Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

CDs are safe, but high-income households may benefit more from tax-efficient alternatives like Treasuries, municipal bonds, and money market funds.

Liquidity and flexibility often favor alternatives, since CDs lock up money with early withdrawal penalties.

The right choice depends on your tax bracket, savings goals, and access needs—often a mix of tools works best.

There are many alternatives to CDs that investors never consider. While bank CDs provide excellent protection for savings, there can be significant advantages when using alternatives for high-income households when tax efficiency is most important.

The recent rise in interest rates has greatly increased the attention that savers are giving to CDs, or certificates of deposit.

For many years, CDs offered very low rates and were not very attractive places to save. That is changing today, but before you buy, you should know about a few options that may be more beneficial than CDs, depending on your finances.

Determining whether a CD is best for you or finding the right CD alternative means understanding your federal and state tax burden, how the various investments are taxed, and the pros and cons of each to make sure the investment you select is appropriate. Here is a list of considerations to be aware of before making a decision:

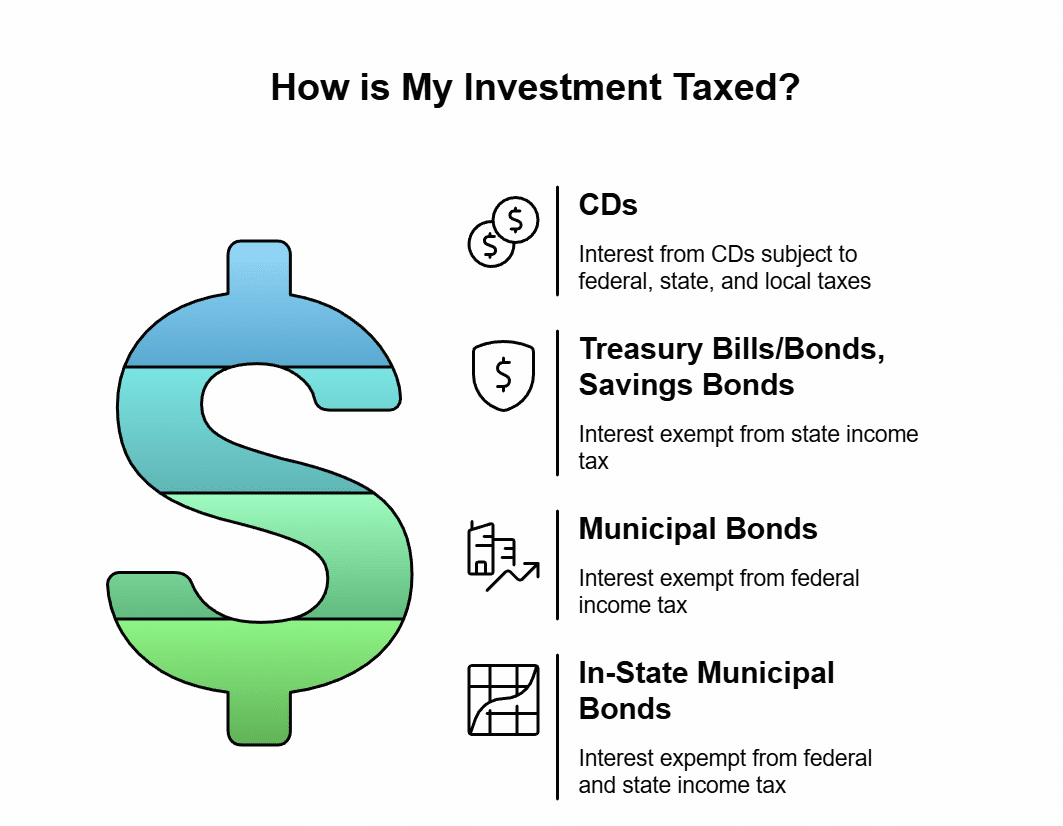

First, know that there may be a tax benefit to using alternatives. This is because the interest from CDs will be treated as taxable income for federal income tax, state income tax, and local income tax if it applies.

There are many other safe investments that are taxed in more favorable ways.

We will discuss these alternatives in detail below. But first, it is important to know the basic rules of taxation for various certificate of deposit alternatives:

For those in high-tax states, you should know that interest on U.S. government securities, such as Treasury bills and other government bonds, is exempt from state income tax. In-state municipal bonds are also exempt from state income tax.

For those in high federal tax brackets, municipal bonds offer tax-free interest at the federal level.

Switching to investment alternatives that are exempt from federal, state, or local income taxes can be one of the best ways to reduce state income tax burden.

The liquidity of your savings may also be a concern. CDs typically require you to lock up for money for a set time and have penalties for early withdrawals.

You may be tempted to use long-term CDs since they typically offer the highest interest rates, but if you require your money before the CD matures, you will not receive the advertised interest rate. This can make CDs not ideal for short-term goals or for use in emergency funds when it is uncertain when you will need to access the funds.

Your savings within a bank CD is only insured by the federal government up to a certain limit. While it is unlikely that your bank or credit union would fail, do not put yourself in a position where a significant part of your savings is at risk.

For those with cash savings above the FDIC limit, purchasing CD alternatives may provide you with nearly limitless federal government protection on your savings, which would not exist if your money remained within CDs from a single bank.

Lastly, it can be time-consuming to ensure you are getting the best rate with CDs. Maximizing CD interest may mean having multiple CDs at multiple banks around town and moving money around each time a CD matures to a new bank.

This makes using short-term CDs burdensome as you will regularly need to shop around for the best interest rates and transferring money from bank to bank.

Also, banks typically offer special interest rates for new money but will renew you into lower-yielding CDs at maturity.

Ensuring you are getting the best return using CDs can be very time-consuming.

Money within a brokerage account, instead of a CD at a bank, gives you the flexibility to move between a wide variety of investments very quickly and easily. As interest rates or your personal tax situation change, investments within a brokerage account can quickly be adjusted to fit your circumstances.

Some alternatives we advise our clients on besides bank CDs:

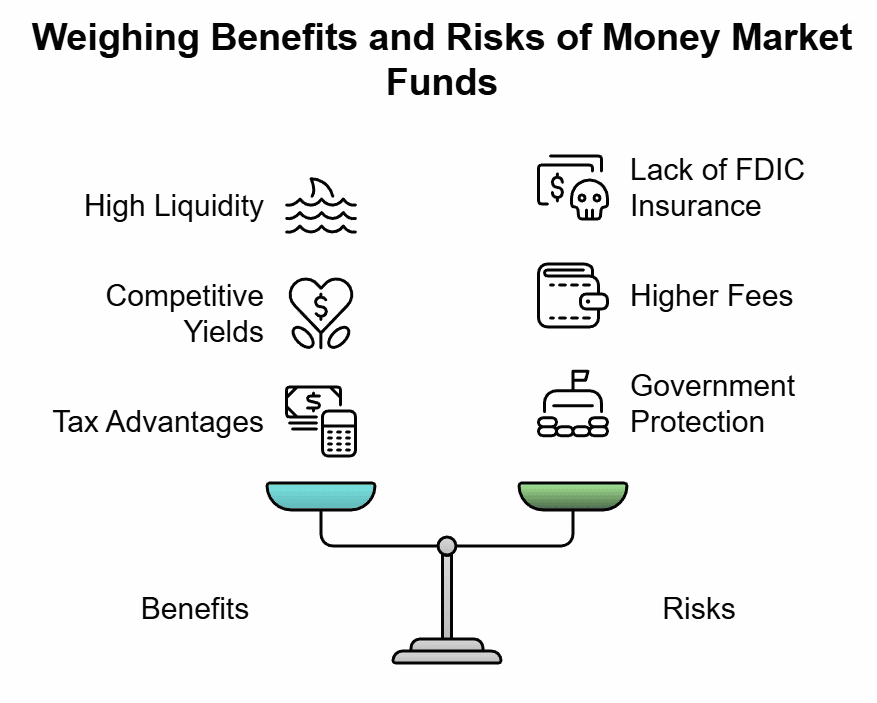

Money market accounts are very flexible savings accounts that can be added to or withdrawn from at any time without withdrawal penalties.

These invest in very high-quality, short-term debt securities that are issued by the U.S government, companies, and municipalities.

Your local bank or credit union may offer money market funds, but we have found that money market mutual funds available within a brokerage account are typically better. These not only tend to offer higher yields but also give you access to more tax-efficient options like money market funds that invest in municipal securities, for example.

Benefits of Money Market Funds:

Potential Risks with Money Markets Accounts:

“Prime” money market investments are not FDIC-insured. However, you can look for Treasury money market funds that invest solely in U.S government securities to get increased government protection.

Money market funds may come with higher fees than other investment alternatives. It is not unusual for money market mutual funds to have fees of more than 0.40%.

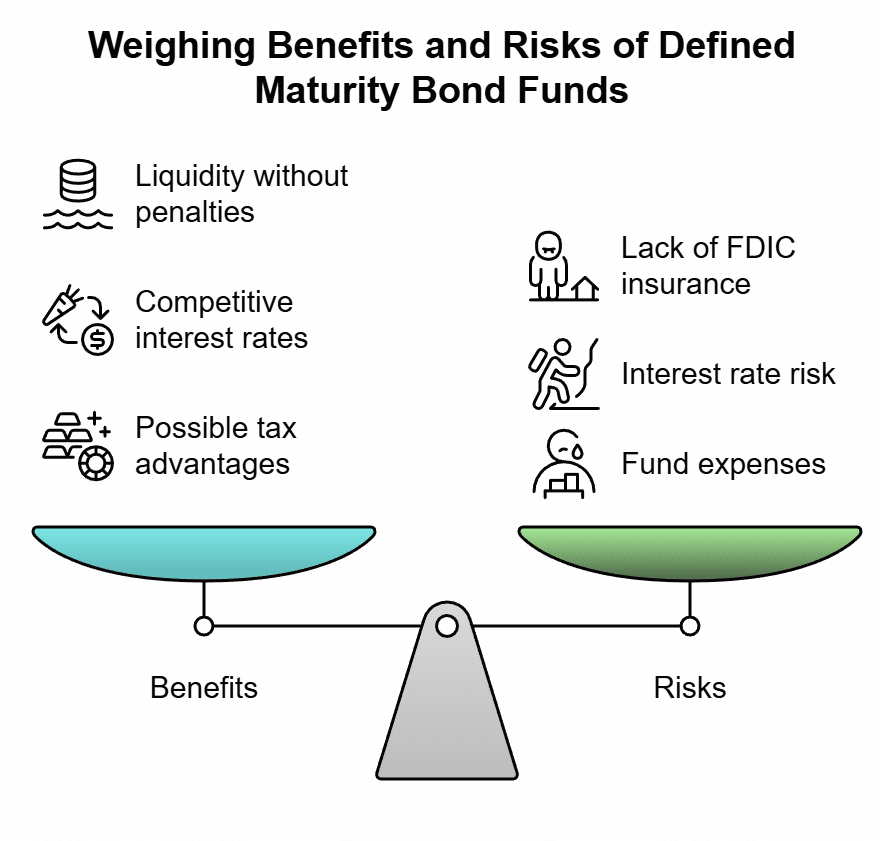

Defined Maturity Bond Funds are investment funds that hold a diversified set of bonds that all mature in a single year. For example, a “2027 defined maturity bond fund” holds only individual bonds that mature in 2027.

That makes these funds a great alternative to CDs because they allow you to select the fund that matches a maturity to your financial goals or the period of time you want your money invested.

Like money market funds, these types of funds can hold any type of bond. If you need the tax advantages of owning U.S. Treasury or municipal bonds, there are funds you can use. These funds also exist for investment grade corporate bonds and high yield bonds as well. Whatever your risk tolerance, there is a defined maturity bond fund that fits your needs.

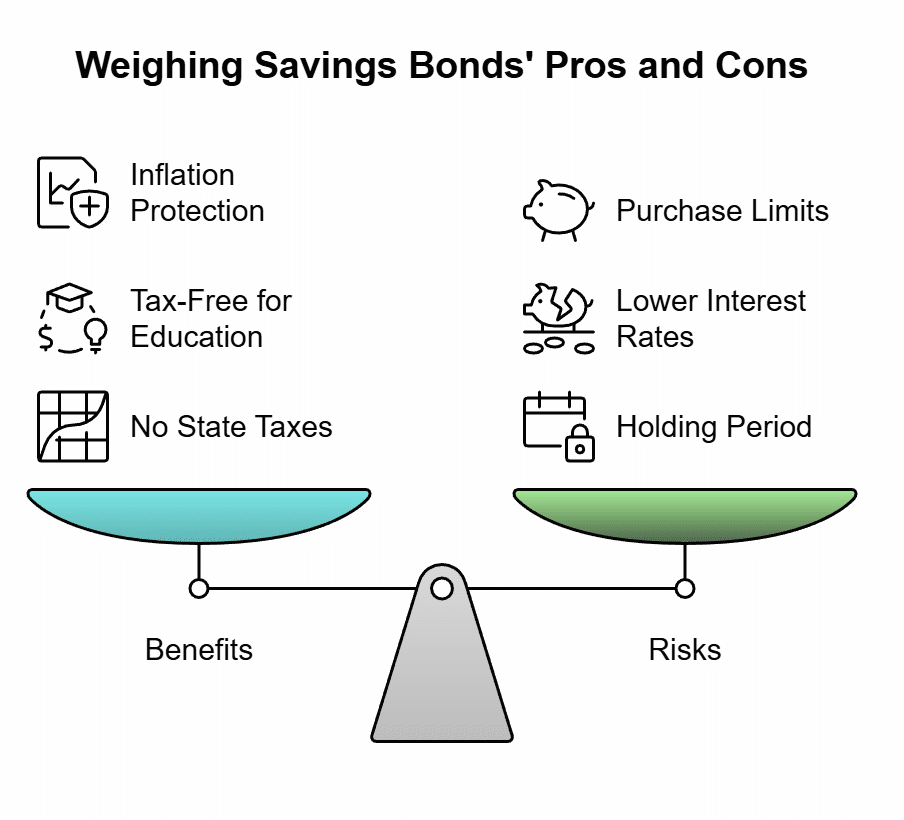

U.S. Savings Bonds, such as iBonds or EE Bonds have long been popular for a safe investment option.

Like U.S. Treasuries, interest from savings bonds is exempt from state taxation, making these more attractive to investors in high-tax states.

Additionally, the interest accrued on U.S. Savings Bonds is not taxed at the federal level until the bond is cashed or matures, offering a significant advantage for those looking to minimize taxable income in the short term.

Benefits of U.S. Savings Bonds:

Potential Risks with U.S. Savings Bonds:

Because there are annual limits on the amount of savings bonds you can purchase each year, you may not be able to put enough money into savings bonds depending on your savings goal.

Interest rates may be significantly less than you can get via U.S. Treasury bonds. Be sure to compare the rates on other U.S. government options before purchasing.

Savings bonds have a minimum holding period of 1 year.

Brokered CDs work just like the traditional bank CDs you are familiar with, but they have a few features that will make them a better investment for some investors.

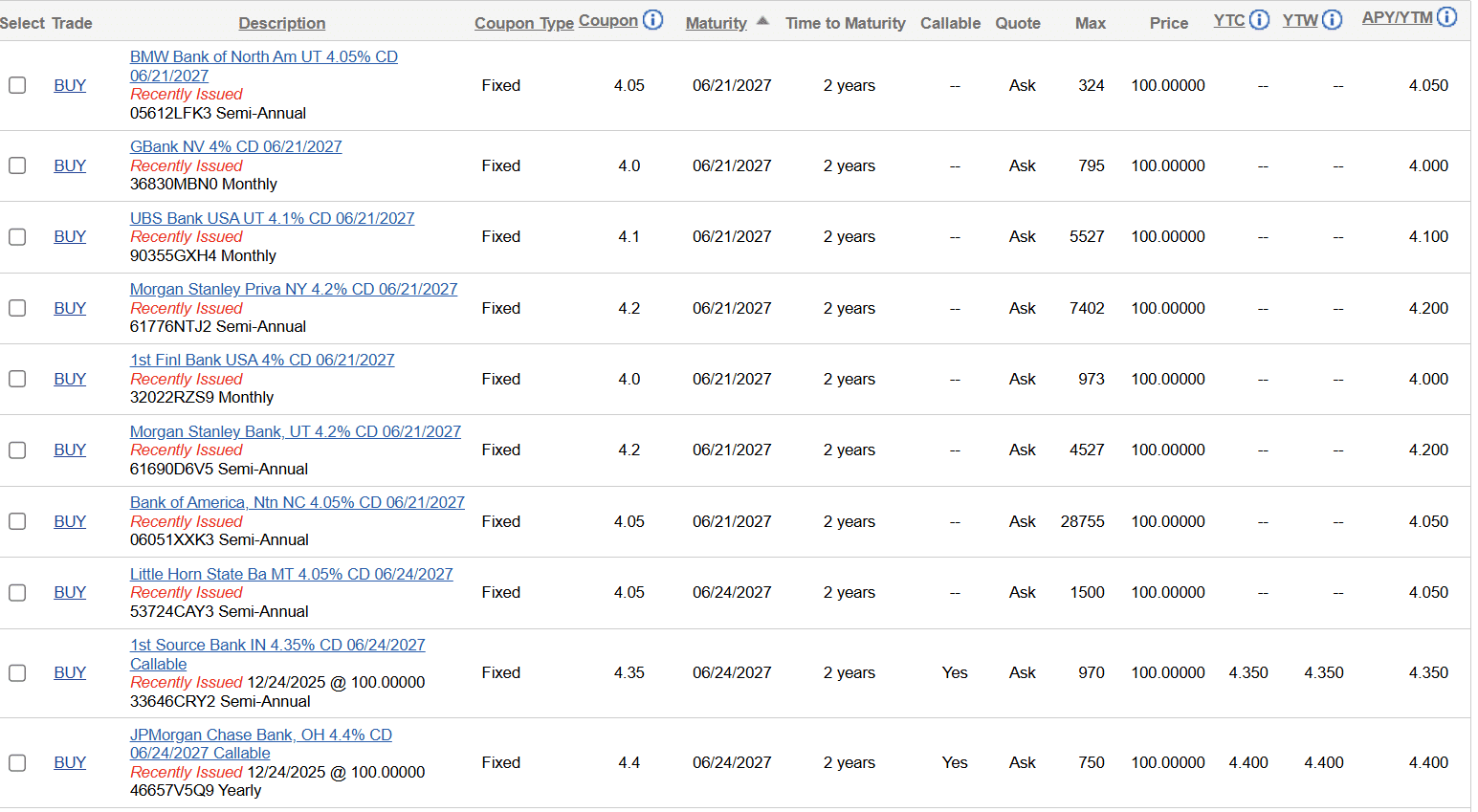

Brokered CDs are bank CDs that are sold within brokerage accounts, unlike banks. This allows investors to easily see CDs being offered from banks across the country. Since it is unlikely your local bank or credit union offers the highest APY (annual percentage yield) in the country, shopping for your CD within a brokerage account can help you find a higher interest rate.

For example, here is what we see when purchasing brokered CDs for clients. We can easily find CDs offering higher interest rates compared to shopping around local banks:

Benefits of Brokered CDs:

Potential Risks with Brokered CDs:

The term Treasury “Bill” technically refers to bonds that have maturity between 4 weeks and 1 year. These are no different than any other Treasury bonds besides their short duration.

Benefits of Short-Term Treasuries:

Potential Risks with Short-Term Treasuries:

There is nothing special about high-yield savings accounts. But for many, especially for those that have short-term goals, or many need the money at short notice, these can be great options.

Several online banks offer high-yield savings accounts that offer interest rates that are very competitive with short-term CDs.

Because money is not locked up, high-yield savings accounts are great options for those that value liquidity, or ease of using the account for features like online bill pay.

Benefits of High-Yield Online Savings Accounts:

Potential Risks with High-Yield Savings Accounts:

It turns out, there is not a simple answer to finding the best cash savings option. There are many options available with different tax consequences, risks, pros, and cons.

That is why cash management is just one of the topics we cover with our clients on a fiduciary, flat-fee basis. Our clients don’t pay any more to have us manage their cash balances in CDs, Treasury bills, or other alternatives. We do not charge a percentage of assets fee!

If we can help you determine the best options for getting returns on your cash, please reach out.

This blog has been updated from July 15, 2024 with current information, as of June 24, 2025

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.