed at a 15% rate for most – That would be a $1,500 tax bill for you.

But, over that same time, maybe international stocks had not done as well like we have seen recently, so you can sell a portion of your international stocks, which have lost $10,000 in value and completely wipe out the gains you would have been taxed on.

This means that performing this tax loss harvesting can save this hypothetical investor $1,500 in taxes!

You can recognize any amount of losses you want during the year, and any amount of losses can be used to offset gains that you have recognized.

If you have a $1,000,000 gain on one stock and a $1,000,000 loss on another, it can cancel out.

But, you can only take excess losses over your gains of $3,000 per year. That’s the difference here.

However, if you recognize large losses that are greater than $3,000 in excess of your gains, it does not go to waste, the benefit just gets spread out over multiple years.

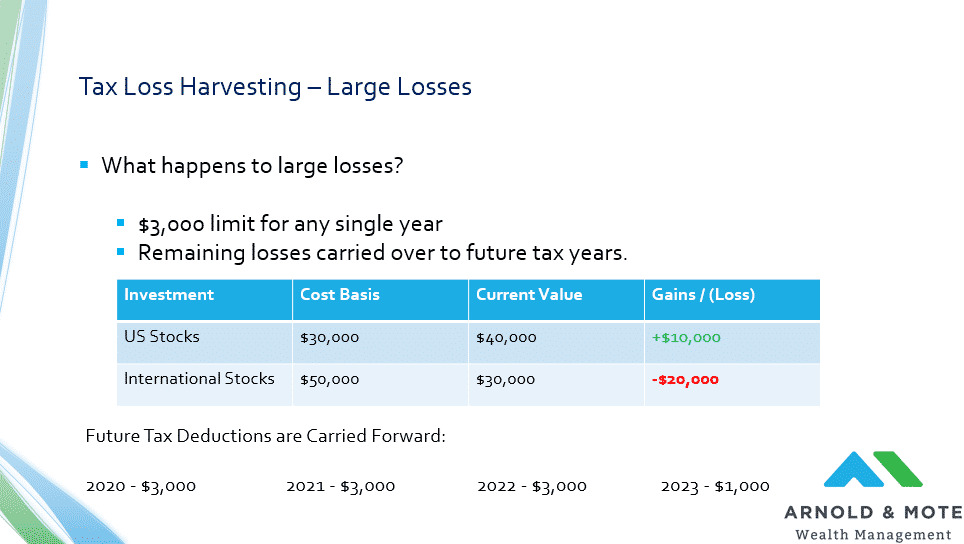

As we said, the most you can use in any single year is $3,000. But what happens if you realize a large amount, say $10,000?

Below we show a similar situation as the previous slide, but now there is $20,000 in losses from this investors international holdings. In total, the would recognize $10,000 in losses.

If they recognize no other gains for the year from their investments, they could use $3,000 to go towards a deduction this year, and then carry the rest forward to future years.

The most you can use in any single year is $3,000. So, this investor could claim a $3,000 deduction for the next couple years, and then use the remainder in 2023, in this example.

This requires an extra tax filing to notify the IRS of the “bank” of losses and then keep track of the balance over time. But any tax preparer would be familiar with this, and even turbotax will help you do this if you like doing taxes yourself.

So, that was a quick review on how these deductions can be captured. Now we want to highlight the planning strategies that are available around this.

Tax loss harvesting creates opportunities because it lowers your AGI, or adjusted gross income.

And a lot of different tax benefits, credits, and deductions are based on your AGI. Were going to look at a specific example below, but first, look at just some of the benefits available and your eligibility is based on your AGI:

Each of these benefits is only available to those with an AGI within a certain range. That means for some high income households, they may not qualify based on their salaries for these benefits. But, tax loss harvesting can help reduce that taxable income and let them qualify for these other benefits.

If you have read other articles of ours, you know how much we value tax planning here at Arnold and Mote. We think it is one of the most significant values that a good financial advisor can provide to their clients, and this is just one example.

This image above is of a tax report that is put out by some really neat software we have added to our toolbox here at Arnold and Mote. We can input the numbers from your tax return, and very quickly it can spit out a report identifying a whole host of tax credits, deductions, tax brackets, and other tax breaks you can qualify for, or maybe even more important, are just on the verge of qualifying for. With this report we can quickly find opportunities where a $3,000 tax deduction could help you.

Let us use our expertise in tax planning to help you reduce your tax burden, and make sure you qualify for all the tax deductions you can. Contact us to set up a free, no cost, no obligation, introductory meeting.

Just to give you one specific potential example for these tax loss harvesting deductions. We’ll look at an example for someone on Medicare.

Everyone in America over the age of 65 is eligible for Medicare. And Medicare Part B is the basic coverage that everyone can get.

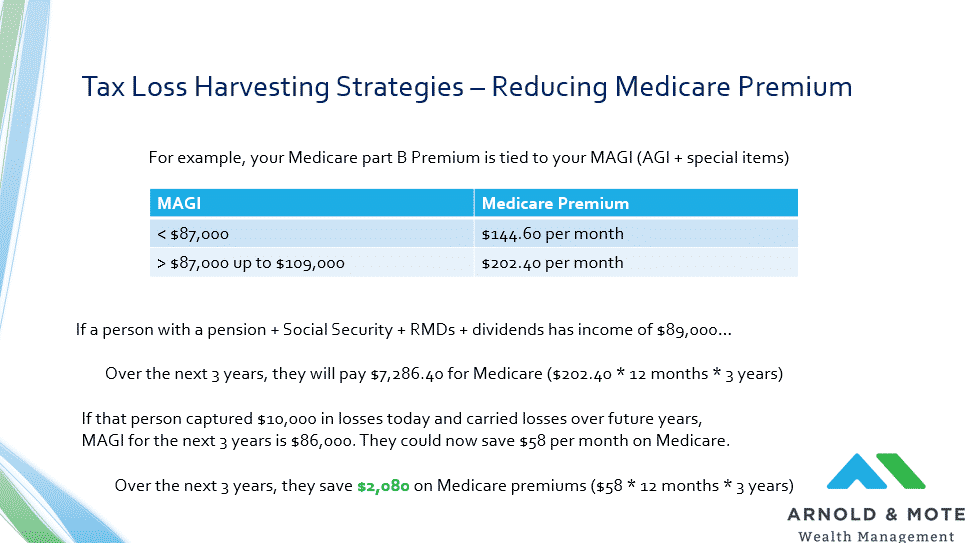

Everyone pays the same minimum monthly amount for Medicare part B, but your premium is increased if your income, measured by your Modified Adjusted Gross Income which is just the same AGI we talked about earlier, with a few other items added back in.

The chart above shows the change in your Medicare premium based on income, and then the first jump up in premiums. There are many more tiers to this chart, I’m just showing the first couple here for simplicity, but for those with very high income, monthly Medicare premiums can be as high as $491 per month! (and this will only rise with inflation over time)

This is one of the few hard cut offs in the tax code. A lot of benefits based around income slowly phase out as your income increases over a certain threshold, but this is one of the examples where the difference of $1 in income could mean a relatively big jump in Medicare premiums.

And you can probably see where I am going with this example, this means there is a huge opportunity for anyone within $3,000 of this line to save a lot of money on Medicare premiums by tax loss harvesting.

Just for example, A person today who is on Medicare may have a pension, their social security, required minimum distributions, plus maybe some interest or dividends from their investments. And let’s say for example all of that totals to $89,000 for the year.

That $89,000 means that they will pay $202 per month for their Medicare part B.

But, A year like this one may give them a good opportunity to not only lock in enough losses to take a $3,000 deduction this year, but also carry some forward over future years.

Using our example from the previous slide, if they could capture $10,000 in losses, they could lower their MAGI $3,000 per year for the next 3 years. That would bump them back into this lower tier for Medicare, and save them $58 per month for the next 3 years. That could save them nearly $2,100 on Medicare premiums over that time frame!

Now obviously this is a bit of a specialized scenario. And just one of many scenarios, not everyone is within $3,000 from this income level….

But as we saw on the image listing all of the benefits tied to income above, maybe its not Medicare for you, but a $3,000 tax deduction could be keeping you eligible for Roth IRA contributions. Maybe its not for Roth IRA contributions, but it is for keeping your income low enough to deduction your child’s tuition expenses, or for a younger couple to continue to deduct the interest on their student loans.

There’s a lot of possibilities here, and we can’t give an example for every situation today. But we wanted to be sure to show how a stock market decline can give a lot of people opportunities to qualify for tax deductions and benefits that they may not have before.

The last important point in this article is that Tax Loss Harvesting is not a magic $3,000 that you capture with no tradeoffs. There is some long term thinking that needs to be done before you execute a tax loss harvesting strategy.

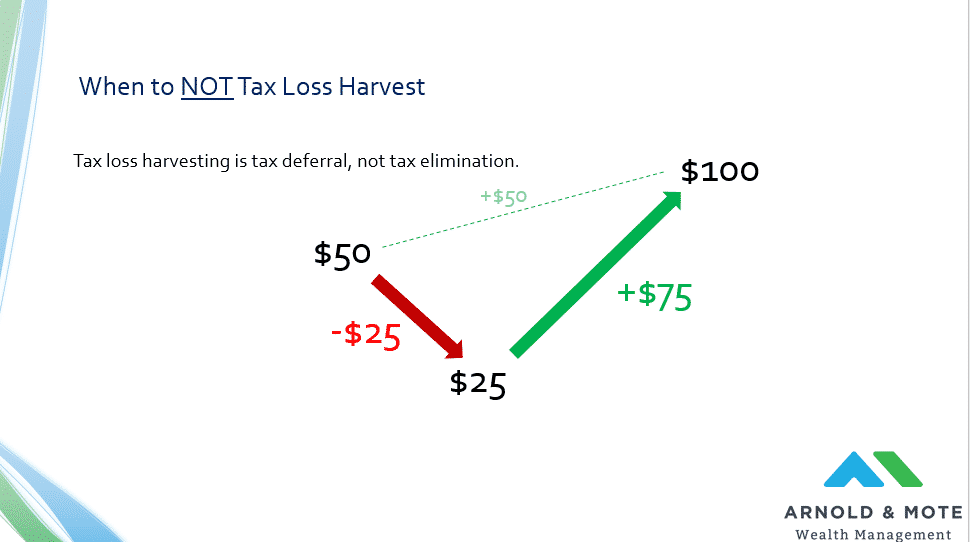

Because really, tax loss harvesting is more of a tax deferral than a free $3,000 deduction.

To illustrate this, consider a very basic example of someone who buys a stock at $50 a share, and sells it at $100 per share. They will pay capital gains taxes on that $50.

Pretty simple and straightforward, right?

But lets say during that time, the stock drops to $25 and you sell it to capture the loss and get the deduction and then repurchase it when able.

Now, your new cost basis for this investment is $25, so when it goes to $100, you now have a $75 dollar gain to pay taxes on.

If your tax rate was constant through your life, this tax loss harvest does not have a lot of use here. You sort of borrowed from the future to get a deduction today, but you would pay it back later in the form of higher capital gains taxes at some future date when you sell the stock again.

And maybe now you can think of a couple scenarios where harvesting this loss could have been a bad idea.

If you are currently in a low tax year, that $25 dollar deduction may not be that valuable, especially if that $75 in taxes would be taxed at a higher rate in the future.

An example here could be a young saver, who is just getting started in a career for example, who may be in a lower tax bracket than they will be later. They probably don’t want to make this trade off for higher taxes later if their incomes will be significantly higher in future years.

Or another example could be a recent retiree who has not yet begun Social Security or their RMDs. They might be in a very low tax rate now, but in the future once RMDs and Social Security kick in, will have much more income and therefore taxed at a higher rate.

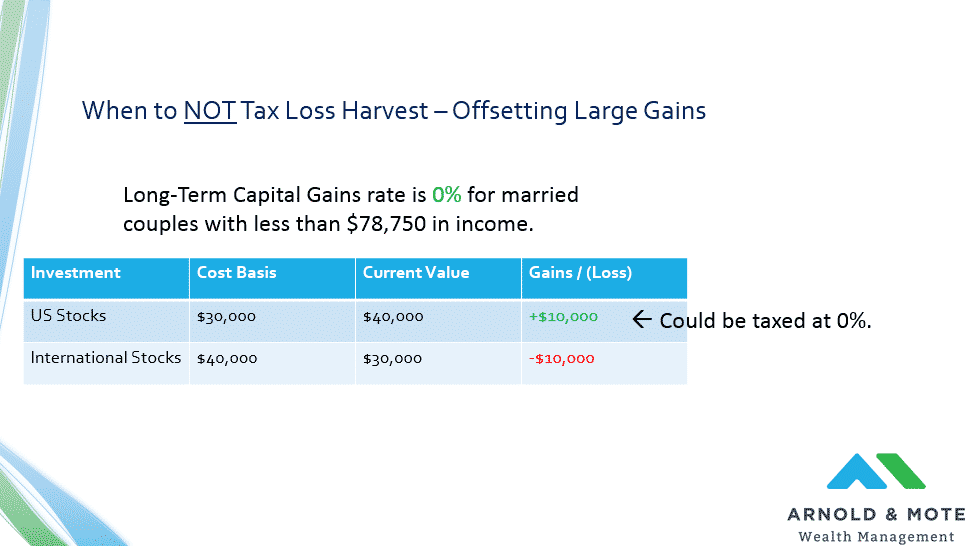

In fact, many retirees qualify for 0% tax rate on their long term capital gains, so tax loss harvesting has no impact at all!

If you are a married couple and your income is below $78,750 in 2020, long term capital gains are taxed at 0%. And remember, recognizing gains raises you income, so its not like you can recognize $1,000,000 at 0%, but if you had no other income at all, you could recognize $78,000 in long term capital gains and pay no taxes at all.

So think back to our example earlier about an investor selling investments to raise money for a large purchase. If they sold their US stocks, they would recognize $10,000 in gains. Previously, they chose to also sell international stocks to offset the gain.

But of course, you can probably think of some scenarios where tax loss harvesting could make a lot of sense. Maybe a Doctor or Senior engineer who is at the peak earnings of their career right before they retire. They could take a deduction now, and it would be a very valuable deduction since their income is high, in exchange for more gains later, which could be taxed at a very low rate if they have no other sources of income once they retire.

So, like a lot of personal finance topics we talk about, there is no one size fits all here.

This will be very valuable strategy for some, while also potentially being a very bad idea for others. There are times in your life to take advantage of this, and times where it just won’t make that much sense.

Now remember, in order to take advantage of tax loss harvesting, you need an investment that has declined in value from the time you purchased it.

Some people make a mistake investing in their taxable accounts to only hold 1 investment. A really popular investment for some today is a target date fund for example.

This is one fund that holds both stocks, and bonds. Target date funds are designed as “one-size fits all” approach to asset allocation. It is convenient, and is very diversified, but it could really limit how you are able to tax loss harvest because you can’t target and sales towards the specific holdings of that fund that have declined in value. All you can do is sell shares of that one fund.

So, all else being equal, you want to hold a diversified set of investments, in multiple funds, in your taxable account. We have mentioned the benefits of diversification before to many of you, this is just another example.

Every year different types of investment go up, while others go down. This is especially beneficial if you are looking to tax loss harvest because you want assets that are uncorrelated. You want to own investments that behave a little differently, to give you more opportunities to have an investment that will go down.

Some year international stocks will do better than US stocks, others they will do worse. By owning these different types of investments in different funds, you are better able to take advantage of their volatility.

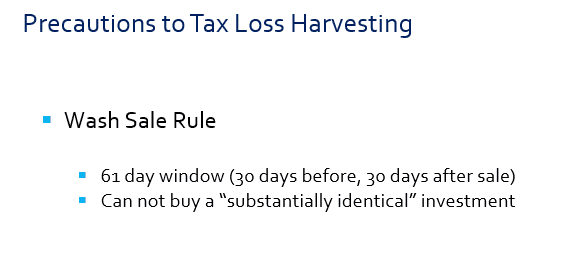

There is one more key to tax loss harvesting, and that is complying with what is called Wash Sale Rules.

This is a law set up to ensure you do not simply immediately buy back the same investment that you sold for a loss.

So, if you sell Microsoft stock to recognize a tax loss, you can not immediately buy it back. You have to wait at least 30 days after the sell before you can reenter the investment.

And this rule applies to mutual funds and ETFs as well. If you sell a S&P 500 index fund, you can not re-buy that same fund, or another fund that invests in the S&P 500 for at least 30 days.

So, when we tax loss harvest for our clients, we have to buy a new fund that they are probably not used to seeing in your portfolio. And so, for a period of a month or two, you will see a different fund in your portfolio – this is why.

Because if we were to repurchase that same fund that we sold in order to recognize the loss, it would cancel out the deduction we were hoping to get. That could be potentially bad for you if you were looking for the deduction or offset of gains.

Tax loss harvesting is a very popular strategy for getting a tax deduction.

We wanted to show you a little bit more detail about the process, but also show that it is certainly not a “Gimme” that you should perform whenever it is available. A lot of the personal finance writing out on the internet today puts this out as some no-brainer action you should perform, and that is certainly not the case.

It can be valuable, but you need to make sure it fits your specific situation first.

Let us help determine if this is a good strategy for you (and do all the work, too!)

Contact us here and lets get started

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network. Arnold & Mote Wealth Management is a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas.