Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Gifting money is a great way to help out a family member in need, or just a way to share your wealth with loved ones. However, there are ways to give money to others that can reduce your tax burden and hassle with future tax returns.

Here’s a few things to consider before you write that check:

When it comes to gifting money to family members, there are rules and guidelines from the IRS that you should be aware of:

The IRS allows you to give a certain amount of money to each family member each year without incurring any gift tax, or even having to report the gift to the IRS.

This amount changes every year, but for 2024 the annual gift tax exclusion amount is $18,000 per year.

That $18,000 is per individual. Married couples can give twice that, or $36,000 per year to each individual without having to report the gift to the IRS.

If any one single person gives more than $18,000 to someone else, the IRS must be notified when you file your taxes and you may have to file a gift tax return.

Understanding the annual exclusion amount is particularly useful for those who want to make regular financial gifts to their family members. By staying within this limit, you can give money or property to your loved ones without worrying about any tax consequences. Whether it’s helping your children with their educational expenses, assisting your parents with medical bills, or simply providing financial support, the annual gift exclusion amount allows you to do so without any tax liability.

Just because you give a gift in excess of the annual gift tax exclusion amount does not mean that you or whoever you give the money to will be subject to gift taxes, though.

A gift this large only means that this amount will begin to offset from your “lifetime gift exclusion amount”, and must be tracked by filing a Form 709 to the IRS with your annual tax return.

Gift taxes do not apply until you exceed your lifetime gift tax exemption amount, which is currently at more than $13 million in 2024.

Though, note that there is possibility this lifetime exemption amount gets significantly reduced in the future.

With today’s limits, very few individuals will find themselves impacted by the gift tax.

However, if you give more than the lifetime gift tax exclusion amount, you may be required to pay gift tax on the amount given in excess of your lifetime exclusion limit.

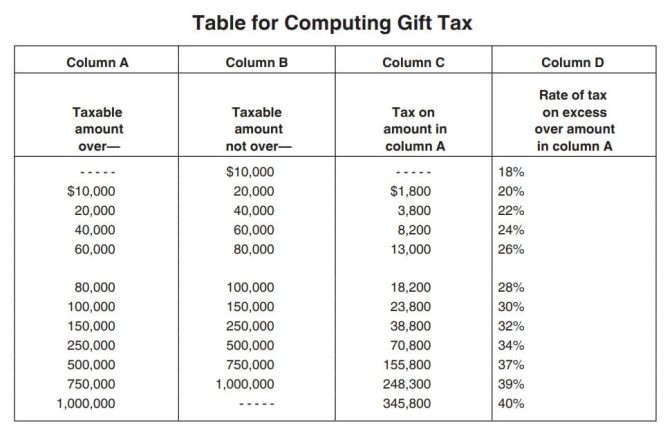

For 2023, the Federal gift tax rates are between 18% and 40% depending on the amount you give.

The gift tax is a tax imposed on the transfer of money or property (such as real estate) from one person to another without receiving anything in return. While it may seem counterintuitive to tax someone for giving a gift, the purpose of the gift tax is to prevent individuals from avoiding estate taxes by giving away their assets before they pass away.

The gift tax is governed by the Internal Revenue Service (IRS) and applies to both cash gifts and the fair market value of property or assets given as gifts.

However, there are certain exemptions and exclusions in place to ensure that not all gifts are subject to taxation.

While the annual gift exclusion amount allows you to give a certain amount without reporting it on a gift tax return, there are additional exclusions that can further benefit you and your loved ones.

One common exclusion relates to medical expenses. If you directly pay for someone’s medical bills, whether it’s for your child, parent, or any other family member, those payments can be excluded from your taxable gifts.

This can be incredibly helpful in situations where a family member has significant medical expenses that need to be covered.

Another exclusion applies to qualified tuition expenses. If you pay for someone’s tuition, that amount is not considered a taxable gift. Note that no educational exclusion is allowed for amounts paid for books, supplies, room and board, or other similar expenses that are not direct tuition costs. If you want to gift money to contribute towards these other expenses, see the section on utilizing a 529 plan for family giving below.

Paying tuition can be a great way to support your children or other family members in pursuing higher education without incurring any gift tax liability.

If the person who are wanting to give money to is not yet in college or realizing qualified education costs, but you’d like to give money now for that purpose, see the section on 529 college savings plans below.

It’s important to note that these exclusions apply to direct payments to the education or medical institution. This means that if you directly pay the medical or educational institution on behalf of your family member, the payments can be excluded.

However, if you give the money to your family member and they use it for those purposes, it may not qualify for exclusion and could be subject to gift tax.

Lastly, know that gifts made to your spouse, as long as they are a U.S. Citizen, do not count as reportable gifts.

Also, charitable gifts do not count as reportable gifts. This is another reason why creating a tax efficient charitable giving plan can be so important.

When it comes to gifting money to family members, it’s important to consider all forms of financial gifts. While many people think of cash gifts as the primary way to provide financial assistance, there are other options to explore that may have tax advantages or specific benefits for both the giver and the recipient.

If you are married, you and your spouse can choose to split gifts. This means that both of you can gift money to an individual, effectively doubling the annual exclusion amount. Gift splitting can be an effective way to maximize the benefits of the annual exclusion without incurring any gift tax liability.

Another option to consider is gifting shares of stocks, mutual funds, ETFs, or even real estate that you own.

If you have appreciated assets, gifts of stock or other investments to a family member could help both parties. The recipient can receive the asset at its current fair market value, potentially avoiding capital gains tax when they decide to sell it depending on their Federal income tax situation.

As the giver, you can avoid paying capital gains tax from selling the shares, reduce your taxable estate, and potentially benefit from a lower taxable income.

While gifts made to a 529, or other qualified tuition program (QTP) do not count as an education exclusion detailed above, using a 529 account for family giving still has a few great advantages.

529 college savings accounts can be used for many purposes, qualified education expenses being the most well known, but they can also help pay for private elementary, middle, and high school tuition as well. They can also be used to pay for other expenses that do not count towards the education exclusion such as room and board, textbooks, and computers.

529s can also be used to pay for student loans (up to $10,000), and vocational and postsecondary institutions as well.

Another added benefit, depending on the state you live in, you may receive a state tax deduction for your contribution into a 529, and the gift can be invested and grow tax free.

When it comes to gifting money to family members, it’s important to explore all forms of financial gifts and understand the rules on gifting money to family.

By considering options such as direct payments, gifting stocks, and utilizing gift splitting for married couples, you can find the best way to provide financial support and maximize tax advantages for both you and your loved ones.

And lastly, make sure that your plan for gifts fits within your general retirement plan.

Gifting too much early on in retirement can leave you feeling stressed later in retirement.

We can help you find sustainable gifting strategies that help your loved ones in the best way possible, with the lowest tax burden for you and without putting your retirement plan at risk.

That is the benefit of working with a fee-only, fiduciary, comprehensive financial planner like Arnold and Mote Wealth Management.

As Fee-Only, flat fee financial advisors, we are not compensated more by recommending specific investments or giving strategies. Our only incentive is to create the best financial plan for you.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.