Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

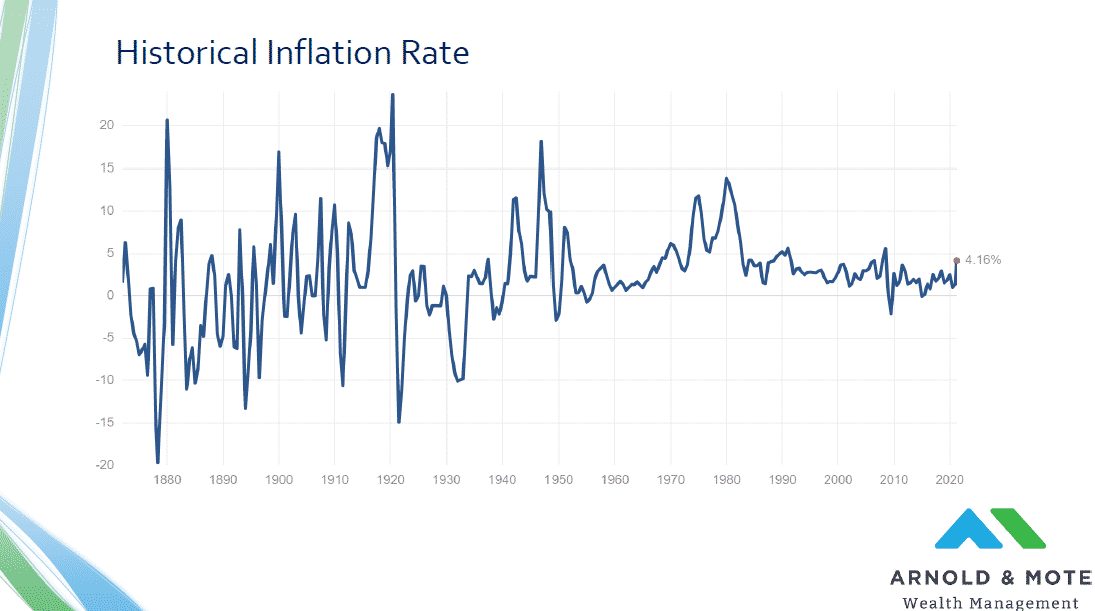

Inflation today is high but not alarming compared to history.

Cash and most bonds lose value in inflation, though I Bonds and short-term bonds help.

Stocks remain the best long-term protection against rising prices.

This is a recording of a webinar we gave to clients in June of 2021 on the topic of rising inflation, and how inflation impacts the stock market, your investments in stocks and bonds, and the best way to protect your portfolio from inflation.

We look at today’s headlines on recent rise in inflation, and put it in perspective with past episodes of inflation. Then, we look at how the 3 main assets of your investment portfolio should fare in an inflationary environment – Cash, bonds, and stocks.

First, I thought it would be interesting to start out with a look at where we are today.

While today’s headline inflation numbers seem high relative to what we have experienced recently, they remain well within historical norms and certainly below some notable periods like the 1940s and 1970s.

Even with this most recent spike in inflation, we are still well below where we were just in 2007, and I don’t think the mid 2000s are really remembered for their inflation.

So, I just like to set the stage with this to first try and calm any fears that we are in any way approaching worrisome levels of inflation.

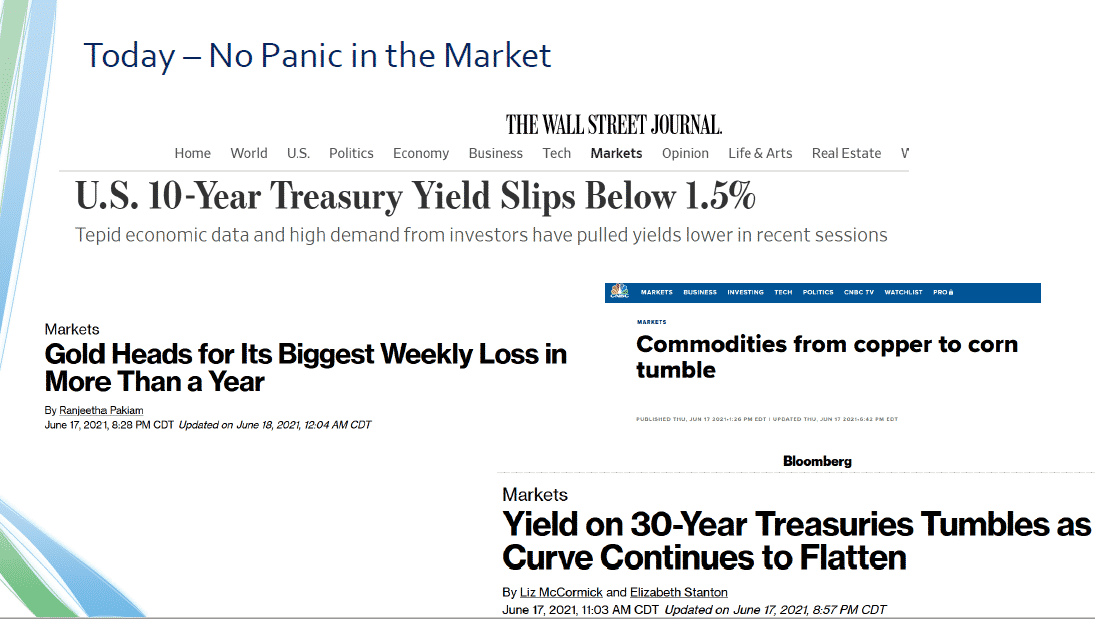

But that doesn’t stop a lot of the scary headlines from appearing in the news.

This is just a couple of headlines this week that I picked out from news articles this week.

And a couple of things to note:

First, we have been through a lot in the last couple years, with trade wars, stock market crash from the pandemic, presidential elections, civil unrest, and so on. I hope you recognize a bit of a theme in our webinars of highlighting these scary headlines, and then now with the benefit of hindsight realizing that reacting to these headlines is usually the worst possible thing you can do.

And second – I think there is one thing that is really important to realize. The market has taken these recent inflation numbers in stride.

And in fact, maybe reacting a lot differently than you would expect. This is a collection of headlines from this week as well that were published on exactly the same days as some of the headlines on the last slide.

Just as the panicky headlines were hitting, bond yields actually fell a bit, which you would not expect to happen if investors expected a sustained rise in inflation.

Commodities have begun to fall in price. Lumber was the big one in the news, and it is down close to 50% from its highs just a few weeks ago.

Between treasury bonds and commodities, there are trillions of dollars that make up these markets. And today, these markets, and the big institutions that invest trillion of dollars in these types of investments that would be hurt by inflation, are really not making any long term changes.

But now lets get into the more important part of the webinar – How a rise in inflation, even if it is relatively modest like we are seeing today will impact your financial plan and your investments.

In this webinar we are going to look at 3 main asset classes, Cash, bonds, and stocks.

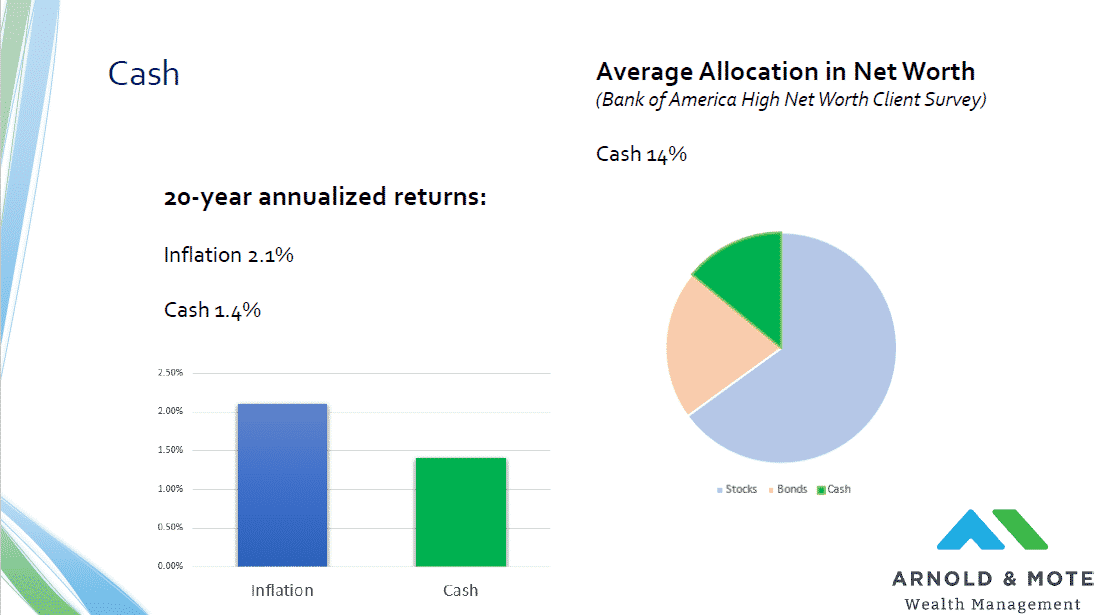

First, we will look at cash.

Of course cash is an important part of your finances, and its vital to keep some amount. But, as far as long term holdings or a large part of your portfolio – cash is one of the poorer investment choices in a time with rising inflation.

Despite that though, it is regularly a very large portion of an investor’s portfolio. Bank of America does an annual survey of their high net worth investors, so this is people worth more than $1 million, and on average 14% of their net worth was in cash or cash equivalents. So things like CDs, money markets are going to count here as well.

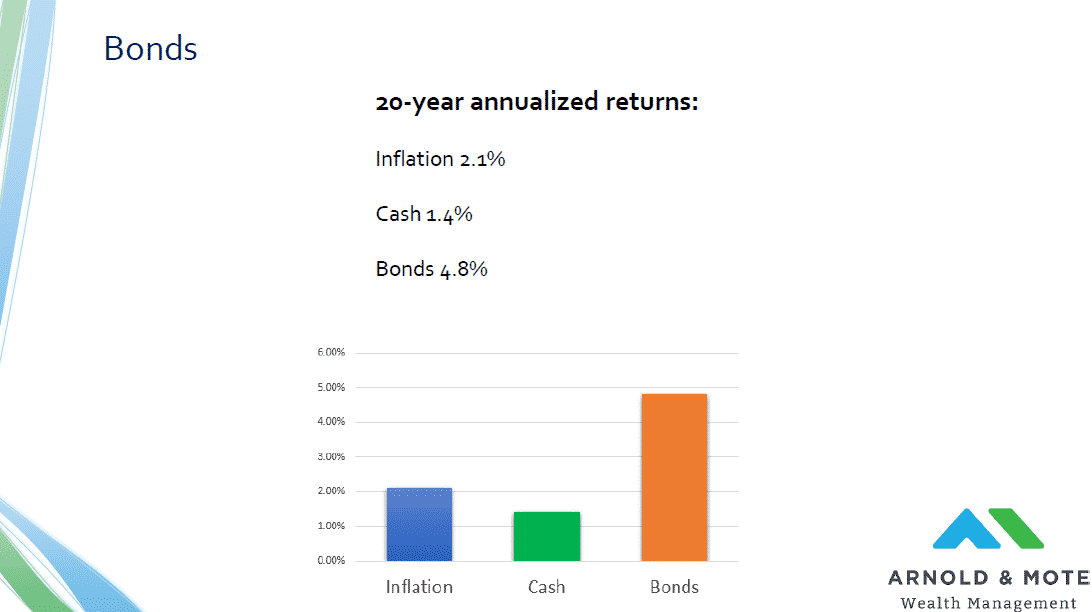

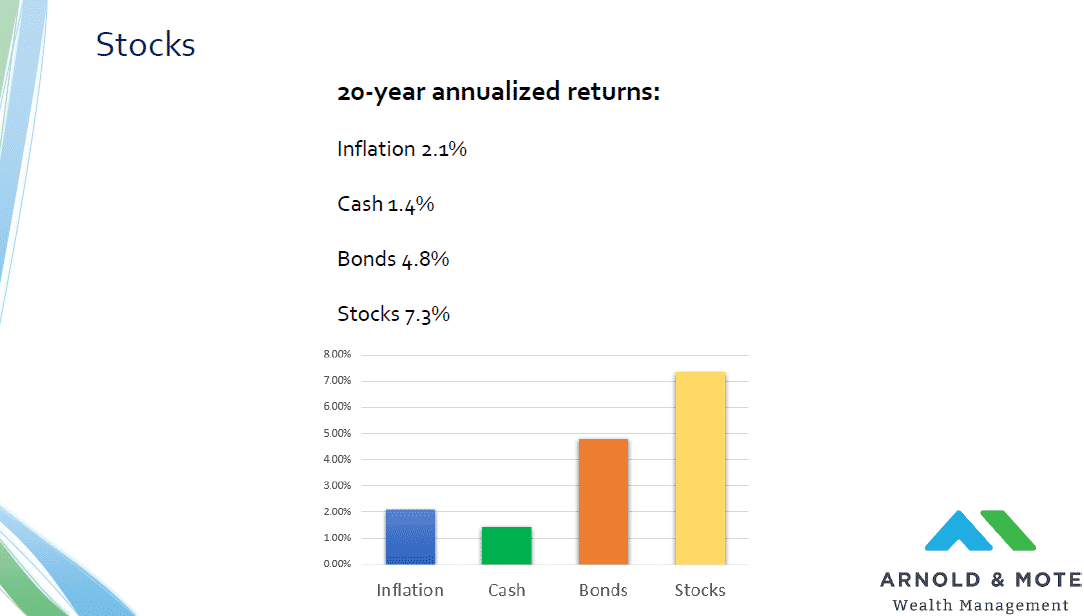

And cash has consistently not returned a positive real, or after-inflation return. Even the last 20 years which have seen relatively low inflation, cash has led to about a half of percent per year on average loss to inflation.

Again these numbers are averages over the last 2 decades. That 1.4% return on cash is higher than what you see today, but 15 years ago you were getting 5% on cash, so that is accounting for some higher rates in the past. Today of course, I think that’s much closer to 0%.

But I don’t think it is a surprise for many to learn that in general cash loses purchasing power to inflation every year.

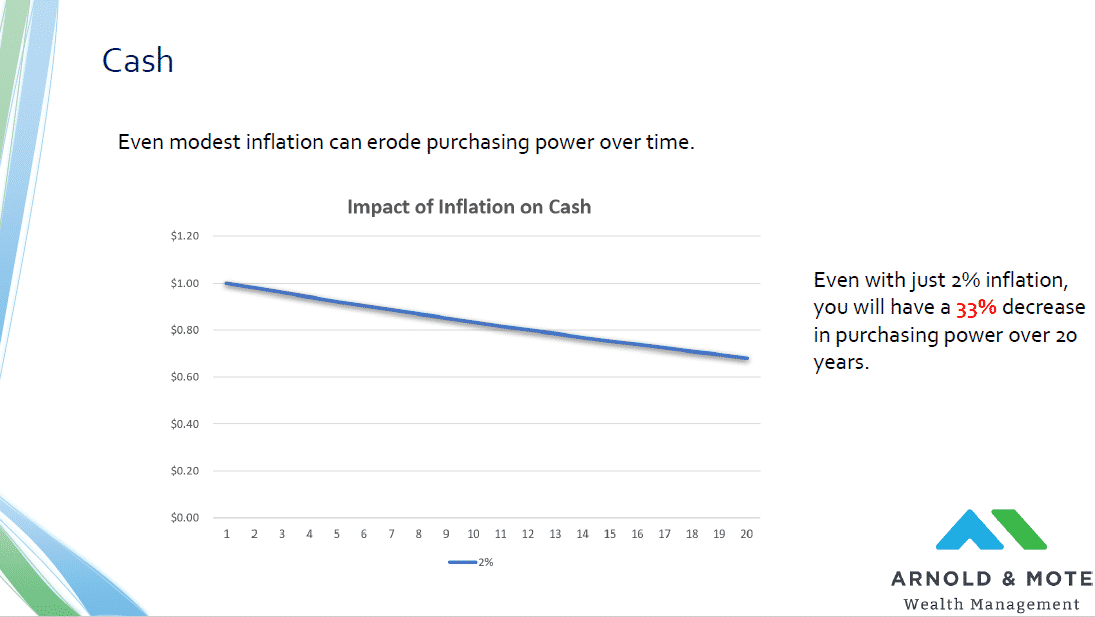

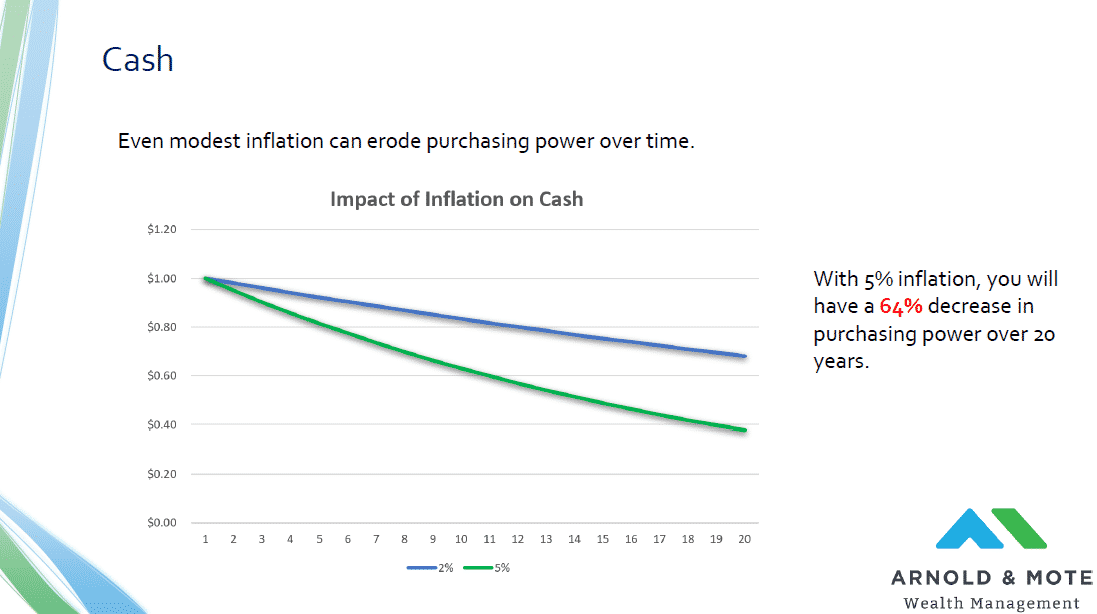

And even with just modest inflation going forward, the value of that cash to you gets really hit.

This chart here is showing the purchasing power of cash over time with just 2% inflation.

Over a 20 year period, which is even a little shorter than a lot of retirements will be for a recent retiree today, cash would see a 33% reduction in value.

Now everyone is scared of the stock market going down. But I think its worth noting here that the general stock market has never returned negative 33% over a 20 year period. Even if you invested in 1929 before the great depression, you had a higher 20-year return than that.

And while the short term safety of cash is valuable, few think of their cash allocation as a nearly certain way to get a negative real return.

And if we put in today’s inflation numbers, it gets much worse.

With 5% inflation, you lose almost two-thirds of the value of your cash over a 20 year period.

So, cash is very valuable because it doesn’t swing up and down in value so much. Having a small amount is important. But it is almost guaranteed to be a terrible long term investment.

I think its important to point this out because cash allocations tend to grow as retirees become more risk adverse. And it is also a very common holding for people that are worried about the stock or bond market, and yet there are very few investments that have worse long term returns than cash.

However, like we said, having some amount of cash is important. So what is the right thing to do with that emergency fund or amount of money you want set aside for safety?

We know that bank accounts and money markets yield about nothing right now. Some CD specials might get you a little less than 1%, but there is one possible option that works for some. And we find that these are not as familiar of investments to all our clients, so we thought we’d mention them here.

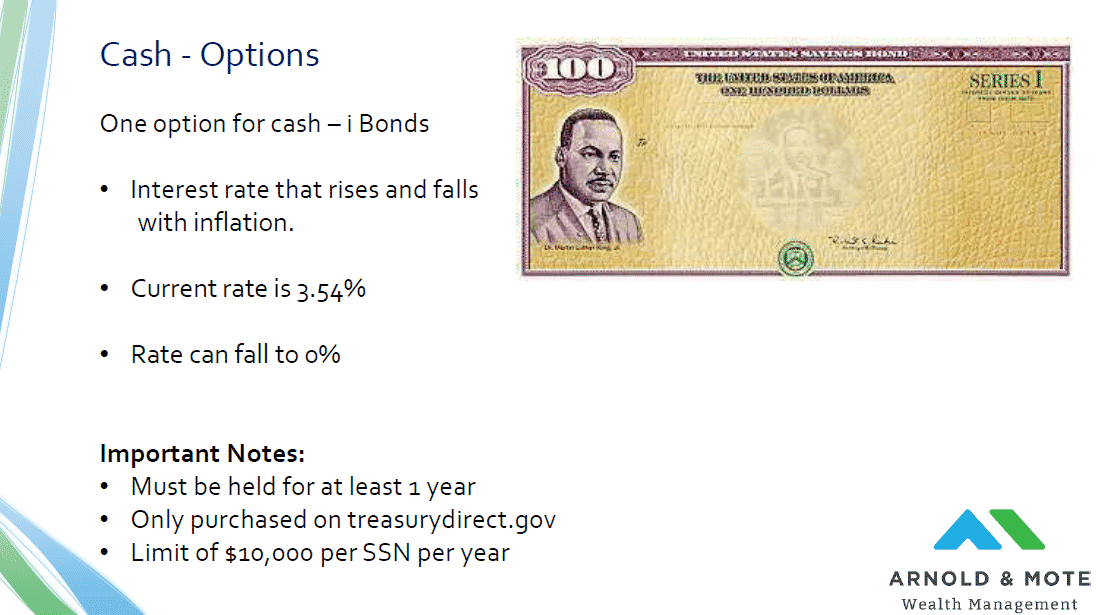

I Bonds are a type of savings bond issued by the government. The other savings bonds, which are series EE, those orange savings bonds you probably had growing up, are more popular. These I Bonds are newer and function quite differently.

I bonds have an interest rate that changes every 6 months based on inflation.

These have been getting a lot of attention recently because in May their interest rate was adjusted up to 3.54% after May’s inflation numbers came out. So, this is a US government guaranteed bond that is returning 3 and a half percent.

Now that sounds great, but know that this rate is not locked in. So if inflation does go back down, interest rates on these can go all the way to 0%, though they can not go below that, so you are guaranteed not to lose money unlike some other inflation protected options we’ll look at later.

But, it still seems likely that these will perform better than a bank savings account.

There are a couple of features that are important to know about I Bonds though.

First, they can not be sold within the first 12 months of purchasing them. So, it takes some planning to eventually build up an amount of these because you don’t want to lock away all of your cash.

There is also a limit of $10,000 per year per person for purchases. So a husband and wife can do a max of $20,000 per year. So again, it might take a few years to convert your cash into these investments due to the holding period and this limit.

These are not investments that we can buy for you in Schwab. The only way to purchase them is through the Treasury and TreasuryDirect.gov. Here you essentially create a brokerage account with the US Treasury and can buy savings bonds there.

We think this is a good option for the amount of cash that you do want to hold and have set aside for a emergency. But again, they are probably not going to grow your money at all in a real sense, notice that this rate today is lower than the headline inflation number – but they should do better at helping you preserve the purchasing power of your savings than a simple bank account.

After cash, the next asset that makes up a significant part of your portfolio is probably bonds.

As a whole, bonds have done a better job than cash in growing your investments in excess of the rate of inflation.

Over the last 20 years, bond have returned an average of 4.8 per year, so giving you a couple percent above inflation.

So that is certainly an improvement over cash, but because of how bonds work, they still leave you potentially vulnerable to inflation.

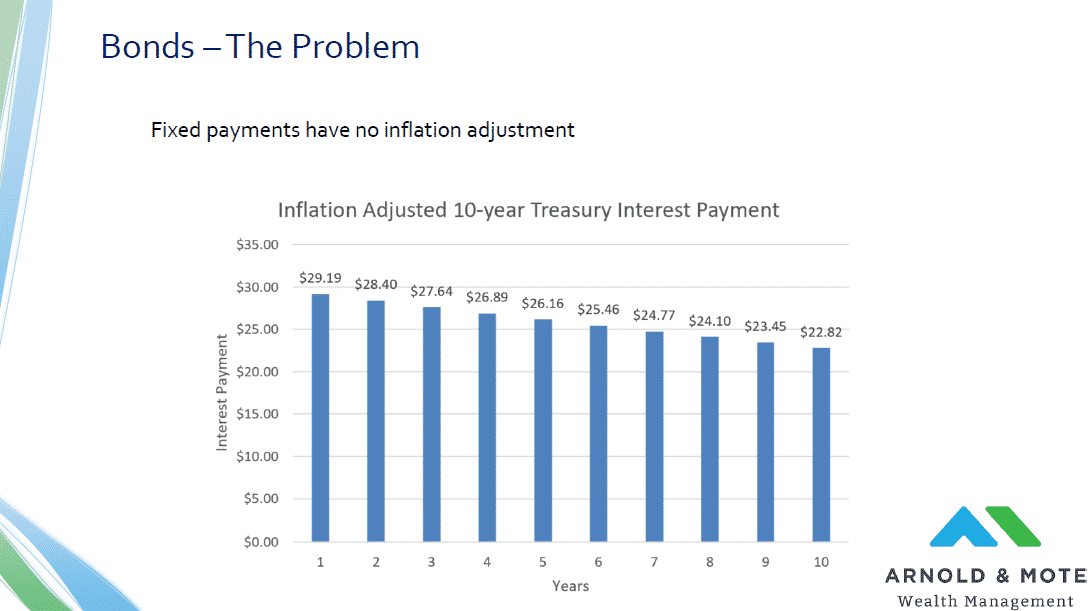

Because bonds offer a fixed payment that will not adjust to inflation, holders of bonds are still at risk. Although there are a lot of different types of bonds, most simply bonds will just pay you a flat interest payment every year.

So, if you buy a 10-year, $1,000 bond yielding 3% today, you will get $30 per year for the next 10 years. The problem of course is that $30 will not buy the same amount of things in 10 years as it does today. In fact, even under low inflation you might lose a third of your purchasing power. With today’s headline inflation numbers you may lose more than half of your purchasing power.

And so maybe now you start to see why inflation can be such a problem for retirees. Everyone is taught that over time you allocate more and more of your portfolio in safer investments. The problem today is that safer investments yield next to nothing, and if inflation rises you will receive a negative real return still.

Bonds are obviously an important part of your retirement savings. We certainly would not recommend aggressively moving out of bonds in general. However, there are a few things we do for clients when managing their money to help protect their bond investments from inflation.

One Option for Bonds with Inflation – TIPS

But before we get into how we manage portfolios, we wanted to talk about one option that a lot of people have heard of, and that is TIPS, or treasury inflation protected securities.

These have been really popular lately. This is a headline from Bloomberg this month about TIPS ETFs are seeing record inflows, or purchases, from investors recently.

In case you are not familiar with TIPS, they offer investors an adjustment to the value of their bond each year to match inflation, as measured by one of the sub-indicies of the CPI, or consumer price index.

Now at first glance, these seem a little bit like the I bonds we just looked at. TIPS have a certain principal value that is adjusted over time to keep up with inflation. When you buy a TIP you are signing up for a fixed interest rate, but the face value of the bond will be adjusted up every 6 months based on the CPI, or consumer price index inflation data.

And a lot of people seem to think they act in a very similar way.

But they are quite different, and in fact are quite complex investments.

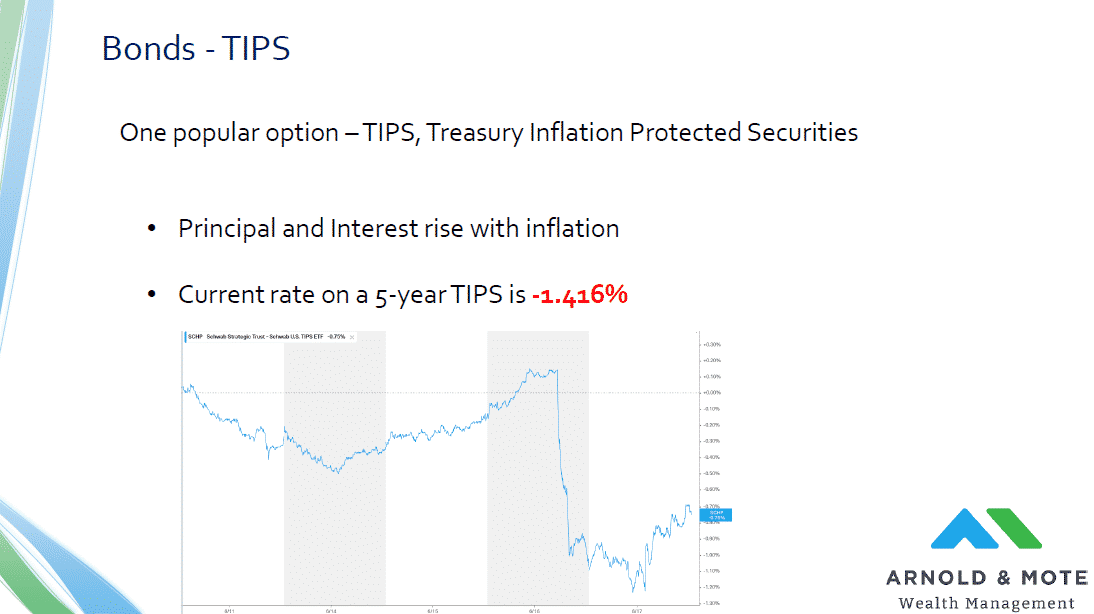

The first thing that many investors do not realize is that today if you purchase a TIP you are signing up for a negative interest rate. This number here was from yesterday’s 5-year TIP auction. A negative 1.4% return. What this means is that investors are buying these bonds well in excess of their face value, and already anticipating a certain amount of inflation that will happen and bring these bonds up to a positive yield over time.

This means a couple things. First, unlike I Bonds, a TIPS investor can actually get a negative return in a low inflation environment. Just for example with this negative 1.4% yield in today’s TIP, if inflation drops to 0%, an investor will lose a little more than 7% by holding this bond.

So the first thing to recognize before you purchase a TIP is that you are not solely buying inflation protection, but instead are making a trade-off that inflation will be higher than what other investors have already priced in. In other words, there is a lot of speculation that is built into the price of TIPS.

Just for example, the chart at the bottom of the slide pictured above is the price chart of Schwab’s TIP ETF fund this week. Notice how this week, once the big scary headline inflation number hit, these bonds actually sold off. They lost a little more than 1.5% in value in just a couple hours, which is a big move for what is supposed to be a safe investment in your portfolio.

So what does this mean to me? It means that the market was already pricing in this recent inflation number and investors who didn’t have an understanding of how these investments work are now finding themselves losing money on an investment that they may have incorrectly assumed would be very safe.

We do not personally use TIPS in client accounts currently. It is not that they are bad investments per se. They might be very valuable if you had to choose a single investment to lock up for a long period of time and needed a guaranteed real return.

But that doesn’t describe a lot of our clients. We are always there to manage and rebalance the portfolio, and we can use many different types of investments over time.

We don’t need one single investment to put a client in for the next 20 years.

So instead of TIPS, we do 2 things:

First, we keep duration short on our fixed income investments.

This prevents your money from being locked up so to speak in a long dated bond. If you buy a 20-year bond, you are stuck with that interest rate for 20 years. If instead you buy a 3-year bond, you are still going to be stuck with that interest rate, but only for 3 years. And if interest rates rise, after 3 years you will be able to reinvest in the higher yields that will be available.

Keeping duration short will reduce the volatility of your fixed income investments, and also reduce the potential loss in value from rising inflation.

And we use diversified funds. We are never putting all of your money in a single bond. The bond funds that we use hold thousands of bonds, and are constantly having bonds mature and are being reinvested at today’s rates, which would be higher if this inflation really takes hold.

We use bonds in your portfolio to keep a certain segment of money safe from the short term volatility of the stock market. While shortening duration does have the potential to reduce returns over the long term because short term bonds have lower interest rates usually. That is OK because are allocating a larger portion of your portfolio to stocks, which as we’ll see here next, also offer you the best chance of inflation protection.

We are now adding the last 20 year stock return to the numbers we have seen on the previous slides. And probably no surprise to you, stocks have been the star performer over the last couple of decades relative to other investments.

And remember, this 20-year period does include some time in a higher inflationary environment. Remember the early 2000s had inflation between 5 and 7%. So, despite the 2008/2009 crisis falling right in the middle of this period, stocks have done very will in not only providing inflation protection but also growth.

So how have stocks done specifically in times like we see today where inflation is rising?

This is a chart from an article that was in the Wall Street Journal just the other day, showing how often different investments produce real, or positive, returns after inflation over 1 year periods. This chart is using data from the last 48 years for stocks, commodities, and treasuries, and 24 years for TIPS since they were not created until 1997.

And when we look at a little larger data set like this, we start to see that stocks have historically done very well at producing positive returns even after rising inflation. 90% of the time equity investors have come out ahead of inflation, significantly better than even TIPS, which you would think would be better perhaps since they are marketed as an inflation hedge.

Stocks have also significantly performed better than commodities, which are also a popular investments for those worried about inflation, and also treasury bonds.

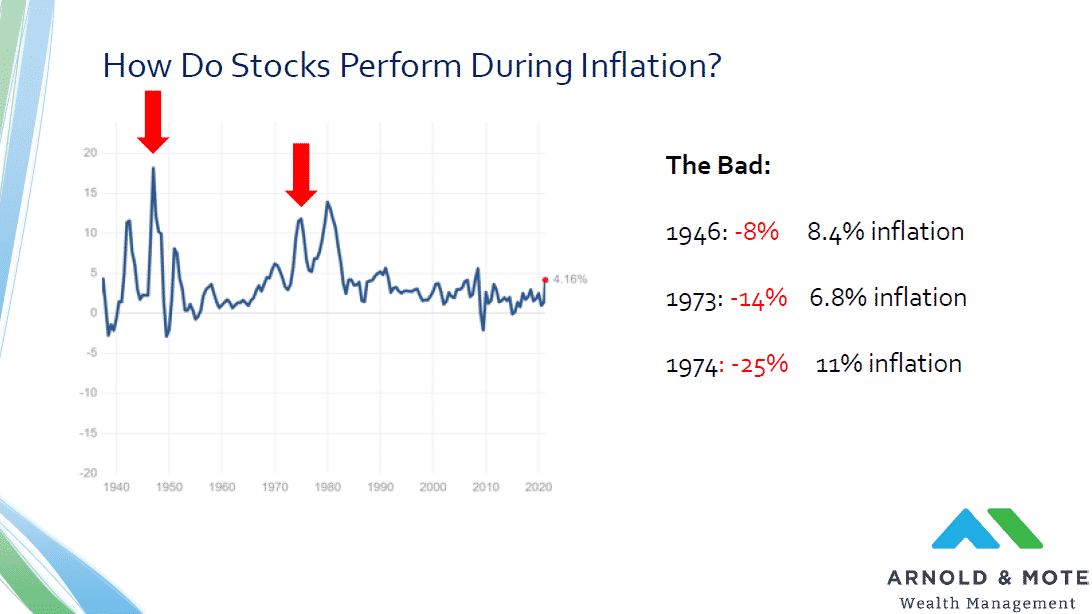

I thought it would also be interesting to look at how the stock market in general performed during those real notable periods of inflation we have had in the past.

Remember that last slide said that 90% of the time, stocks have produced real, positive returns to investors. That also means that sometimes they don’t, so I wanted to look at when they did not just to give you an idea.

After WW2, the US saw really high inflation for just a couple of years. In fact, a lot of people are equating today’s environment to a bit like the post-war 1940s where it just took some time to get markets back to normal.

Anyway, 1946 saw inflation running about about 8 and a half percent. And during that year stocks returned about negative 8 percent. Not great, but harly outside of normal stock market movements.

The early 70s are certainly the most notable, and in the early 70s stocks really struggled. Inflation eventually approached double digits by 1974, and stocks – I should say as measured by the S&P 500 here – lost nearly a quarter of their value in 1974, one year after losing 14% the year before.

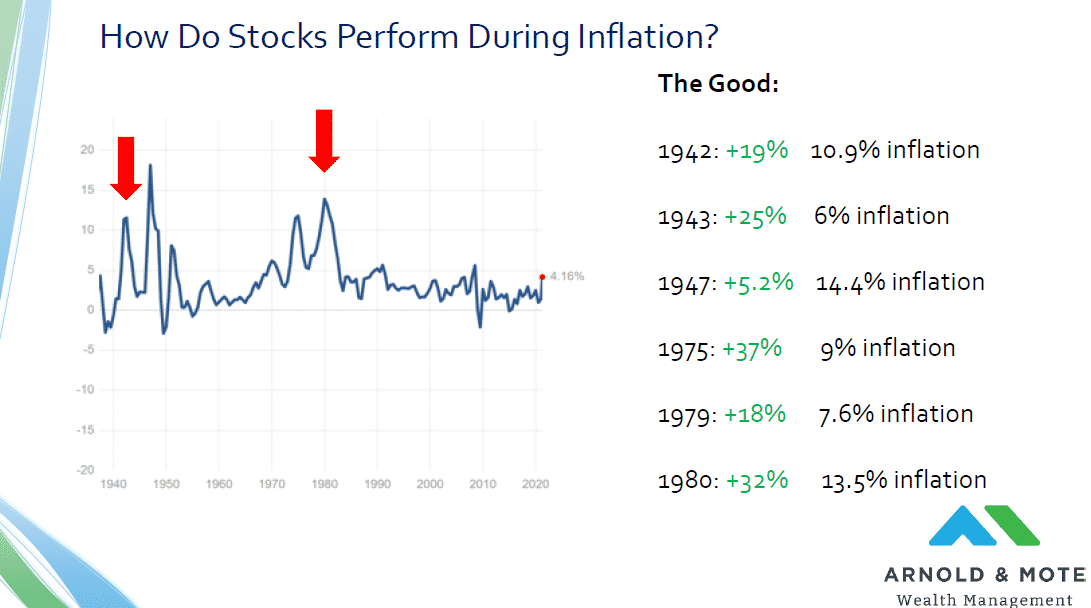

But, stocks performing poorly is certainly not the rule.

Shown on this slide now are returns in other years that saw very high inflation. Note specifically many of these years have even higher inflation than those years noted o the previous slide.

Remember on the last slide we showed those 2 terrible performing years of the early 1970s, well as inflation continued to rage on at the end of the decade, and actually as inflation got even higher, stocks actually performed quite well. Just look at the bottom line there, in 1980 when inflation peaked right around 13 and a half percent, stocks returned more than 30%.

So, it is certainly not the rule that stocks do poorly in inflation like many believe just by making assumptions about how markets performed in the early 70s.

So what is the right way to invest your stock allocation knowing that inflation could be around the corner?

We might be sounding like a broken record here we know, but inflation is not a reason to make dramatic changes to our investment portfolios. We invest in broadly diversified stocks funds that invest you in many companies that could do very well in inflation, but also international markets which may be spared from the inflation in the US, and also these funds are rebalanced over time so that if inflation does cause the value of these funds to drop like we saw in the 70s, we will have other assets that should have done well over that time, that we can sell and use to purchase those investments that performed poorly to take advantage of the future rise in value, like the later part of the 1970s brought.

Despite what a lot of people will try and say, inflation can not be predicted with any amount of certainty. Even Warren Buffett, who is usually regarded as one of the best investors of our lifetime at least, told his shareholders in one of his annual reports that it is foolish to try and guess which stocks will outperform over a short period of time in an inflationary environment.

The main point we wanted to show here was that the way we construct portfolios and invest client assets will help protect you from inflation.

Your investments give you a lot of ways to protect yourself from inflation. And we put those options to use when we manage your portfolio.

We face a lot of uncertainty when we invest, inflation is just one of those risks. And we know that it can be scary to be invested in a time like today. But hopefully this helped show just how important stocking to your plan can be, and specifically how important that stock portion of your investments are over the long term in not only providing growth, but also just protecting you from inflation.

For our long term clients, you know that our portfolios got your through 2008-2009 crisis, and through the cornonavirus crisis. This same investment philosophy will also get you through a period of rising inflation, if it does indeed come.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management, a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.