Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

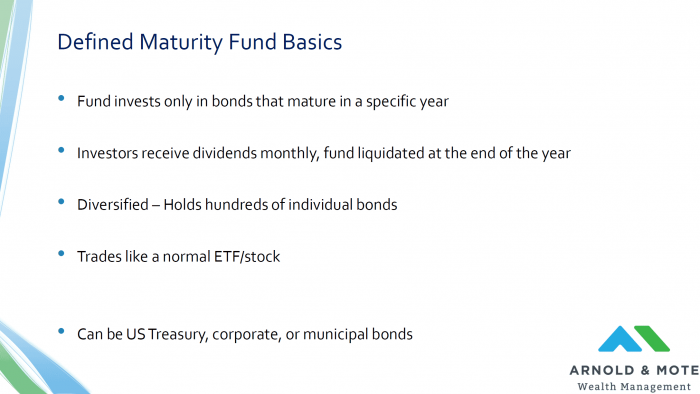

The best bond investment to reduce interest rates risk is defined maturity bond funds.

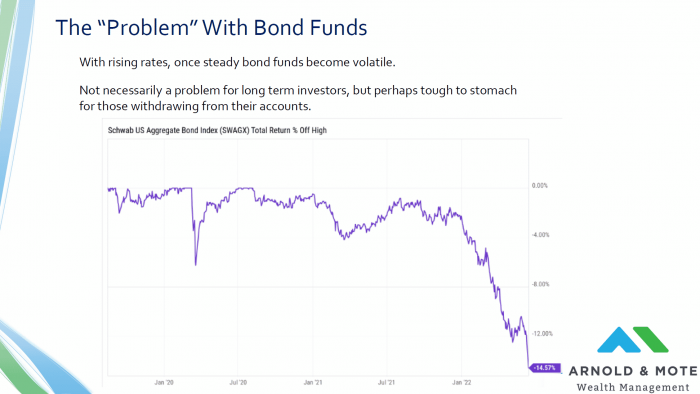

The rise of interest rates has led to one of the more volatile times in recent history for the bond market, and for a balanced investment portfolio. Normally, short term price movements are not a big concern for long term investors…

However, it can be tough to watch the bond portion of your portfolio, typically the steady and boring part of your asset allocation, changing in value rapidly – especially if you are retired and withdrawing from your accounts.

The concept works similarly to old-fashioned CD or bond ladders that retirees have set up in the past. However, these newer investments allow for better liquidity, diversification, and (based on today’s interest rates) higher yield.

In this webinar originally done live in August 2022, we discussed how these investments (also sometimes called “Fixed Maturity Bond Funds”) can help you worry less about rising interest rates and falling stock markets.

We discussed:

– A basic overview of defined maturity bond funds

– Advantages over CD and individual bond ladders

– How to implement a strategy without sacrificing long term portfolio growth

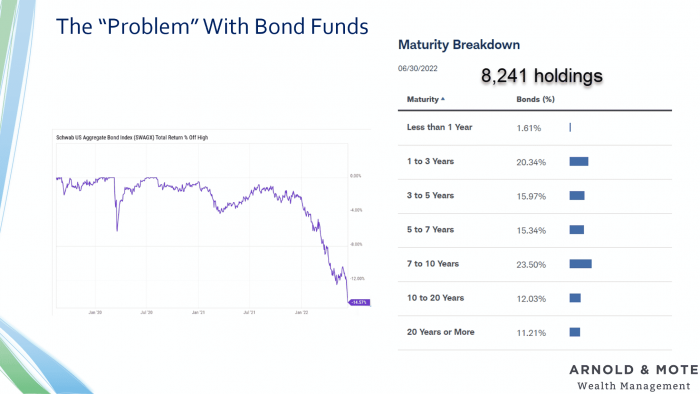

This year, at its worst, a total bond fund – which is just a fund that owns thousands of different bonds of all types, treasuries, corporate, and others – was down 15%. It has bounced back a bit now. But, at the worst of it, this is the decline an investor in a total bond fund was looking at.

Just to give you an idea on how unusual that is, prior to 2022, the worst annual performance for a total bond fund over the last 35 years was a 2.7% decline in 1994.

“Problem” is in quotes here because for a long term investor, this isn’t necessarily a problem. Obviously no one likes to see account values decline, but for a person that has time to hold, these funds are now buying higher interest rate bonds which will increase your returns in the future. Rising interest rates are actually a long term benefit for you!

But this does get potentially unsettling for a retiree who is withdrawing from their accounts, and particularly those withdrawing heavier amounts earlier in retirement before Social Security begins, and while living expenses are high.

And, if you know that you have a certain need for money in the short term, this is a great example for why a typical bond fund might not be a good choice – If you need $50,000 next year it might not make sense leaving $50k in something that can drop 15% or more very quickly if interest rates rise.

Why did this drop occur? And why are these bond funds potentially not the best place to invest money needed in the short term?

I’m going to use a very simplified and quick example here. But if you want to understand a little better about how exactly bond prices change please see a webinar we did previously titled “What’s Going on in the Bond Market?”

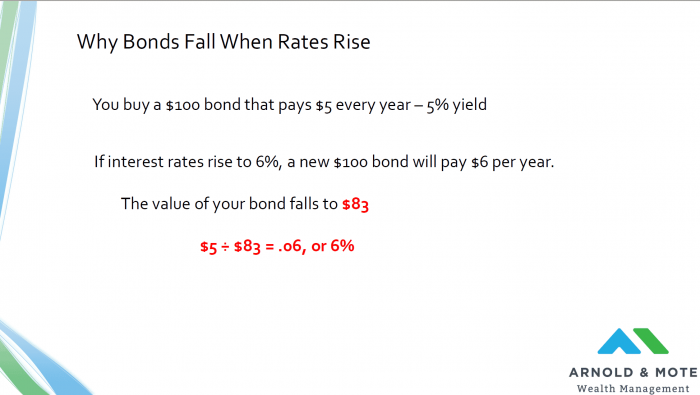

Just to use a very simplified example – say that you buy a bond for $100 that has a $5 annual coupon, or has a 5% yield.

If general interest rates rise 1% and now new bonds out there yield 6%, no one is going to want to buy your 5% yielding bond if you try and sell it.

So, you’ll have to offer it at a lower price where the $5 payment equals a 6% yield, because that’s what they can get anywhere else.

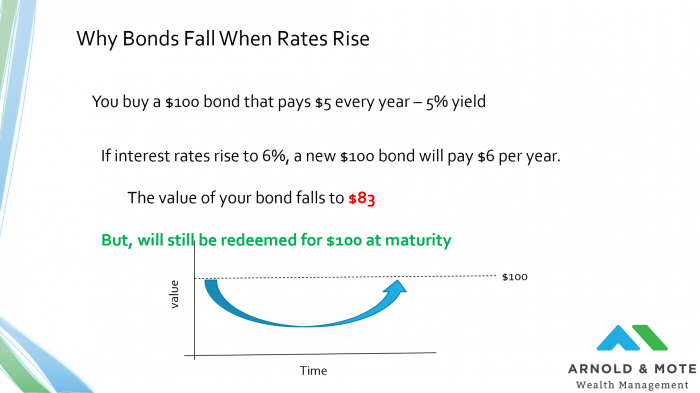

Exactly how much this bond will fall in price is a little more complicated in the real world, because there is also another characteristic of bonds…

And that is that upon maturity you also get your principal back, or $100 in this case.

So as long as the issuer of the bond doesn’t default, no matter what interest rates do in the future this bond will eventually get back to $100. As long as an investor holds this bond until maturity they will get their $100 back.

But, bond funds like most investors use don’t operate this way. Schwab’s aggregate bond fund is never going to mature at a certain date and give you all your money back.

The fund owns more than 8,000 bonds at any given time, and instead of sending the principal back to investors as bonds mature, it reinvests the proceeds into new bonds.

This is a very good thing for those with longer time horizons or who are comfortable with the volatility. If you don’t need the money, you want it reinvested into new bonds continuing to grow and compound.

But, for a person that has a fixed cash need, you don’t have the certainty of getting your principal back at a certain date using a bond fund like this compared to how you would with a single individual bond, or something else with a fixed maturity like a bank CD.

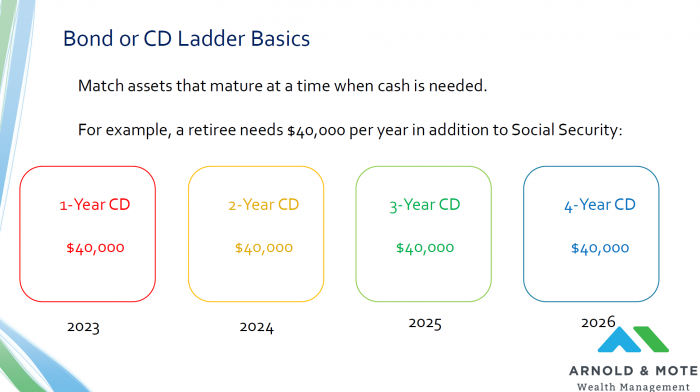

All this is the reason that investors have used what is called ladders in the past. This is nothing new at all and has been around forever.

Typically ladders have been created using bank CDs or individual bonds. They will set up holdings that mature at a certain time to meet their anticipated cash needs. You buy a 1 year CD for next year’s cash needs, a 2 year CD for money needed 2 years from now, and so on.

This laddering helps reduce interest rate risk because you have assets that mature at a certain date. You know you are getting your principal back at a specific date and don’t have to risk a bond fund declining 15% right before you need to sell it.

I think this concept is pretty familiar for most, so we’re not going to go into a lot of detail here.

But what is worth discussing is how these ladders are done today and some downsides to doing them with CDs or individual bonds.

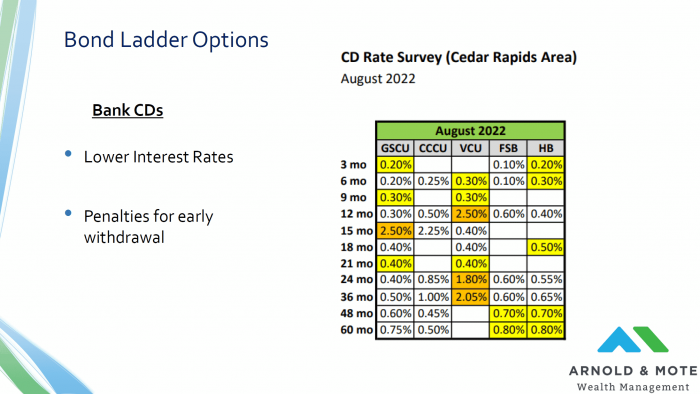

With bank CDs, specifically today their interest rates are really low. Banks just don’t need customer deposits right now, so there’s no incentive for them to offer higher rates.

Just to give you an idea of general interest rates available right now for bank CDs…this is a screenshot of something that Nick puts together every month. It shows the CD rates for local banks and credit unions for various maturities.

And you’ll see that baring certain specials that are out there, which may also be for limited money or only for new customers by the way, interest rates are low. A 2 year CD at Green State credit union has a 0.4% interest rate.

Today, a 2 year treasury bond, something we can very easily buy for you at Schwab and guaranteed by the federal government, has a 3.2% interest rate.

An investment grade corporate bond, which has some risk but is still a bond issued by a company in very good financial shape, is somewhere around 3.8%.

Note: This information above is from August 18th and may not be representative of today’s interest rates.

Besides interest rates, CDs can also have penalties for accessing the money early. This could be another reason they aren’t ideal for retirees with variable expenses or who don’t keep larger cash cushions elsewhere.

So, the principal of using a CD is very good for bond ladders. But today especially, they just don’t make a lot of sense.

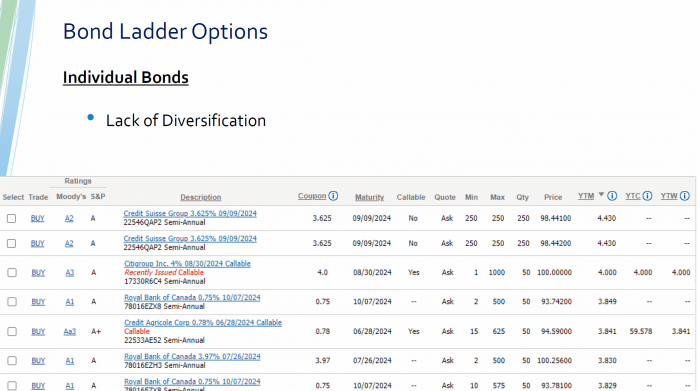

Another option is to buy individual bonds.

This is popular for some, especially for those who have worked with a broker, someone who is paid commissions for selling bonds or other investments, instead of a fee-only planner.

This is another strategy that works well in principal, but is hard to implement correctly in a real portfolio.

And just to show why that is the case, I thought it would be good to show what we look at when we go to buy an individual bond for a client. Here I just did a search for bonds that have a maturity of about 2 years and are investment grade.

I know this is busy, but what you see here is a list of individual bonds for sale. You see the company issuing the bonds here – Credit Suisse for example

The coupon of that bond. 3.625%

And the maturity. September of 2024. I think those are straight forward

But another thing I want to point out here is the minimum trade size required. That is this MIN column here. 250 in this case means 250 bonds, each bond has a $1,000 face value.

That means the minimum purchase right now for this is a $250,000 purchase. I feel pretty comfortable saying that most people here don’t want to invest $250,000, likely a huge portion of their net worth, in Credit Suisse bank.

So, it gets tough to diversify. There are bonds out there where you can buy only 1 or 2 of. But, its limited. Depending on the market when you want to make these purchases, it might be very hard to diversify your bond ladder into more than a few companies.

We think that’s way too risky for most retirees and is a reason we just don’t do this sort of thing with corporate bonds.

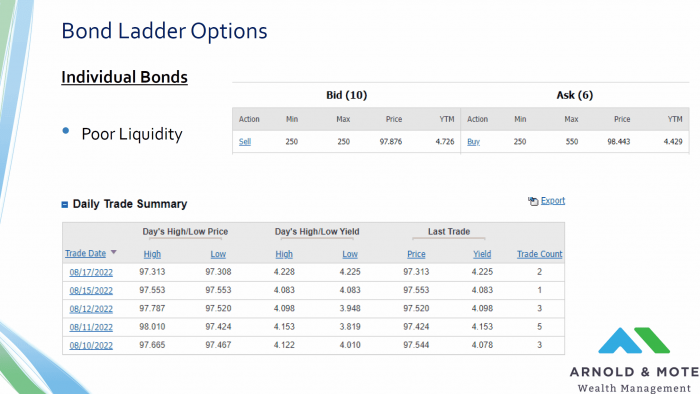

Besides the trouble in diversifying, in general corporate bonds just are not traded that regularly. This means it can be tough to buy and sell the bond at a specific price.

So, lets say you do buy this bond and then need to sell before it matures. The top image here shows the Bid/Ask spread of one of the bonds listed on that last image. It tells you that the highest price to sell a bond is 97.876, and the lowest price to buy a bond is 98.443.

That spread is basically a transaction fee for trading the bond. For stocks this is usually just a penny or two, so pretty inconsequential. But in this case is much more.

And the bottom image here shows the trade history of the bond. The number I want to highlight is the far right column, Trade count.

This bond offering, issued by a huge international bank, traded just 2 times on the 17th, no times the day before, and once the day before that.

If you have to sell this bond before it matures, you need to either accept that it may take a while to sell, or you will have to really lower your price to entice someone to buy it now.

We think this is a big issue for money that you are setting aside for short term needs.

So what’s an alternative? It is a relatively new idea called a defined maturity bond fund.

They aim to combine the good characteristics of individual bonds, with those of ETFs and index funds to make for a better alternative to laddering your investments.

These are funds that only purchase bonds that mature in a specific year. At the end of that year, the fund does not reinvest the proceeds of the maturing bonds, but instead gives that principal back to shareholders of the fund.

So, it acts like an individual bond in a sense.

But a benefit is that instead of just one bond, it holds hundreds. Because these funds have billions in assets, they can properly diversify unlike an individual investor trying to navigate the individual bond market.

These funds have intra-day liquidity. They trade just like any other stock or ETF. You can hit sell, and there is a market to buy and sell the shares of the fund instantly for very little spread.

Lastly, there are also a lot of different types of these funds available, that make it easy to build a portfolio to suit your needs. There are Treasury defined maturity bond funds that just own treasury bonds if you want to be safest, there are corporate bond funds that help you get the higher yield that corporate bonds provide without as much risk because you have your money spread out between hundreds of companies, and there are municipal funds also, for those where municipal bonds make sense due to their tax situation.

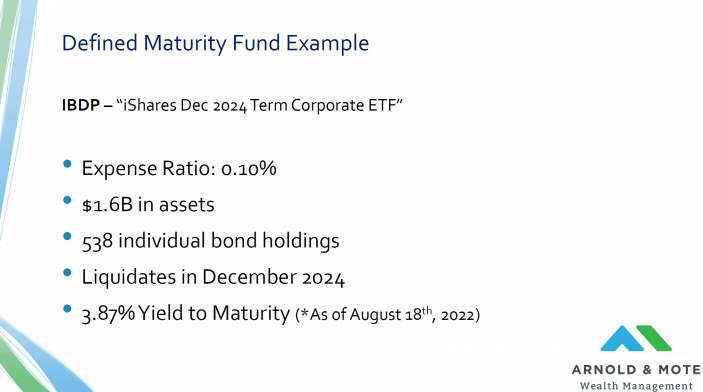

What do one of these funds look like?

Here’s a specific example, a fund by Blackrock with the ticker symbol IBDP – it is called the ishares December 2024 Term corporate ETF.

As you can probably tell by the title this fund owns corporate bonds that all mature in 2024, and the fund will actually liquidate in December of 2024.

One big concern with investments is expenses. And the good thing about these are that they are easy to manage, and so some with a very low expense ratio. In this case, just 10 basis points, or 0.1%.

These funds have a lot of assets, this one in particular has $1.6 billion, which allows it to diversify into many different individual bonds – 538 in this case.

You can see this is a great improvement over an investor using individual bonds and having a significant portion of their net worth in a single company’s bond. Here, even if a few companies that have bonds in the fund default, it represents just a tiny percent of your investment in the fund.

Then, this fund will liquidate in December of 2024, so you can be certain that you will get a payment on that date, and that the fund is holding all of the bonds in its portfolio until maturity, ensuring that they get back that par value of the bond.

And, perhaps best of all – with the recent rise in interest rates, these offer a relatively good yield. Just under 4% in this case for a bond fund.

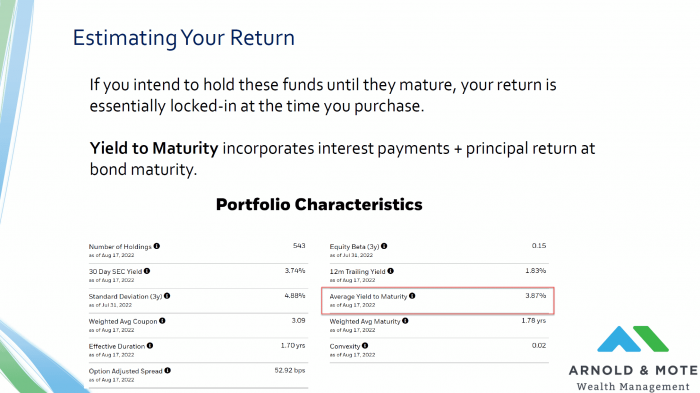

I wanted to spend one minute explaining that term – Yield to Maturity, because it may not be something you are familiar with or we have covered in the past.

Yield to maturity is just a calculation of your annual return if you hold a bond until maturity.

Remember our example before about a bond purchased at $83 and then matures at $100, and also pays a $5 per year interest payment? Yield to Maturity calculates the return from not only that $83 going to $100, but also the interest payments along the way.

For this fund in particular that we are looking at, you can see the average coupon is 3.09%, but the yield to maturity is 3.87%, that tells us that many of these bonds are trading below their par value, that $100 in our previous example. So investors are not only getting the interest payments, but also some appreciation in principal as well.

If you want to consider these Defined Maturity Bond Funds, this is probably the important number to look at because this is the return that you are essentially locking in when you purchase this fund. If you hold this fund until maturity you will get somewhere around a 3.79% annualized return. If you need or are expecting something higher, you won’t get it by holding this until maturity. So, you need to be comfortable with this number.

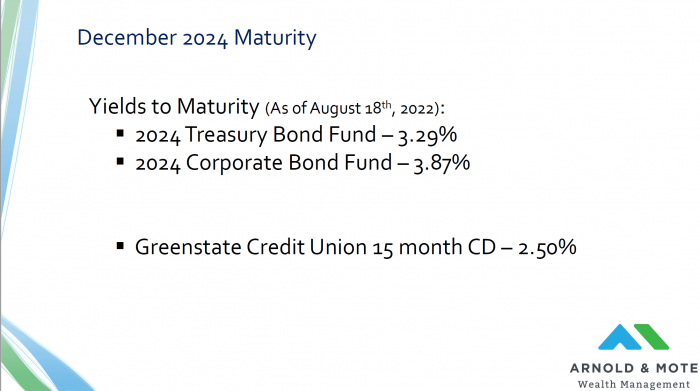

And just to summarize one reason why we think these make more sense today compared to laddering with CDs, here’s the current yields to maturity of both a treasury defined maturity bond fund, and a corporate one.

And then compared to GreenState Credit Union’s 15 month CD special. This is the highest rate on any CD they offer, or really any local bank offers right now for that maturity of a CD. And it is well below that of the rates you can get in these defined maturity funds.

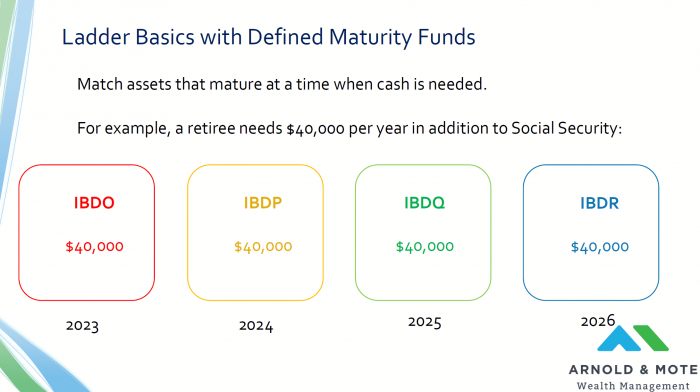

Its easy to put this type of ladder in place. There are defined maturity funds available for every single year for the next 10 years out.

So, just buy a similar amount in each fund as you would a CD, and its all set. With just a few trades in Schwab or wherever your retirement assets are held, you can get a high quality, decent yielding ladder set up.

Of course, there are pros and cons of everything, and there are a few cons with these funds you should be aware of.

We mentioned that the start that the issue with bond funds is their potential volatility. For some, the recent volatility of bond funds has just been too much.

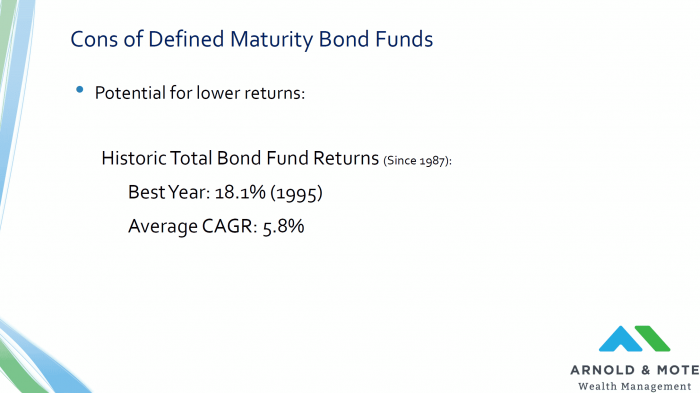

But, investors who have held through volatility are typically rewarded by the market. And historically, a total bond fund has outperformed today’s defined maturity bond fund interest rates.

Again, we don’t know what the future holds, but if it is anything like the past, a total bond fund has returned just under 6% annually over the last 35 years.

And the best annual performance in that time frame was a 18% gain in 1995 – which perhaps not coincidently occurred the year after 1994, which prior to this year was the worst year for a total bund fund.

So, just know that there is a potential for lower returns. You get the reduced volatility, but could be giving up gains.

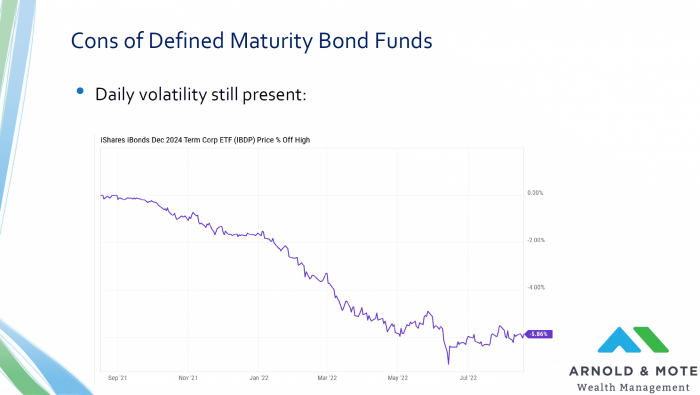

Also, while there is a plan to hold these to maturity and get your principal back, you are still going to see volatility in the day to day share price.

Again, you don’t have to worry about this if you plan to hold to maturity, but you will see prices temporarily decline if interest rates continue to rise.

Here is a chart of the 2024 corporate bond fund, its down about 5% over the last year.

So unlike a CD, this does not prevent you from seeing the daily ups and downs in the market.

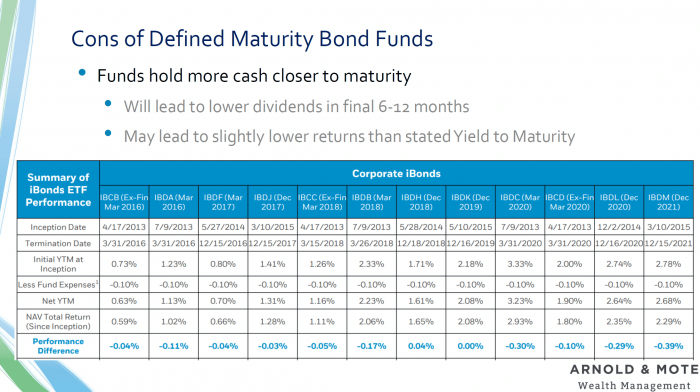

Lastly, these funds end up effectively just being cash later on in their lives, which reduces the monthly dividend you receive, and can lower your actual realized return compared to the published yield to maturity, since you will be holding lower yielding cash compared to a bond.

Just so you know, there is lots of published data on how this added cash impacts realized performance. This is a chart from Blackrock here and the key data is the bottom row which shows the difference in annualized performance an actual investor received compared to the published Yield to Maturity of the fund at time of purchase.

You can see in general its lower, at worst about 0.39% per year in reduced returns.

That still makes these a better investment return-wise than CDs I think, but could be a risk going forward depending how interest rates behave as these funds hold cash.

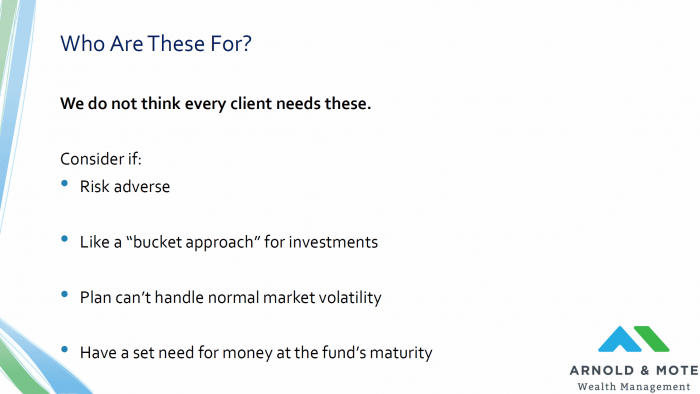

In the end, we don’t think every client needs to switch to using these.

But they are a good alternative for investors who fit the following criteria:

Do Defined Maturity Bond Funds make sense in your retirement portfolio? We help hundreds of clients get answers to their financial questions and create successful retirement plans. Schedule a meeting today for a free 30-minute consultation with us.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.