Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

QCDs let you donate directly from an IRA after age 70½, avoiding taxes on withdrawals and reducing taxable income.

You can give up to $100,000 per year (indexed for inflation starting 2024), and donations count toward your RMD.

QCDs don’t provide a deduction—they bypass taxes entirely, often making them the most tax-efficient way for retirees to give.

Qualified charitable distributions, or QCDs, are almost always the most tax efficient ways to give to charity. However, they are only available for those of a specific age, and with a specific investment account. Here we cover what you need to know to be eligible to perform QCDs, and the rules in order to receive the tax benefits.

A QCD is a distribution made directly to a charity from an IRA. This allows you to donate directly from your retirement accounts, and avoid taxes that would normally result from IRA withdrawals and Required Minimum Distributions (RMDs). For most, they are the primary tool of a retiree’s charitable giving plan.

Not 70, but 70 and a half years old! You can only begin to donate via QCDs once you have turned 70.5 years old.

It must be an IRA, you can’t do this from a 401(k).

You can donate via a QCD from an inherited IRA account if you are over age 70.5.

You are only allowed to donate $100,000 per year through QCDs (Calendar year 2023). Beginning in 2024, that amount will be adjusted for inflation.

Why are QCDs almost always the best way to give to charity?

If you take a distribution from your IRA and send the proceeds first to your bank account and then give to charity, you’ll be taxed. Worse yet, that IRA withdrawal could impact your Medicare IRMAA surcharge and cause you to pay more for Medicare.

With QCDs, the money goes straight to the charity, never to your bank account and therefore is not subject to any taxes.

You do not get a tax deduction from doing QCDs. Instead, it is never even taxed at all!

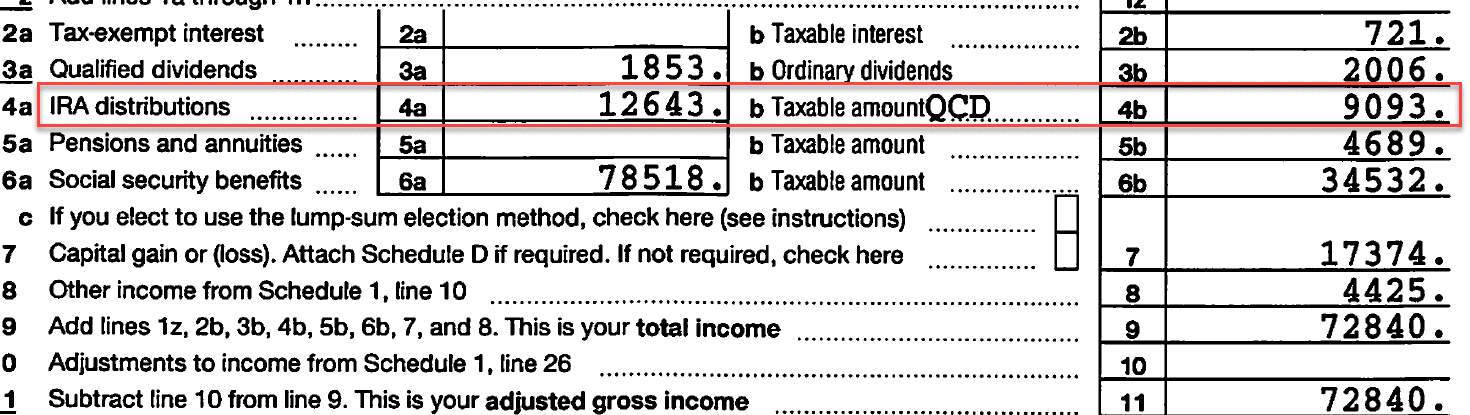

Here’s how it will look on your tax return:

Notice that the household in the above return withdrew $12,643 from their traditional IRA during the year. However, not all of that $12,643 will be taxable to them because they donated $3,550 via qualified charitable distributions. That leaves only $9,093 of their IRA distributions resulting in taxable income.

You can begin doing QCDs at age 70.5, but an even bigger advantage comes a few years later, when your RMDs (required minimum distributions) begin. If you do not need your RMDs to help fund general living expenses, RMDs typically result in unnecessary additional taxes.

However, QCDs will reduce your RMD, helping you avoid this unnecessary tax liability.

For example, if your required minimum distribution is $10,000 and you donate $7,000 via QCDs during the year, you will only need to withdraw $3,000 from your retirement accounts to satisfy your annual RMD.

How do you do a QCD? For clients of Arnold and Mote Wealth Management, you receive a special checkbook only for charitable giving. This checkbook makes donating, and record keeping for tax purposes, easy. It is as easy as writing a check!

QCDs take coordination with your overall retirement plan, your financial advisor, and your tax preparer. If you have questions about how to use QCDs to maximize your impact to charities, and save yourself some tax liability, please reach out.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management, a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.