Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

The benefits of dividend investing are frequently hyped across financial media, by bloggers, and even by financial advisors. We get a lot of questions about the best dividend funds and strategies to use dividends in retirement.

We also find that there is a lot of untold dangers in creating a retirement portfolio solely focused on a certain dividend yield.

Below is a webinar we did on this topic in September 2024, with the full transcript below:

Obviously, dividends are not bad.

What we’re referring to here is the concept that is really popular and regularly pitched online about heavily concentrating in only dividend paying stocks or high dividend paying funds, and using those investments to create an income stream from those dividends.

Then, this strategy is also usually centered around the idea of “never touching the principal”, and living solely off those dividends for your retirement plan.

I just included a few examples that were easy to find here, covers of magazines devoted to helping you find the best dividend stocks:

And sites like YouTube are full of this, hundreds of videos with millions of views talking about how they are going to retire off these dividends.

Tons of people are searching for dividend content like this. And there is a lot of content to take advantage of someone searching trying to educate themselves on the basic ideas

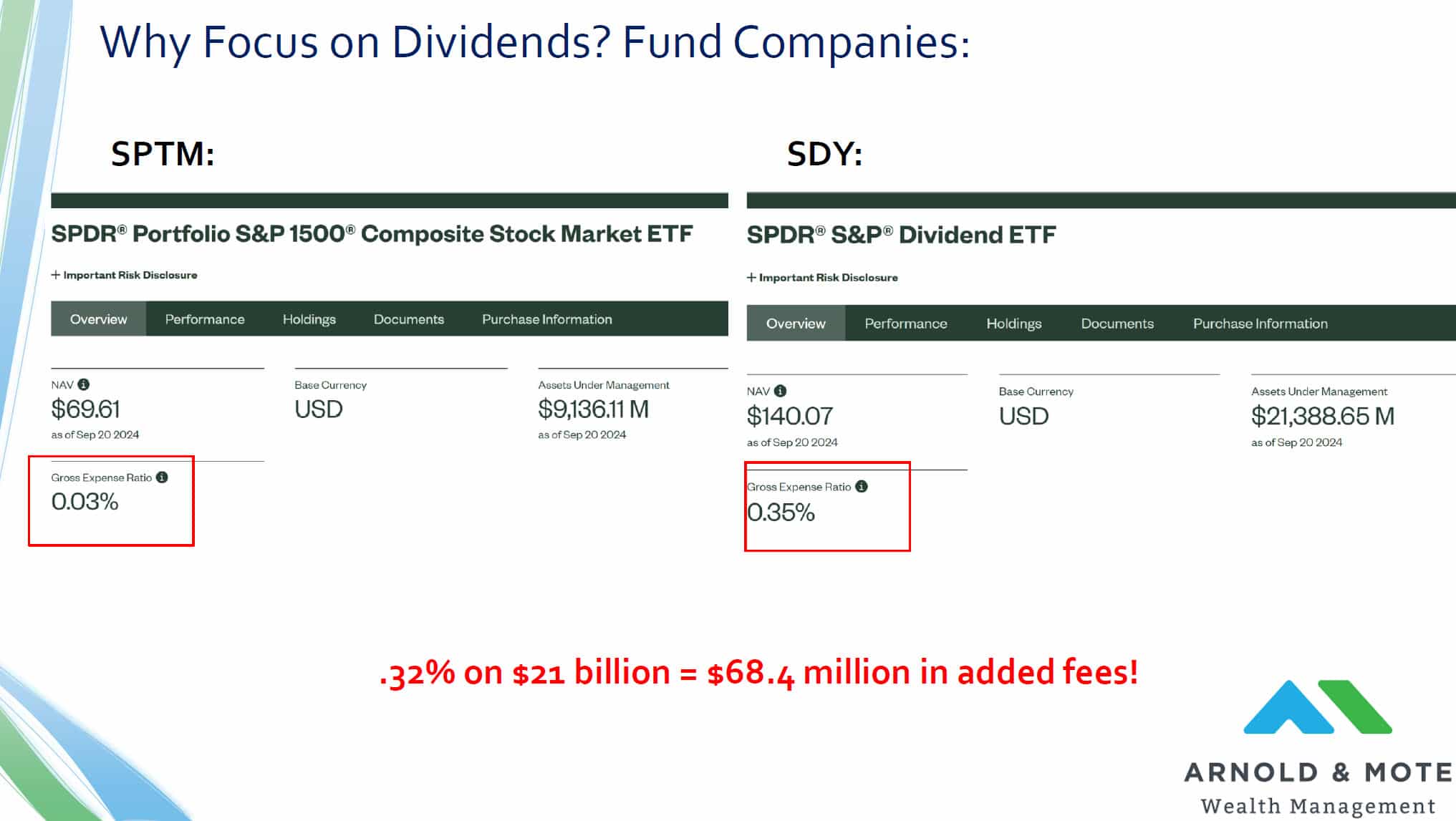

Besides media and bloggers, fund companies are behind this craze too, because anytime you can add any bit of complexity to a fund, they can charge more.

Shown here are 2 funds from SPDR. On the left is the fund with the ticker symbol SPTM, this is your basic boring, low cost index fund. It owns 1500 individual stocks, essentially a huge chunk of the stock market and all for 0.03% fee. In our eyes, this is a really great fund that could really be the keystone of a great retirement portfolio.

On the right is a different fund by the same company. This one has the ticker symbol SDY and it is a fund that starts with the same 1500 stocks as SPTM, but then removes all the companies in the list that haven’t paid a dividend in a certain number of years. In fact, it filters out about 90% of the holdings and invests in only about 130 companies.

And for that extra work, they charge a fee nearly 11x higher, more than a third of a percent.

And also shown here is the assets that are in the fund. For SDY for example you see it is about 21.3 billion dollars, which is more than double what is in SPTM.

So fund companies love this trend of dividend investing too, because here is a fund that charges a 32 basis point, or 0.32%, premium to invest people in just certain dividend stocks out of the index.

The added fee that SPDR gets from $21 billion being invested in SDY rather than SPTM, and it is pretty close to $70 million dollars.

And yet, investors throw continue to throw their money at these types of dividend funds.

To be fair, there are a couple of reasons that I think dividend investing may have, at one point, had a little more merit

One is that before the internet in particular, the fees to trade and just invest in general were much higher than they are today.

This chart on the left is showing historic average trade fees by ways of commissions on stocks over time. Until the mid 1970s, it would have been very common to pay .8% or even .9% commission to do a trade.

And also, the chart on the right is showing average fund fees over time, which even more recently were well over 1%.

So if you were in a position where you needed income from your retirement and one option was to invest in dividend paying stocks, and the other was to pay a nearly 1% commission to trade and then also a 1% fee for holding a fund….I think a portfolio of dividend paying stocks could actually make a little more sense.

But, that’s not the case today. Its pretty unusual to pay percent commission for trades anymore, and fund fees can be well under .1% now, like we just showed on the last slide with SPTM charging 0.03%.

And finally, one last reason that dividend investing may have made sense in the past is that historically, a lot more companies paid dividends, and higher dividends than what they pay today.

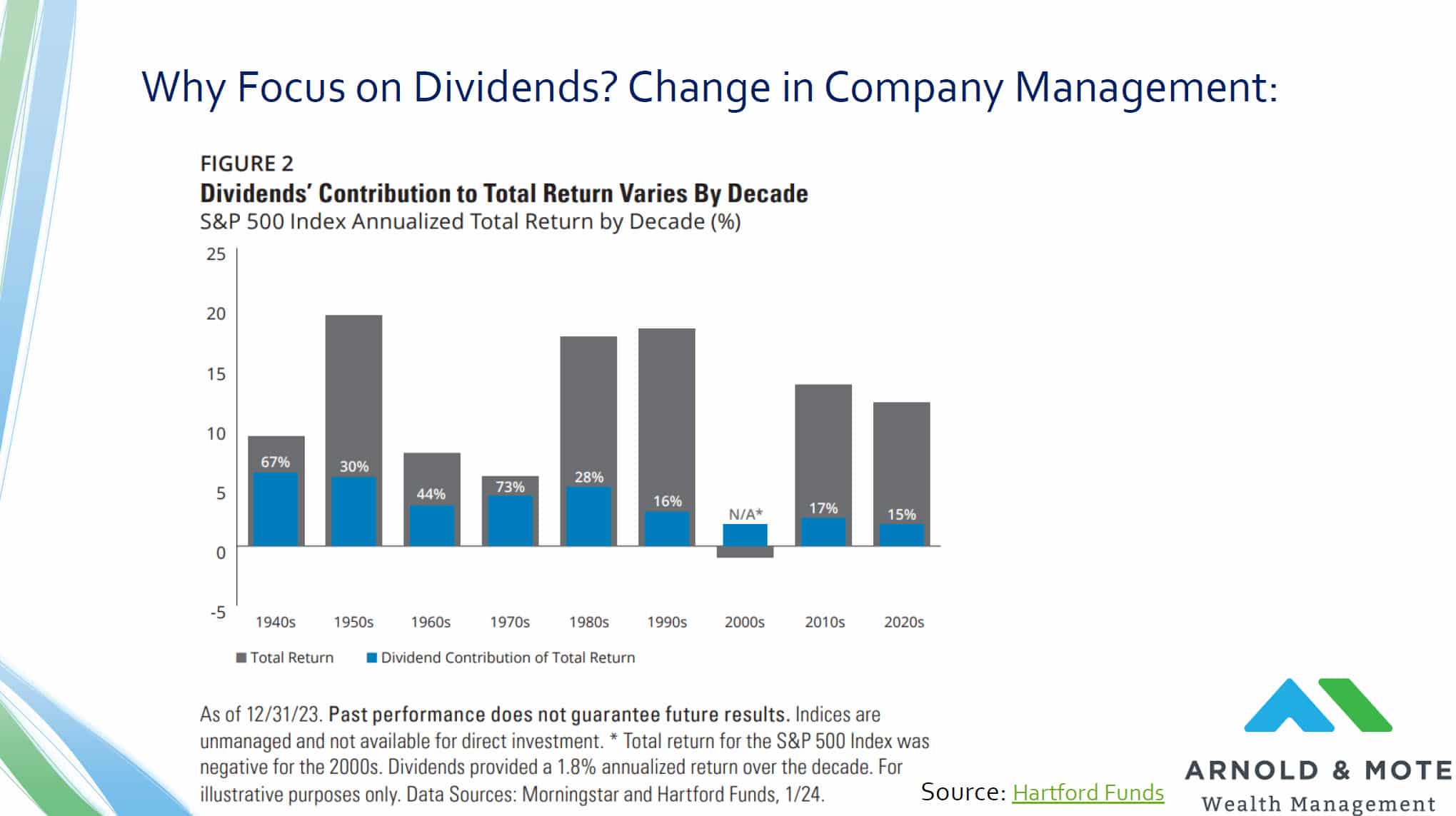

This chart is showing the return of the S&P 500 by decade and then the component of that total return that came from dividends.

Just for example in the 1940s, the S&P 500 averaged just about 10% per year in total return and about two-thirds of that return was solely from dividends.

You can see as the decades go on here, in general these last couple decades have seen much lower portion of the total return of the stock market come from dividends. That’s just because companies are changing to be more focused on doing buybacks instead of paying dividends, or just retaining that money reinvesting it in the company and trying to grow. Think of companies like Amazon and Berkshire Hathaway as examples.

These types of companies that have never paid dividends have been very successful kind of influence this next generation of companies and we’re just seeing companies not pay out that much in dividends anymore.

So if you grew up investing in the 70s, dividends were a huge part of your return. But, they are not so much anymore.

What is the problem with focusing your portfolio on dividends? Why is optimizing your asset allocation on only investments that have a certain dividend yield or that pay dividends an issue?

We’re going to go through these three points:

Just how difficult it is to have a diversified portfolio if you’re focusing on dividends?

As I made the point in the last slide, the number of companies that are paying dividends now is much lower than it has been in the past. Today only about 40% of companies actually pay any kind of dividend at all.

You can see see back in the 1940s and 50s upwards of 90% of companies paid some dividend on their stock. And we’ve seen this pretty dramatic shift in companies not paying dividends over the last couple decades.

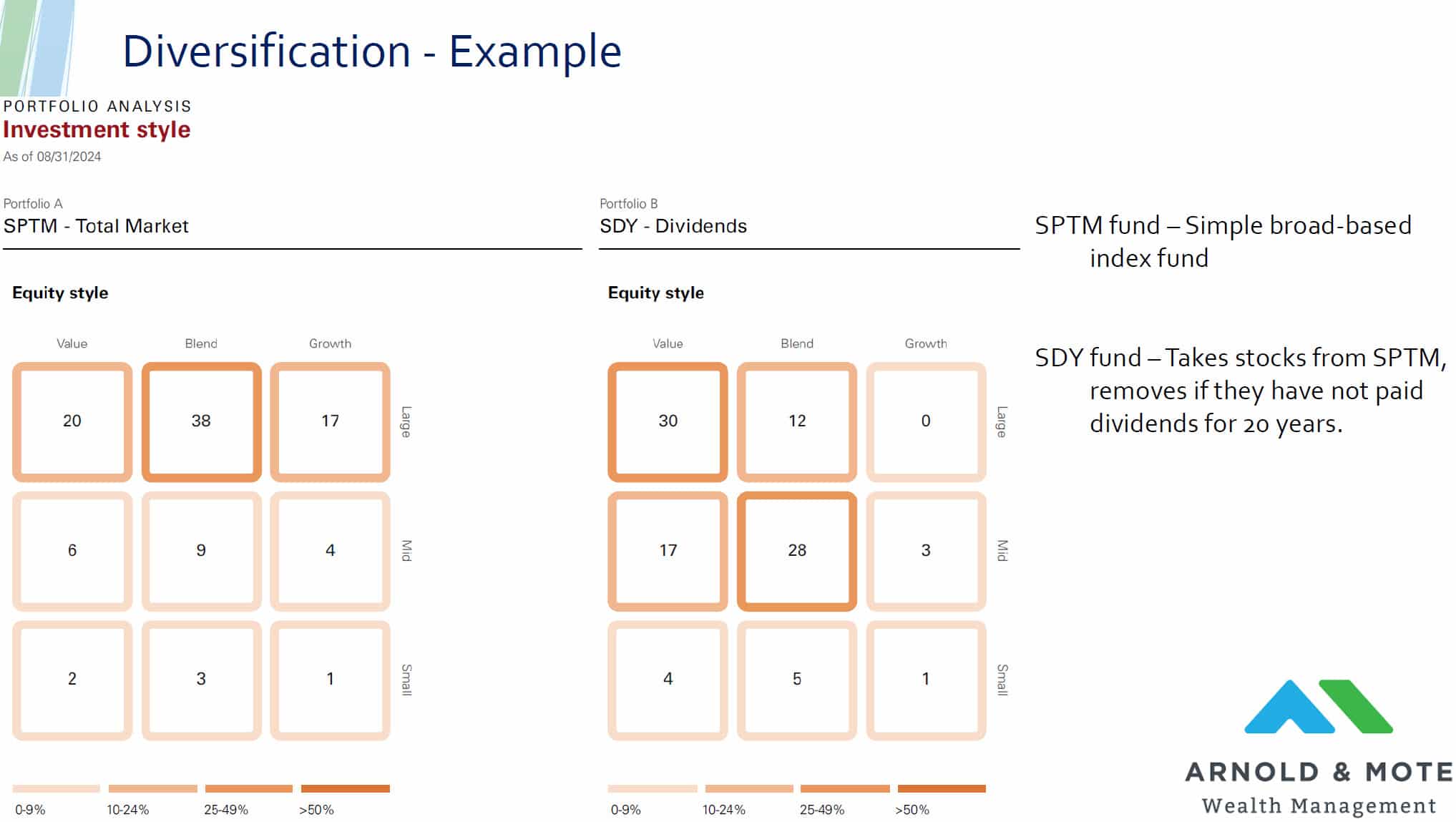

What this looks like for someone creating a retirement portfolio around dividends is much more concentrated investments in different parts of the economy. This is a side by-side chart of what’s sometimes called a “style box” that shows how the investments in a certain fund are kind of split up between large companies or small companies, growth companies or what’s called value companies, etc.

On the left here is SPTM this was that very basic low-cost index fund we mentioned earlier. On the right is that same dividend fund, SDY.

These boxes show you the percent of assets in the fund that are invested in a certain area. So for example SPTM has about 17% of its assets in large growth companies.

You’ll see a big difference here comparing this allocation to the dividend fund, which has no large cap growth companies, and very little growth at all.

What SDY is excluding here are companies like a lot of tech companies that are starting out growing and they can’t afford to pay off dividends. Or, companies like Facebook like Amazon that just don’t pay dividends because it’s worth it for them to reinvest their their earnings back into the company.

You can see there’s some pretty big differences here in how the investments in these two funds are allocated. This next slide’s just a different way to try to show the same thing:

There’s two columns here showing the different sectors that these funds are invested in.

As a reminder, SPTM is that basic index fund, SDY is the dividend focused fund. You’ll see some very big differences here in how these funds invest!

It would be a very honest mistake to think you’re buying this dividend fund focused on the S&P 1500 stock index, and not realizing that you’re very differently invested than the the general market. SDY has a much higher allocated to sectors like utilities, defensive companies, and has much less in technology than you would think.

And that leads to some difference in performance from the general stock market.

This is a chart showing the performance over the last 20 years of $100,000 invested in either one of these funds we have been discussing.

The purple line is SPTM, that very basic index fund. And the orange line is that dividend focused fund. What we see here is that concentration in things like utilities and consumer staples and away from technology eventually starts to hurt you when we get into a period where technology starts to perform very well.

There’s also a little bit of a drag here just because the dividend fund has that higher expense ratio. Over a 20-year period, that higher fee is going to start hurting the ability for that dividend fund to compound as much.

An important note here – this chart above is showing the total return. So this is assuming that dividends are re-invested, we’re not neglecting the fact that this dividend Focus fund pays a higher dividend.

This is the first piece of evidence that we’re going to look at that high dividend does not necessarily mean high return.

I would much rather be an investor with you know $666,000 with a little bit lower dividend yield rather than only you know only having $521,000 but maybe a percent higher in dividend.

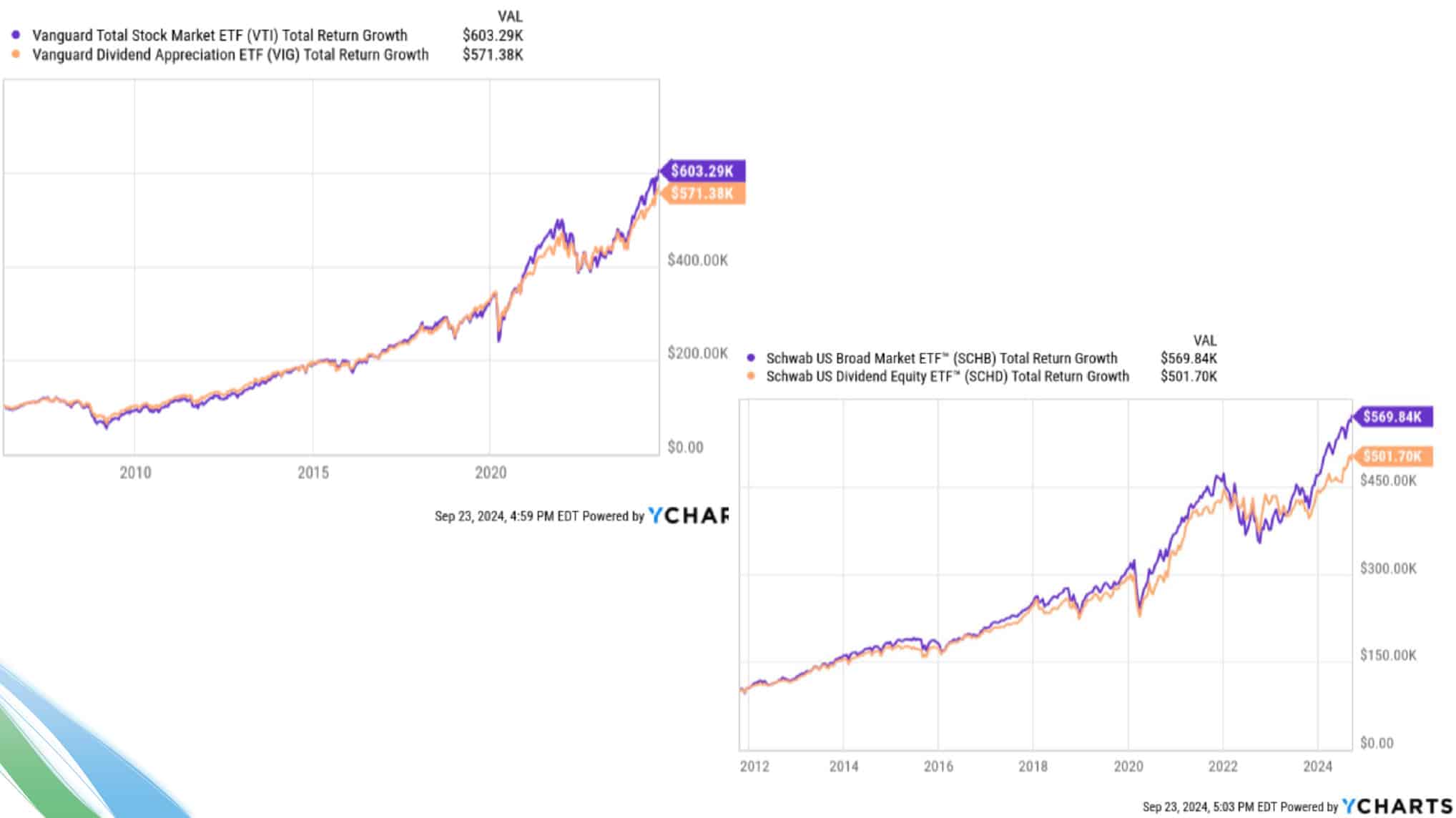

This is not something meant just to pick on that specific SDY fund. We see the same trend across any other fund family that offers both dividend focused funds and a general stock market market fund.

This chart in the top left is the same view of two investment options from Vanguard. The fund in purple here is Vanguard’s Total Stock Market ETF, ticker symbol VTI, which is another very basic index fund. The orange line is Vanguard’s big dividend fund, The Vanguard Dividend Appreciation Fund, ticker symbol VIG.

Again, you see a little bit of a difference in performance a little bit of a lagging performance from the dividend fund.

Schwab has the same kind of lineup here. We’re showing the charts of two fund, SCHB, which is Schwab’s broad index fund. And also SCHD, Schwab’s US Dividend Equity ETF. This dividend fund from Schwab is based on that same index as SCHB, but they filter out just a certain number of dividend paying stocks.

And again, very similar shape in the in the charts here some long-term underperformance from those dividend focused funds.

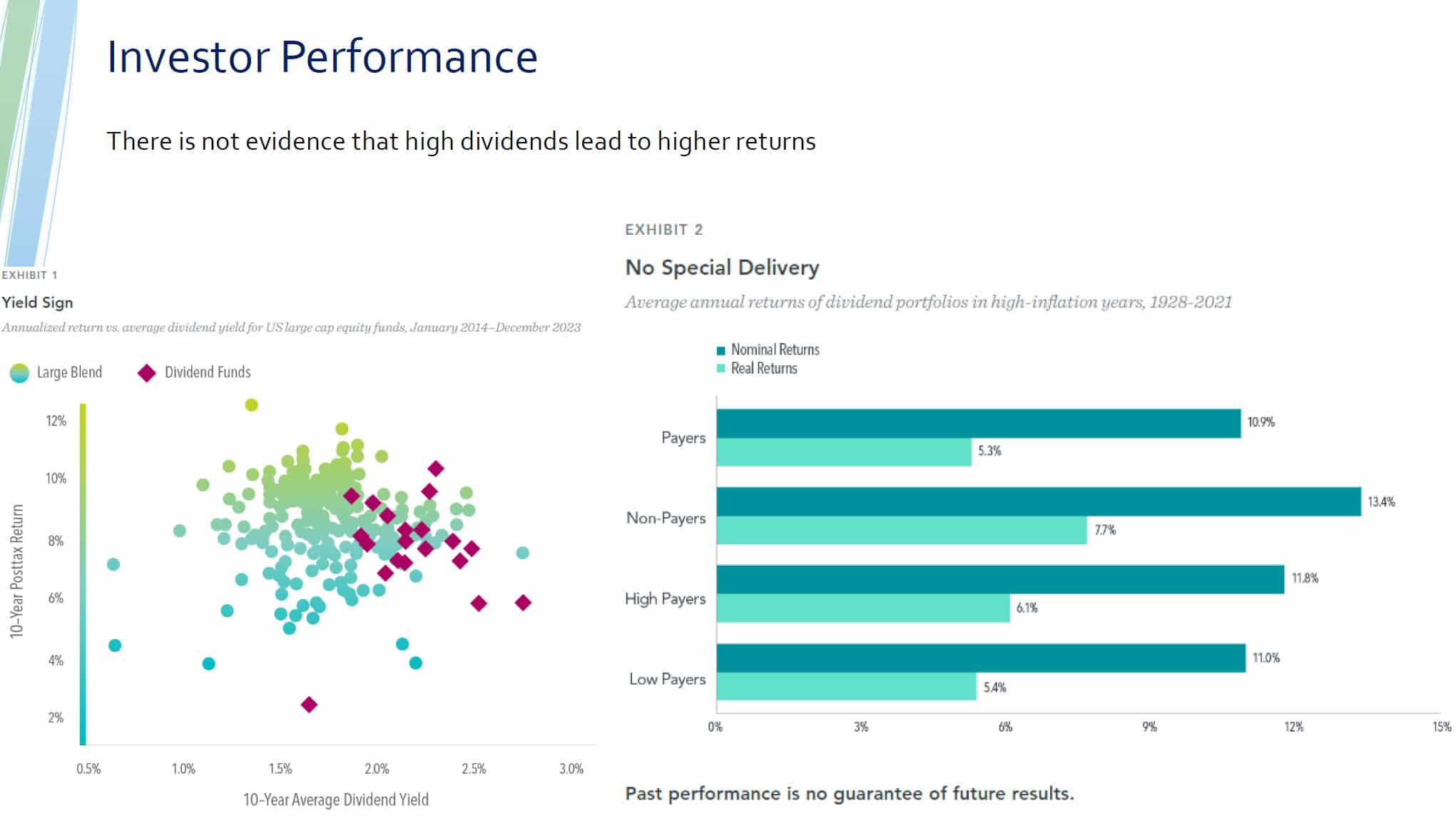

Another way to evaluate the performance of dividend funds besides looking at just a few specific charts, is to look at studies that take into account the many hundreds of funds that are out there.

Spoiler alert – They all point to the same evidence that high dividends do not lead to higher total returns for investors.

This chart on the left is a study from DFA or dimensional fund advisors that is plotting the dividend yield of a fund and then the Y-axis is the 10-year return.

If was a correlation between high dividends and high returns you would expect the chart to go up and to the right.

Instead, what we see is a little bit more random and certainly not evidence that as you go to the right here on the X-axis (as you get to higher dividends) you end up with higher long-term returns.

In fact, there is some evidence here of actually even lower dividend funds having higher 10-year returns!

The chart on the right here is a much longer term study so this is looking back all the way to 1928 in periods of high inflation and looking at the return that investors received in companies that were either very high dividend paying stocks, not payers at all, or they paid a dividend but were very low.

Notice that in these periods of high inflation, high dividend paying stocks had actually underperformed by a pretty good amount compared to non-paying companies.

I just think this is interesting and was top of my mind since these dividend focused stocks became really popular again with people thinking that dividends would do a better job of keeping up with inflation. But, there just is not evidence that that is the case.

The last point we’re going to refute about dividend investing is around the idea that building a portfolio that lives off of dividends is much safer than a portfolio where you have to actually sell some shares.

In particular the idea of creating this portfolio where you “never have to touch the principle”

There’s a couple big faults with this line of thinking.

One is that dividends are just a return of capital. Dividends are not this income that comes out of thin air and magically appears in your account. When a company pays out a dividend, the value of that company’s shares drop because now all this cash has left this company and it’s not worth as much.

This visual on the left is another study from DFA where they analyzed how the share price of stocks performed right after they paid out a dividend. The study looked at the 10 largest dividend paying companies in the S&P 500 over a five-year period.

The average dividend that those companies paid was a dollar per share, and the next day the average decline in the share price of those companies was $1.15!

You received a dollar, but you lost $1.15 in value.

When you receive a dividend you’re not going in and selling a dollar worth of stock, but the value of your investments do go down a dollar.

This chart on the right is just another way to show the accounting of being paid via dividends or being paid by just selling your shares. The left side of the table shows if you have a hundred shares of a company whose stock is $20 a share and it pays out a dollar dividend a dollar per share in dividend. In this scenario, you now have 100 shares that are worth $19, and you have $100 in cash in your brokerage account.

On the right side of the table is the scenario where you sell five shares to get that same $100. Now you only have 95 shares at $20 per share.

It’s the same thing you’re ending up with $2,000. The second scenario feels a little different because you’re selling five shares, but ultimately it ends up being the exact same thing.

There’s also this idea that dividends are this very safe and secure source of income. And that if you can build this portfolio where you can survive off of the income from dividends, it will lead to this very safe and secure retirement compared to if you need to sell shares, whose prices can go up and down.

First, I’ll just point out that this is a contradictory view because you’re saying that you don’t have trust in the stock market continuing to perform, but you do have trust that these stocks are going to continue to pay out their dividends.

What we’ve seen historically is that companies cut their dividends in bad times.

This chart is just a look at how the income received from a million dollar portfolio would have changed as the COVID crisis hit.

For example if you had a million dollars invested in general US Stock Market right before COVID, you were getting about $16,000 a year in dividend. That next year, your payments were cut by nearly 20%.

For International stocks it was an even bigger drop – $1,000,000 in international stocks produced about $35,000 in income in 2019. That was cut by over 40% in 2020!

And emerging markets were not spared either, seeing payouts drop about 20%.

This is just one point in history, but if you were building this portfolio to kick off a certain amount of dividends that you needed to live on and you had this drastic cut in your income – that’s not a good plan, right? Now you’re having to sell shares when the markets weigh down to recreate that lost income.

This chart is just another way of looking at the COVID crisis and putting a number behind the amount of companies that actually cut their dividends as COVID unfolded. As much as 40% of all companies that paid dividends cut or eliminated their dividends in the second quarter of 2020. This was a huge impact for dividend investors and those that were heavily concentrated in these types of companies.

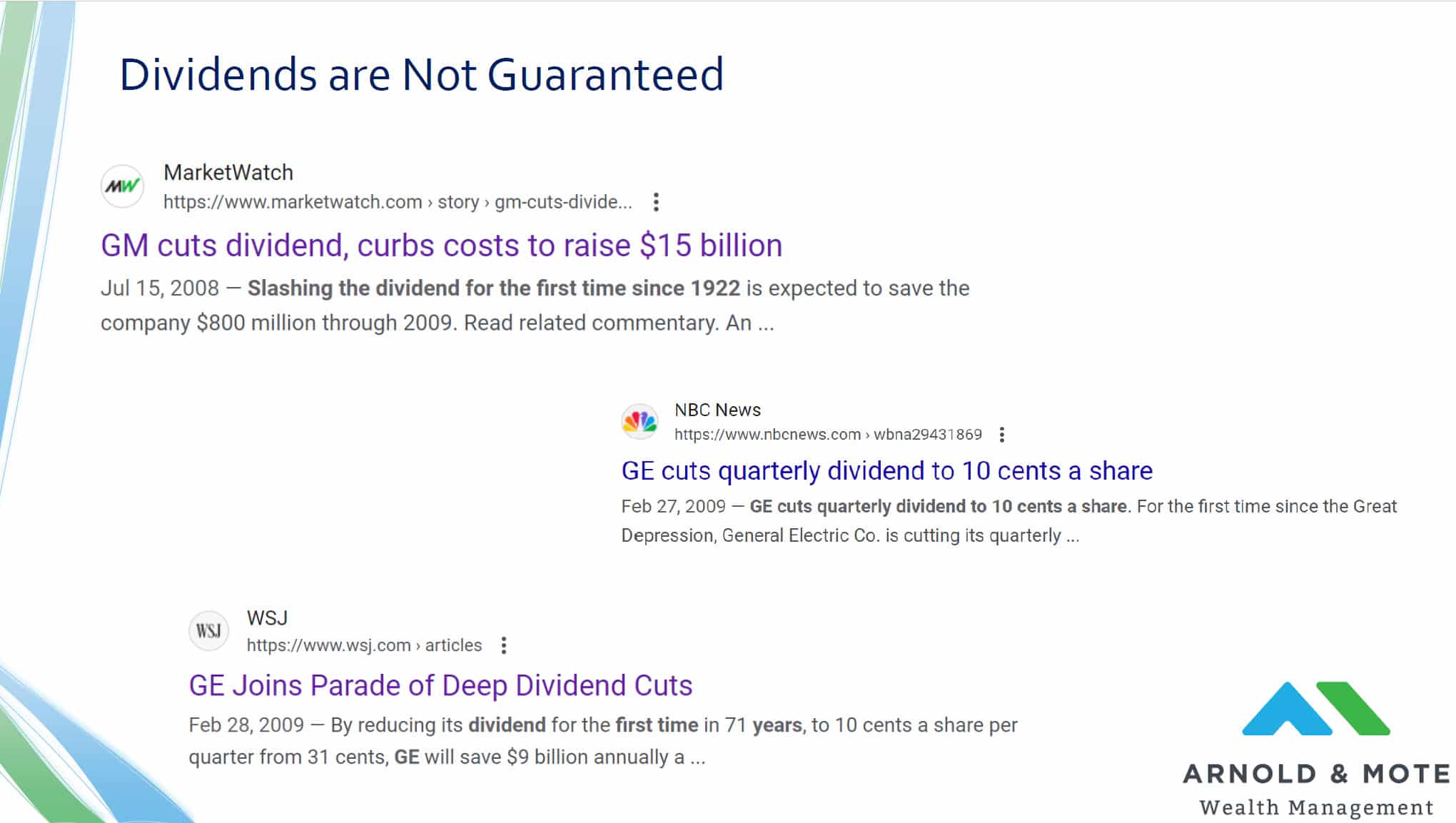

And it’s something that we’ve seen more than just the COVID crisis:

The 2008-2009 financial crisis was notable for seeing companies with many decades of history paying dividends significantly cutting their dividends.

For example, before the financial crisis General Motors had paid a dividend since 1922 – and in 2008 that went to zero!

Of course the company went bankrupt too eventually. So not only did you lose your dividends, you lost your principal as well.

General Electric or GE had paid dividends since before the Great Depression and 2009 it finally cut that dividend for the first time in 90+ years.

GE and GM were not the only ones doing this. The Wall Street Journal described it as “a parade of companies” that cut their dividends at this time. A lot of banks that had paid dividends for many years also cut dividends and this left investors who were depending on this dividend income for paying their bills in retirement in a very very tough spot.

At the very least, know that dividends are not guaranteed at all, and tend to get cut at the same times stock prices are declining.

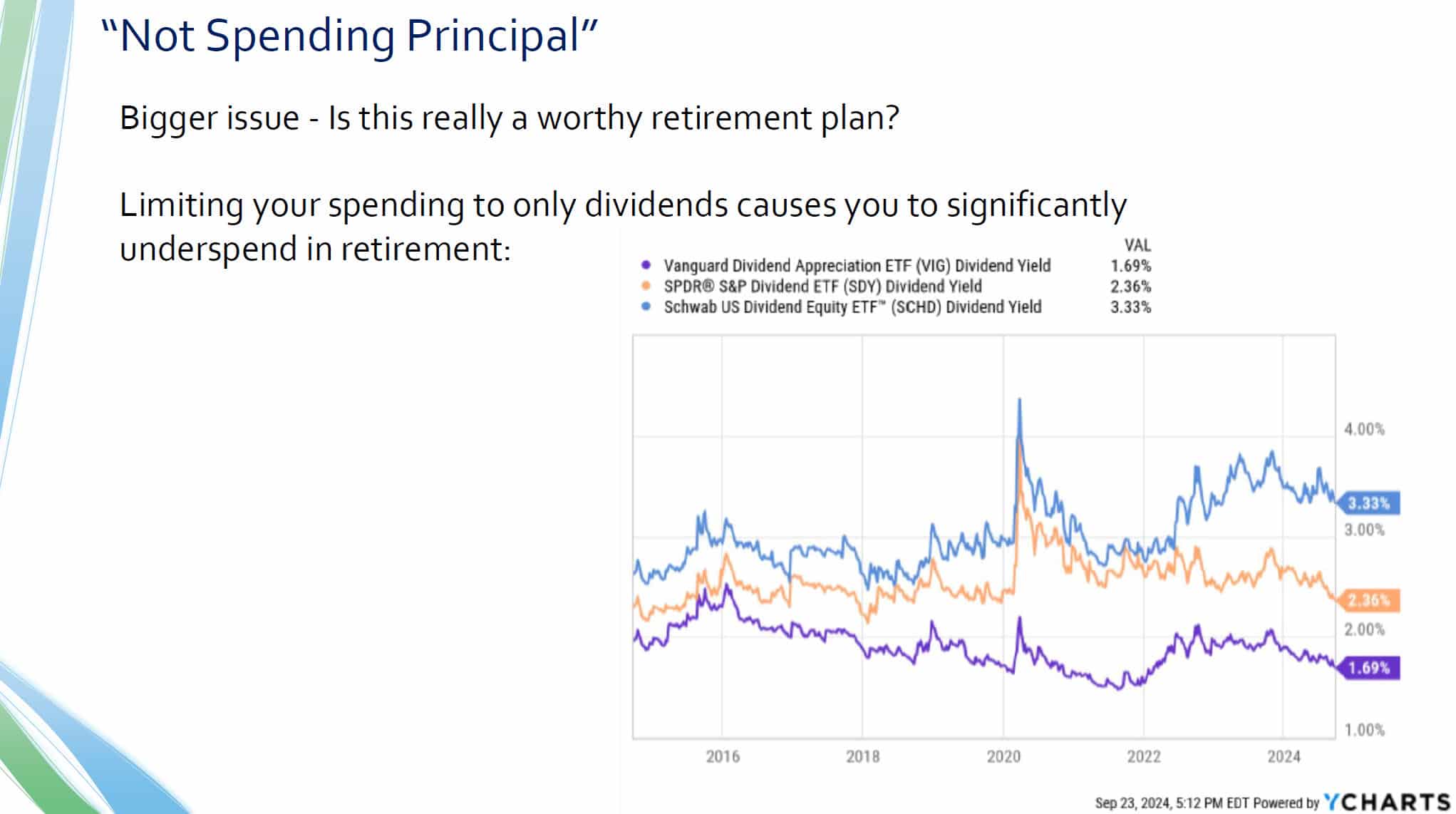

Besides the risks, the other idea here is that being able to just live off of dividends is something that you should strive for. From our point of view, that’s really not a good goal to have.

That is because you end up really limiting your spending if all you do is is live off of your dividends. This chart is looking at the dividend yield of some of those funds that we looked at in the prior slides. Just for example, that Schwab dividend ETF is in blue here it has a yield of about 3.3%.

So then we look at that and run a scenario where you put all your money into the Schwab US Dividend Equity ETF and have you live off of 3.3%. What does your retirement end up looking like?

It turns out that under almost all historic scenarios, you drastically underspend. Here I rounded up that 3.3% to 3.5% and assumed a 65 year-old retired couple with a 30-year horizon, and with a million dollars.

What does their portfolio look like when all they take out is that 3.5%?

What we’re showing in the image above is what’s called a Monte Carlo analysis of that million dollar portfolio. Monte Carlo simulation runs a thousand different scenarios of randomized stock market returns, and so if you are in some of these different percentiles, which are a likelihood that your portfolio would perform you know within these ranges over time.

What we would highlight here is that, on average, a 65-year-old retired couple with a million dollars allocated to 100% dividend funds would end up at the end of their lives was somewhere around $10 million.

I know it is a lot of people have a goal to leave money to their heirs and that can be great. But a lot of people don’t have a goal to drastically underspend during their retirement and leave their heirs with with seven figures!

Even in some of these very low percentile, or in other words very unlikely scenarios, you’re still left with very sizable sum.

It is common to have this worry about these kind of worst case scenarios. There is of course scenarios where the Great Depression occurs, and and a certain withdrawal rate is not sustainable. I would just remind you that’s equally as likely as as having above average returns and having a portfolio that would end up with well north of $15 million at the end of your life.

This is just worth thinking about if you have this goal of having a sustainable retirement plan. Don’t set that up to be just being able to live off of dividends, because historically it means you drastically underspend you can spend much more than 3.5% of your portfolio in normal kind of stock market years.

And of course working with with a financial planner or just having the flexibility to sell some shares when you need more money gives you a lot more flexibility to have a retirement that I think a lot of us would prefer, rather than kind of being on a fixed income and underspending for so much of your retirement.

We’re near the end here, but just a few other random considerations that are worth noting about dividend investing.

If you have a lot of money outside of retirement accounts – so if you have a lot of money in a brokerage account outside of IRAs, there’s a lot of tax advantages to not focusing on dividends. Instead, doing what’s called total return investing which just means effectively selling shares when you need money and not investing in a in an investment solely because of its yield.

What we see is that dividends offer you no flexibility if you want to sell shares when you need money. You should have a lot of flexibility on when to sell those shares, when to recognize capital gains in retirement. There can be a lot of tax advantages to having this flexibility.

But, when you’re living off dividends you don’t have a choice. You’re going to receive that dividend every month or every quarter whether you need it or not.

Also, dividends are 100% taxable. By that I mean that all the income received from Dividends are taxed either at your income tax rate or long-term capital gains rates. Compare that to when you sell shares, you get a portion of your original investment back.

For example, if you sell $100,000 worth of stock, it’s very likely not $100,000 of gains since you put in some original amount of money to make the original purchase. Getting $50,000 out of a portfolio is cheaper when you’re actually selling shares rather than getting $50,000 from dividends.

The final two points here are summarizing what we talked about before – It’s much easier to get a better, a more diversified, portfolio when you’re not worried about yield and dividends.

In general, companies are moving away from paying dividends. They prefer to retain profit or they prefer buying back shares rather than paying dividends. That gives investors flexibility on on when to actually recognize that income.

And then from a portfolio management standpoint, just the act of rebalancing and other annual maintenance items that are needed in a retirement account is much easier when you’re utilizing a total return approach.

When you have all your money invested in one or two dividend funds, it’s tough to you know rebalance get those investments allocated as you need. When you can sell shares you can simply sell your outperforming funds, which right now that might mean selling large cap growth funds for example, to get everything back in line.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.