Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Cryptocurrency has taken the world by storm. But many people don’t have an understanding of what it is or know if it belongs as part of your retirement savings.

Below is a recording of a webinar we did for clients to briefly explain cryptocurrency at a very high level (without the normal industry jargon!). Then, we’ll get into the more important part of the webinar, explaining how cryptocurrency fits, or doesn’t fit into a retirement portfolio today.

Crypto Currency vs the US Dollar

What makes crypto currency so different than what we think of as currency today? Let’s start with something we are all familiar with – The US Dollar ($).

If I give you a hundred dollar bill today you can be confident that you have a piece of paper that is worth $100. Not because the paper itself is worth $100, but because the government guarantees it. Likewise if I transfer money from my bank account to yours, you see an increased balance in your bank account that you can be very certain is really there, even though you don’t have any more physical currency.

And then behind the scenes there are managers like the Treasury and Federal Reserve that are clearing, or verifying these transfers or any payments, controlling monetary policy of the dollar, enforcing laws, and ensuring the stability of the system.

We don’t need to get into specifics here. But I don’t think this is a surprise to anyone to know that our currency is essentially controlled by the government and central bank.

And that is the big difference with cryptocurrency. Instead of a single power or central authority having control, it is managed by private users. Or, perhaps more realistically, the computing power of private users computers.

So, just to use Bitcoin as an example. There will only be 21 million bitcoin in existence. No government or other authority can create or destroy bitcoin. No one is in charge of Bitcoin, it is just essentially run by a computer program that any users follow.

And of course, everything is just digital. Bitcoins are just made up of 1s and 0s that show up in your account.

So, if there’s no central authority to help clear, or process payments or transfers of cryptocurrency or to verify possession or payment of these digital assets, how do you know that when I send you 2 bitcoins to your account, you really have those 2 bitcoins, or how do you even know that I had 2 bitcoins to give in the first place?

And the answer to that is that bitcoin, and the thousands of other cryptocurrencies, operate on what is essentially a ledger.

This is literally just a list of all transactions of bitcoin in history. Everyone can see every transaction. So in theory, you can look back at previous transactions and determine that I do in fact have 2 bitcoin to send you.

How this works is that if I send you 2 bitcoins, we each record a transaction on a ledger, and then encrypt that ledger to prevent others from going back and altering the record of the transfer. This encryption uses principals of cryptography, hence the name cryptocurrency.

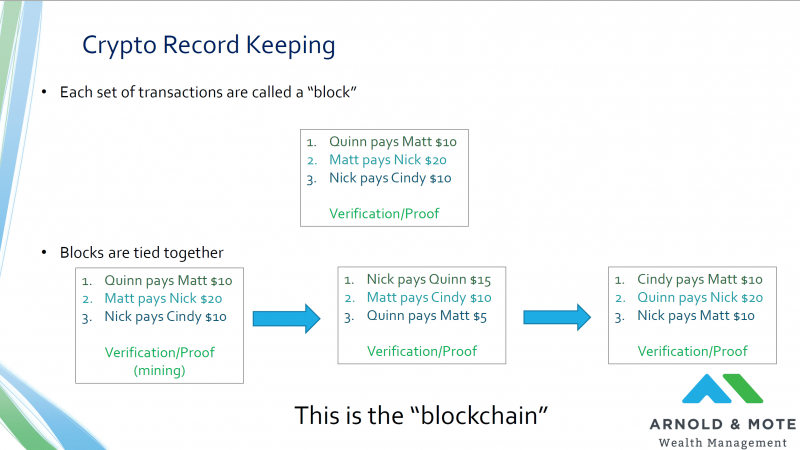

And so this transaction of me sending you a bitcoin would get recorded. For cryptocurrencies a set of transactions is called a block. Essentially a block is like a page in a notebook.

These blocks, or pages, get tied together. So just like you know that if you turn a page in a book you are continuing where the previous page left off, you can go from block to block to block.

For Bitcoin, each block is limited to about 2,400 transactions. Closing out a block requires a computer to solve a very complex cryptographic function or basically solver a very hard problem. Once this is solved it shows that the block is verified and official. Then other blocks are added to it. This is then called a blockchain. All it is is the complete collection of transactions, just like if you took every page from your paper ledger and put it in a book.

And just to throw out one more term that you may come across as you read across the web. This verification or proof to close a block is also called “mining”. Mining because you are paid if you can solve the complex problem before anyone else.

So cryptocurrencies operate by requiring large amounts of computation power to encrypt a record of transactions. No bank or central authority has to verify or certify anything. I see that someone has put in a vast amount of computation power to verify these transactions, and so I trust it.

This is going to be the end of my attempt to explain at a high level what cryptocurrency actually is. Obviously there’s a lot more to it that we left off here and that quite frankly is above my head.

If this stoked your interest in wanting to learn more, please let us know and we can forward along some more information we have found useful that goes a step or two deeper.

This gets us to the more important part of the webinar from our eyes at least. What is the role of crypto as an investment, and specifically in a retirement portfolio?

And I think the first thing that should come to mind now that we spent a few minutes describing what a cryptocurrency actually is, is why separate currencies belong in a retirement portfolio.

Because if you accept that these cryptocurrencies will someday be used on a big scale, I think you have to consider the other currencies that we have today that are already out there.

I can say that no one has ever asked us questions about investing in the Japanese Yen, or British Pound.

And while these other currencies are most certainly useful. The whole world economy requires them to function in fact. Almost no one thinks of the Japanese Yen as an investment like they do a cryptocurrency today.

So I think that’s a good first check if you feel like you are missing out on an investment. What are you actually excited about?

Because most of the time, what fuels these feelings of missing out is not because of what the investment is, but seeing something rise in price and articles like this one, that was published in the New York Times, a few years ago.

As an aside. If I can criticize this article a bit, and help you feel like you aren’t missing out. Remember from our previous slides that the record of transactions for cryptocurrency is all public. We don’t know who owns these currencies, but we do know an account number.

So, this information is all public, and I can say with fairly strong confidence that the number of Bitcoin millionaires is less than the number of people that have won $1 million in the lottery historically. Its hard to track down exact numbers with all sorts of state and local lotteries. But at the very least the numbers are the same order of magnitude. And I have a feeling that if you read this article but it was instead talking about lottery winners, you would feel very differently than if it was about bitcoin, or any other type of investment really.

Anyway, back on topic. What I am trying to say is that when it comes down to it, most people feel like cryptocurrency needs to be part of their portfolio because of the prospect of these lottery like returns and don’t think about the lottery like outcomes! Not because of its usefulness or fundamental value.

And while I have no idea whether Bitcoin or any other cryptocurrency is here to stay, I can say that historically, investing in something solely for the purposes of hoping someone else will pay you more for it in the future has been a terrible idea.

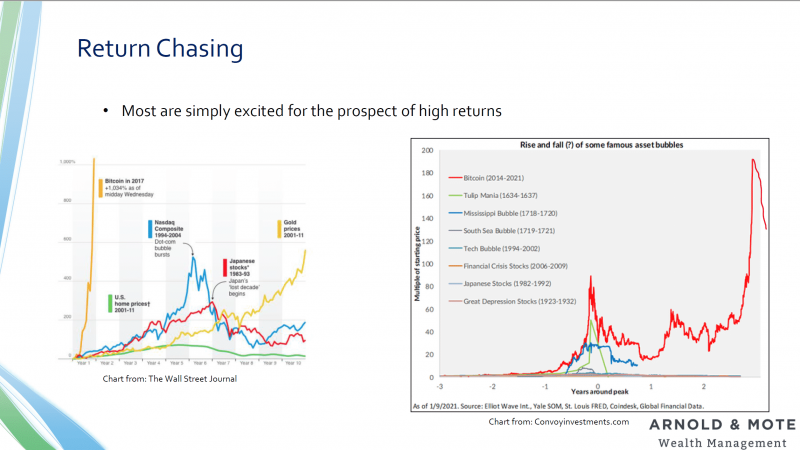

These are just 2 charts here showing a few of histories larger bubbles. The one on the left just more recent, the one on the right goes many hundreds of years back to show bitcoin compared to some of histories more famous bubbles.

And what I think is interesting is that the idea of something almost completely worthless being bid up to astronomical prices is nothing new at all. 400 years ago tulips were worth more than houses, and while there are debates on how widespread these bidding wars between tulips got, it certainly happened and many people got sucked into the feeling of missing out and doing some really dumb things with their money.

So is bitcoin the modern day tulip, I don’t know. But I do think that today’s modern world, and the structure of crypto currency specifically has made it much easier for bubbles like this to happen. We look at some of these previous bubbles and they are almost pretty local or participants are limited in one way or another.

Bitcoin and other cryptos are pretty unique I think where it is the first time that billions of people have been able to participate in this. People can’t go and open brokerage accounts in China to buy some hot stock there. Sure the Chinese might, but its pretty limited to who will participate.

But everyone in the world, can open a crypto account and immediately fight over the same bitcoin, something that is structured to have limited supply. And that is a lot more fuel for the fire so to speak than previous bubbles, like tulips had in my opinion and a big reason why we’ve seen what we have over the last 5 years or so.

Good Technology (or Product, or Idea) Does Not Equal A Good Investment

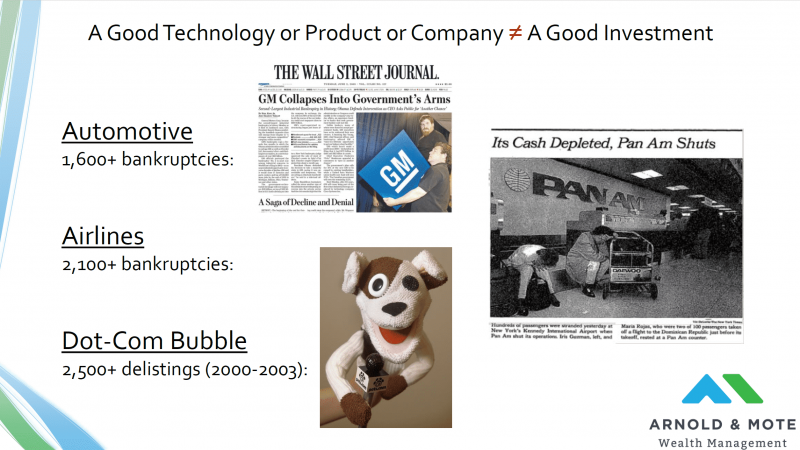

And even if these basis of your investment goes beyond the emotional fear of missing out, and you think cryptocurrency is truly one of the more significant inventions in history, I think history has some really good examples here too.

I listed what I thought was some of the more significant inventions in the last couple of centuries. Cars, Airplanes, and the internet.

Without of doubt all of these have changed the world as we know it. But, they have been incredibly hard areas to make profitable investments in.

Just for example, more than 1,600 auto companies have gone bankrupt since the invention of the automobile.

So, if you correctly predicted that the car would change the world. That wasn’t enough to make a profitable investment. You really had to predict which of the few auto companies out of the thousands would make it.

The same goes with airlines and internet companies in the dot com bubble. Everyone knows the winners, no one talks about the millions and billions lost on the companies that didn’t make it.

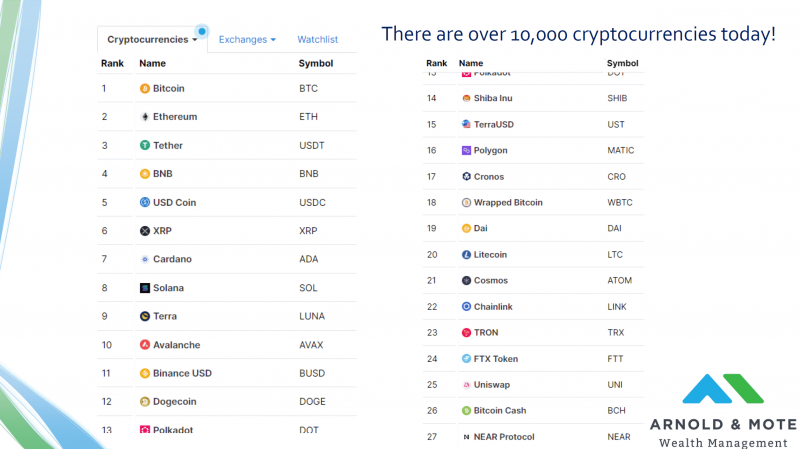

And this is exactly like crypto today. Because we have just been talking about Bitcoin today for simplicity, but there are over 10,000 different cryptocurrencies. I have no doubt that some of these 10,000 will grow in value sometime in the future. I also would bet a lot of money that many of the 10,000 end up worthless.

So, even if you think cryptocurrency is revolutionary and are excited about it. You have to be really careful in letting that excitement lead you to making an investment.

While some cryptocurrencies are traded very frequently, most of that trading is speculative. We see crypto’s usefulness pretty limited right now. And again, we just don’t think currencies have much of a place in a retirement portfolio.

Besides that, the SEC has not approved any Bitcoin funds (ETFs or Mutual Funds). There is one that is only based on futures, or a derivative, that does not work well for long term holding. There is one closed end fund that invests in bitcoin, and fees are very high – in excess of 2%!

Lastly, as we just showed there are thousands of different cryptocurrencies, and right now there is no good way to diversify between all the different cryptocurrencies available. Just like how we don’t pick individual stocks for our clients, we aren’t comfortable picking individual currencies.

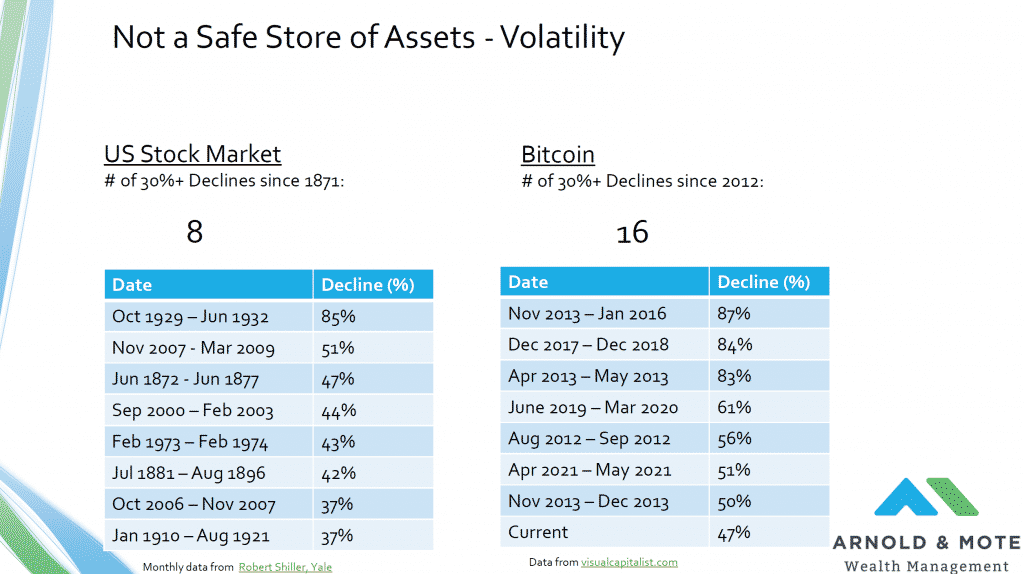

It is probably a surprise to no one that cryptocurrency, and bitcoin in particular, are very volatile. Here is a chart of the largest drawdowns in the US stock market since 1871 (based on monthly return data), and the largest declines in the price of bitcoin over the last 12 years:

Not only is this magnitude of volatility tough to stomach, which is important to be able to do for a long term successful investment portfolio, managing a retiree withdrawal strategy with an investment this volatile is very difficult.

This is also strong evidence against the common claim of Bitcoin being a “safe store of value”. Notice the current decline in bitcoin now, 47%, has occurred with rising inflation, a new war, and general stock market turmoil. This is a time when Bitcoin should really be shining, and it most certainly is not!

Of course the big question here is what if we are wrong? What if Bitcoin truly takes over the world?

With our diversified investment approach, we invest you in thousands or different stocks. Over time, if Bitcoin goes more mainstream, these investments will without a doubt get you exposure to cryptocurrency.

And we have seen this already. A while ago Tesla started accepting Bitcoin for purchasing their cars. And Tesla kept Bitcoin on its balance sheet. So, if you held Tesla stock, or even just a large cap index fund like most investors do, you had exposure to bitcoin through that!

So it is our belief that it is prudent to wait until we see Bitcoin become more widely accepted and integrated into the economy, and get exposure through a diversified set of investments, rather than making large speculative bets today on a specific cryptocurrency.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.