Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

There are a number of ways to use your investments to give to charity that not only are great for the charity, but also gives you potentially valuable tax breaks. Here’s a few strategies our clients have found most valuable:

The first way is to give appreciated securities instead of cash or check to the charity. Your investments have likely gained in value over your lifetime. Therefore if you were to sell those investments, you would face capital gains taxes.

By donating the securities themselves, rather than selling and donating the proceeds, you will save on taxes and the charity will receive more money.

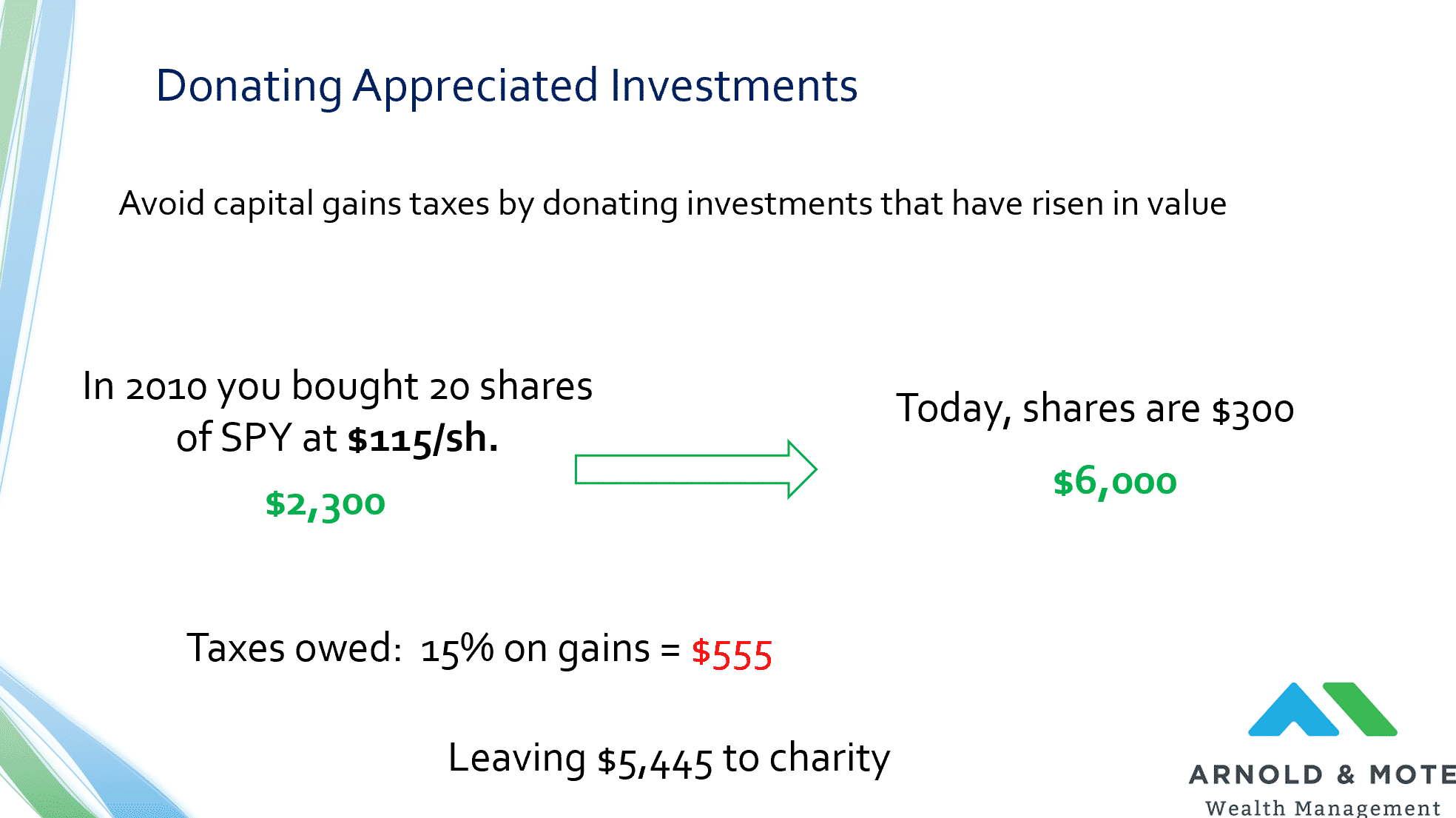

For example, consider if you purchased stock that was originally worth $2,300, that is now worth $6,000. If you sell the stock you will recognize about $555 in long term capital gains taxes:

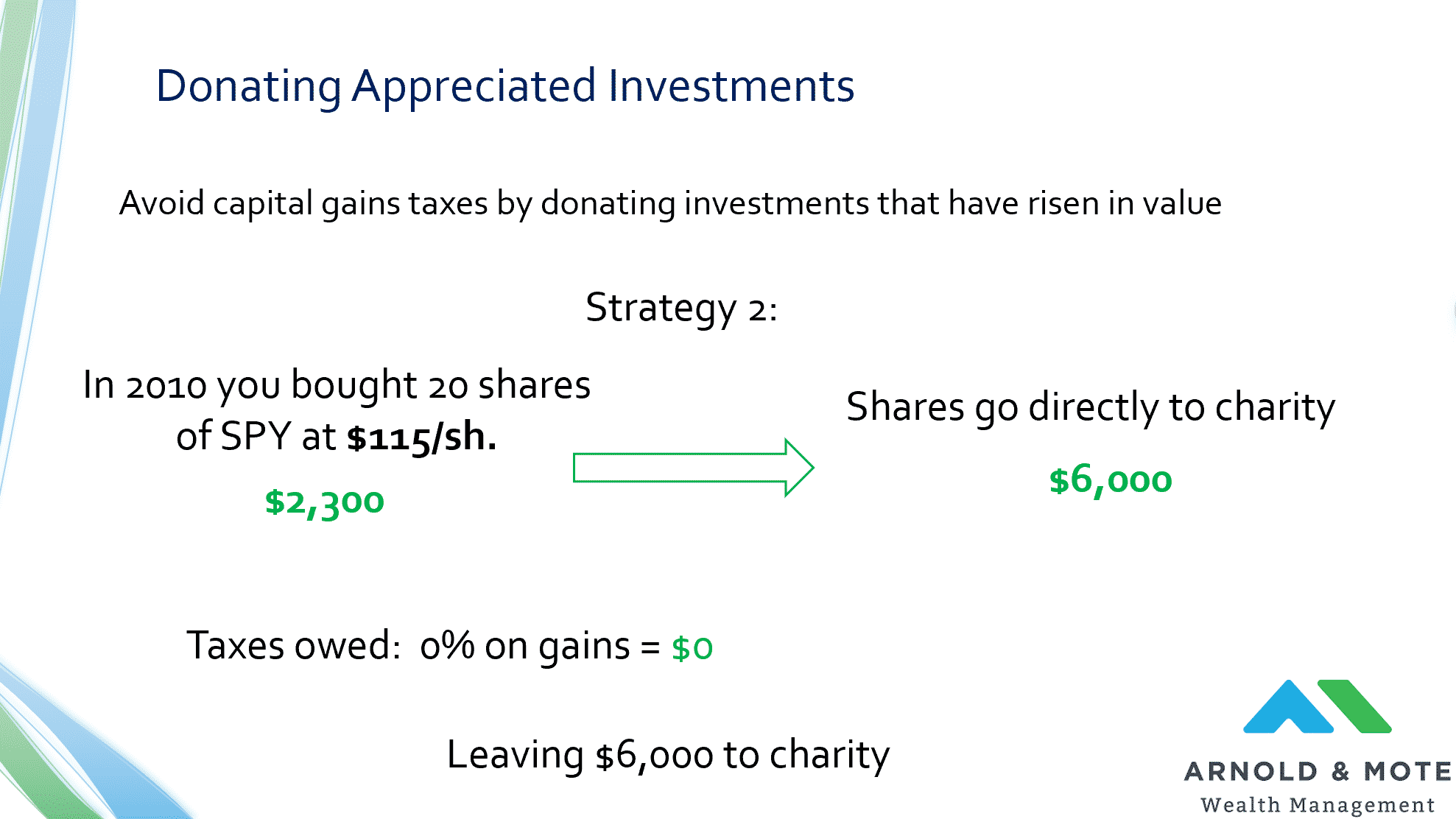

Instead, if you would just donate the appreciated stock directly, rather than selling, you would save $555 and the charity would receive the whole $6,000 donation:

To do this, you must have investments in a taxable brokerage account. Contact the charity you’d like to contribute to on how they accept donated securities. You will likely need to coordinate between the charity and your custodian to make the transfer.

Next is QCDs, or qualified charitable distributions from your IRA. This is available after you are age 70.5, and allows for tax free donations from your IRA.

Normally, IRA distributions result in taxes for you, however when you donate via QCDs you are not taxed at all.

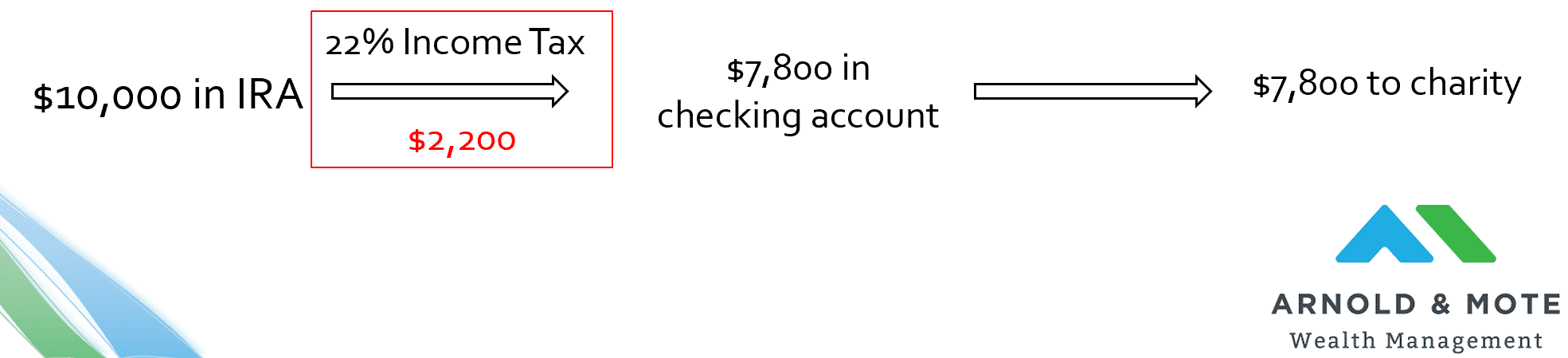

For example, consider someone in the 22% income tax bracket. If they would like to donate $10,000, and first take a distribution from your IRA, they would be subject to $2,200 in taxes.

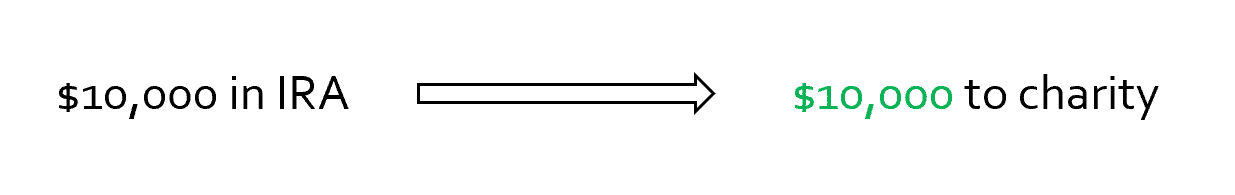

Instead, you could simply perform a qualified charitable contribution. With a QCD, the full $10,000 would be sent to charity, and you would incur no excess taxes.

QCDs are tax free and can even help offset your RMD (required minimum distribution) is over age 72.

Contact your custodian to determine their process for QCDs. For clients of Arnold and Mote Wealth Management, we provide our clients with a checkbook that is only used for qualified charitable distribution donations. That way, it makes it incredibly easy for our clients to donate.

Finally, a donor advised fund (DAF) is great if you have a large sum of money to donate, but you want to give to charity over a longer period of time.

With a donor advised fund, you can make a large contribution into the account today, and realize a tax deduction for that whole amount, but then distribute that lump sum over many years.

This is a valuable strategy for those who would not normally donate enough to get a tax deduction (for example, you claim the standard deduction). Using a DAF, multiple years of donations may be given at once, giving you a potentially increased tax deduction.

Most custodians have donor advised funds available. We have helped our clients set up these accounts at Charles Schwab and Fidelity. Note that custodians may have certain minimums and fees on the accounts.

Watch our recent webinar here: Developing a Tax Efficient Charitable Giving Plan