Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Annuities reduce flexibility. Once you lock in, you lose access to your savings for large or unexpected expenses.

You may not need more fixed income. If Social Security already covers your steady income needs, annuitizing TSP savings could be unnecessary.

Inflation is a risk. TSP annuities offer little protection against rising costs, which can erode your income over time.

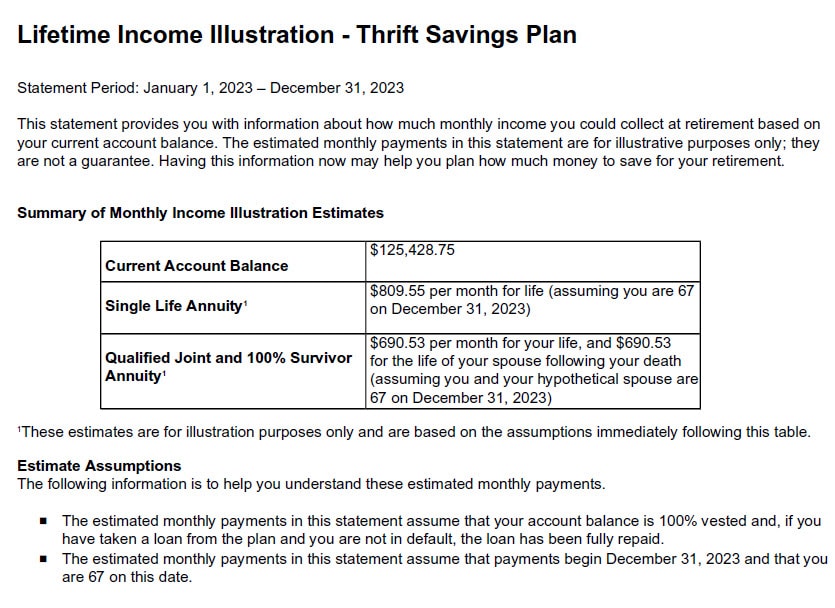

If you have money in the Thrift Savings Plan you receive an document called a Lifetime income illustration each year.

This document outlines an estimated annuity payment you may be able to receive from your current TSP balance. The numbers provided are only an estimate, but this often gets a lot of those approaching retirement wondering if the TSP annuity is right for them.

If you are considering moving some or all of your TSP investments into their lifetime income annuity, we have a few things we think you should consider before making the move:

The annual notice you receive from the Thrift Savings Plan will look something like this:

How comfortable are you locking away a majority of your retirement savings?

Annuities can be great for your piece of mind knowing that you have a check coming in each month. But they provide you no flexibility for any variable expenses you might encounter in retirement. If you need money for a large one-time expense like a car or retirement home, you may need to resort to loans to help fund these.

What other sources of fixed income will you have?

If you, and possibly your spouse, have large Social Security benefits, you may have all the fixed income you need. Social Security is often the best type of fixed income a retiree can have, and it may be a mistake to annuitize your TSP savings for extra income, rather than delaying Social Security to ensure you have a larger benefit.

Know that depending on the option you select, your TSP annuities may not offer payments that increase over time due to inflation.

At best, you will only receive a 2% annual inflation adjustment to your TSP annuity, and selecting this option will leave you with a lower monthly payment early in retirement.

While the monthly benefit you receive today may cover your expenses, will it still provide enough money for 20 years from now when things are more expensive? If you do purchase the TSP lifetime annuity, you’ll want to be sure you have other assets that can keep up with inflation over time, like stocks and some bonds such as TIPS.

Annuities are not necessarily bad, but you should be aware of the other options you have available for retirement income before making this decision. There are also many different types of annuities out there that may be a better fit for your needs. For example, QLACs or qualified longevity annuity contracts, which are unique annuities that can do much more to protect retirees from longevity risk in retirement.

We help households every day meet their income needs, usually without recommending locking money away in an annuity. If you are considering using your TSP funds to purchase a lifetime annuity, please reach out for a second opinion.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.