Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Using a mortgage lets you spread withdrawals over time, keeping you in lower tax brackets and reducing tax and Medicare surcharges.

Even after accounting for interest, many retirees come out ahead financially by financing part of their home purchase instead of paying all at once.

Retirement can mean big changes, and one of these changes may be where you choose to live during your retirement. Whether you purchase a vacation home or move to a different primary residence, this can come with great cost.

To pay for this expense, retirees must decide whether to pay all at once or take out a mortgage. How you choose to tackle a home purchase cost can make a great difference overall.

Choosing to purchase a new home or an additional home without a mortgage can lead to high taxes and ultimately be a costly mistake.

If most of a person’s available funding is in tax deferred accounts such as IRAs or 401(k)s, making this purchase can result in tens of thousands of dollars in extra taxes. This is because withdrawals from these tax deferred retirement accounts are treated and taxed like income.

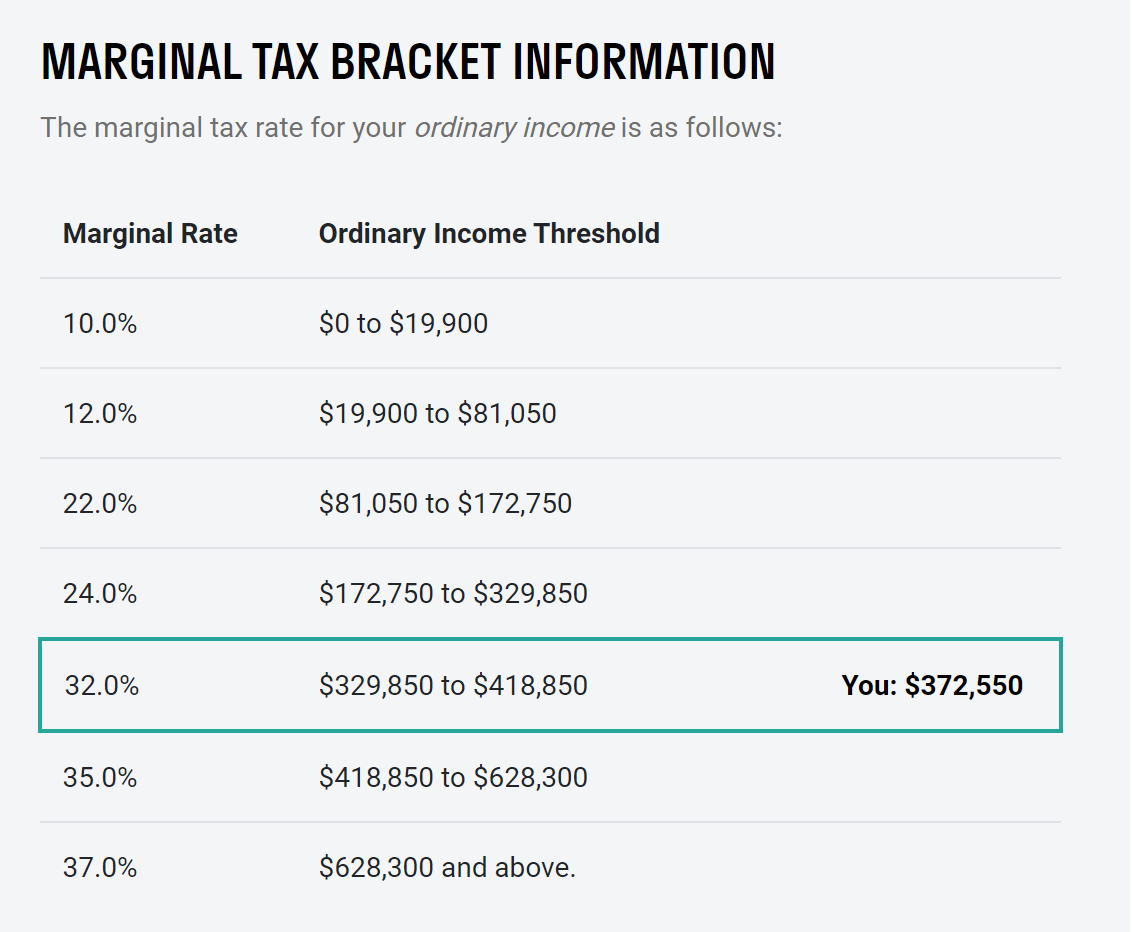

For instance, if you were to withdraw $300,000 to pay for a home in retirement, it will result in paying taxes as if you received that amount in income. Depending on your other spending, Social Security, and other retirement income like pensions, this one-time withdrawal for a home purchase may be taxed at a rate of 32% or higher!

For example, let’s say a retired couple has $45,000 in Social Security and they also take out $60,000 from their IRA for additional living expenses. Then, they decide to withdrawal $300,000 to purchase a retirement home outright. How would their tax situation look?

In total, this purchase would result in you paying $80,864 in taxes during the year!

On top of that, taking this large of a withdrawal from your retirement accounts can also have other negative effects such as increasing Medicare premiums (known as IRMAA), creating ineligibility from certain tax credits and deductions, or increasing the tax rate on your Social Security.

Using a mortgage to make a home purchase can make more sense for many retirees.

Getting a mortgage is less focused on what you can afford, like it may have been when you were younger, and more focused on what steps can be taken to reduce taxes.

Because of the way our tax system is set up, it makes more sense overall to have a mortgage so that large retirement account withdrawals are not piled on all at once. Taking out a mortgage allows you to spread the colossal expense of a home out over several years rather than risking being bumped up to a higher tax bracket.

Using our example above, if our hypothetical retirees make the $300,000 withdrawal to buy their home, they would pay:

If our retirees would instead split that withdrawal up over just 4 years, they will save nearly $10,000 in income taxes over the 4 years compared to if they took out one large lump sum. In addition to that interest savings they would also avoid the $9,500 in additional Medicare expenses. And, in addition to both of those our retired couple would be able to earn interest or growth on their investments for 4 years. Even if they set this in a very conservative allocation that returned just 3% per year, they would get an extra $19,500 in earnings due to compound interest.

Yes, a mortgage comes with interest expense. But, with today’s low interest rates and by holding the mortgage only over a short period of time, the tax and other savings from the mortgage greatly outweigh any interest costs. In our example above, a 3% mortgage held over 4 years would result in $13,300 in total interest payments.

In total this hypothetical retired couple saw a $26,000 benefit from taking out a mortgage compared to a lump sum payment for their retirement home.

Deciding whether or not to use a mortgage to purchase a home within retirement can be a big decision. With our clients, we can assist in determining a payback period that will balance reducing interest on your loan while also keeping you tax liability at a good level. Having an additional mortgage may not be the right choice for everyone, but we can help guide you in making this decision as you go through the process.

Want to see how our in depth tax planning can benefit your retirement plan? Contact us today for a free, no obligation 30-minute meeting to get started.

Want to see more about how we help clients think through tax-efficient retirement withdrawal strategies? Here’s a link to a more detail blog post on retirement withdrawals and a webinar recording: Tax Efficient Retirement Withdrawal Strategies

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management, a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.