Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Withdraw from your Roth before age 65 to keep your MAGI low and qualify for lower ACA health insurance premiums.

Use Roth withdrawals after 65 to avoid triggering Medicare IRMAA surcharges on your premiums.

Tap Roth funds for large one-time expenses so you don’t push IRA withdrawals into higher tax brackets.

When should you withdraw money from a Roth account in retirement? Roth IRAs and Roth 401(k)s are excellent long-term retirement accounts. The money in these accounts grows tax-free, and the proceeds will also be tax-free for any heirs who inherit the account. For that reason, Roth IRAs are often preserved until later in retirement before being used.

However, there are several situations where withdrawing from a Roth early in retirement can be highly beneficial, and a lot of these may be worth talking with your financial advisor about:

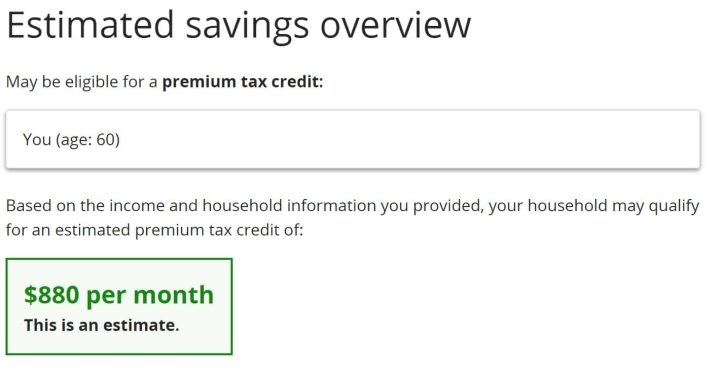

If you retire before becoming eligible for Medicare and purchase health insurance through the Healthcare.gov marketplace, your monthly premium will depend on your Modified Adjusted Gross Income (MAGI).

Withdrawing from your Roth instead of a traditional IRA in early retirement can help keep your MAGI low. This may help you save hundreds or thousands of dollars per month on your health insurance premium.

The monthly tax credits available will depend on the state you live in and your other sources of income. You should analyze your situation or consult a financial advisor to determine if withdrawing from your Roth early in retirement is a worthwhile strategy.

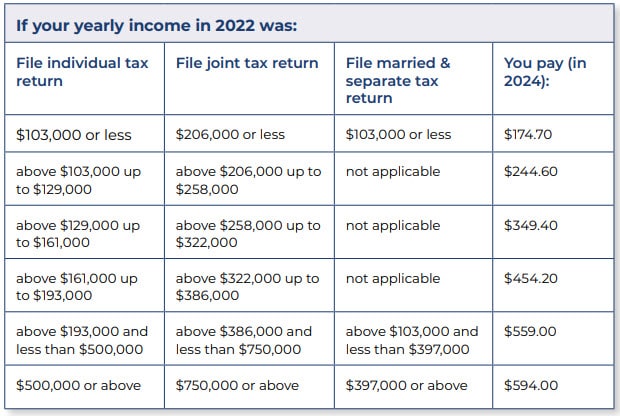

Once you are age 65 or older and retired, you will be on Medicare for your health insurance. If your income exceeds certain thresholds while on Medicare, you may trigger IRMAA, a surcharge applied to your Medicare premium.

For example, in 2024 here is how increased income would raise your monthly Part B Medicare premium:

This surcharge can be triggered by exceeding an income threshold by just $1, potentially costing a retired couple thousands of dollars annually.

Because of this, monitoring your income during the year is really important if you are close to one of these income thresholds. If you can take just a few thousand dollars from a Roth during the year to avoid triggering IRMAA, it is usually well worth it.

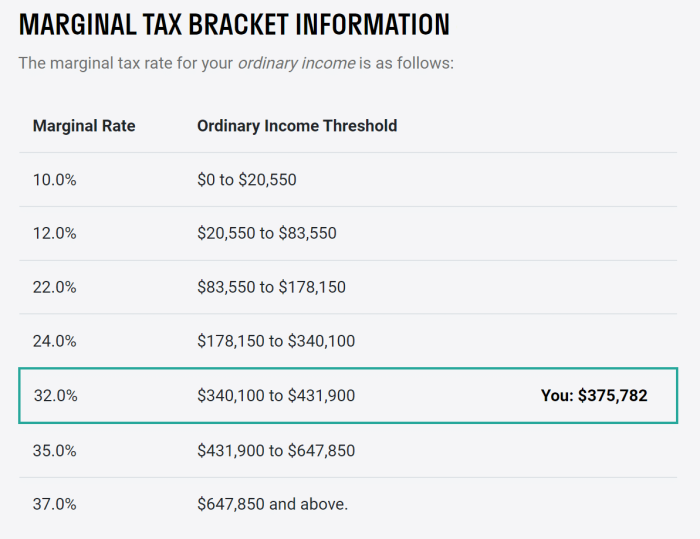

If you have a large one-time expense—such as purchasing a car or a retirement home—it may be beneficial to withdraw from your Roth to avoid pushing other retirement withdrawals into a higher tax bracket.

As you take out more and more money from a traditional IRA in retirement, the marginal tax rate applied to those withdrawals will increase. Large one-time withdrawals can push retirees into higher tax brackets, resulting in a significant tax bill.

Using Roth money can avoid these high tax rates, and can be very advantageous if your marginal tax rate is very high in a single year.

We have more detail on how we create tax-efficient withdrawal plans in a blog post here.

Ultimately, using Roth funds is most beneficial when withdrawals from other retirement accounts would incur significantly higher taxes than in the future. Unnecessary Roth withdrawals can be inefficient, but strategic withdrawals as part of a tax-efficient retirement plan can be highly beneficial.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.