Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

If you are in position to retire with $2 million or more, you have done an excellent job saving for retirement. And now, once you retire you will deal with all new issues that probably weren’t on your mind while you were focused on accumulating assets. Here’s a few topics that we cover with clients with around $2 million in assets at the time of retirement:

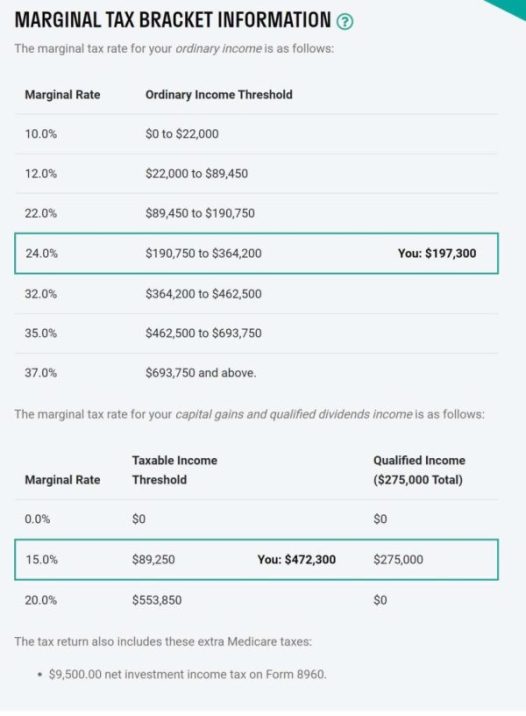

First, we help create tax efficient withdrawal plans. Particularly if a majority of your savings is in pre-tax 401(k)s, 403(b)s, or IRAs, you are likely looking at a very significant tax burden in retirement as the deferred taxes on these accounts come due. We can help evaluate general withdrawal strategies and Roth conversion plans to help reduce this tax bill.

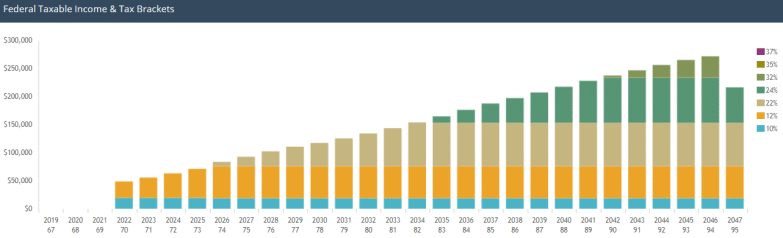

We’ll start by calculating your estimated long term tax rates in retirement. If you have $2 million in pre-tax retirement accounts such as IRAs and 401(k)s, your long term tax liability might look something like this:

As RMDs, Social Security, and spending increases, so will your tax bill. The first step in determining a tax-efficient withdrawal plan is to recognize opportunities to get money out of these accounts at lower tax rates early in retirement.

Or, perhaps you are dealing with appreciated stock subject to capital gains tax. We can help create plans to spend down that stock in a tax-efficient manner to get you better diversified without paying an unnecessary tax bill.

Next, we will help create a plan for charitable giving. With a nest egg of $2 million, you will have a lot of options to support causes that are important to you. You can donate via QCDs, or qualified charitable distributions from your IRA, or donate appreciated stock directly or through a donor advised fund.

This charitable giving plan is crafted around the other parts of your financial plan. Doing Roth conversions? That may be a great time to fund a Donor Advised Fund to get maximum tax savings!

Or, perhaps you are in your 70s and just looking to reduce the tax burden from your RMDs, then we can help create a plan to donate through QCDs to offset your required minimum distribution.

If your goal is to leave a larger legacy at the end of your life, we can help create an estate plan to ensure assets go to charities in the most tax efficient way for your heirs and your estate.

Investing these assets so they can support you through your retirement for many decades to come is your primary goal.

You need to keep a portion set aside in safe investments for short term needs. That might mean money markets or CDs, defined maturity bond funds, or perhaps Treasury bonds for their reduced state tax burden.

And while it might seem tempting to put a majority of your money in these less volatile types of investments, you need to have some long term investments that produce returns to help keep up with inflation and potentially rising expenses for many years in the future.

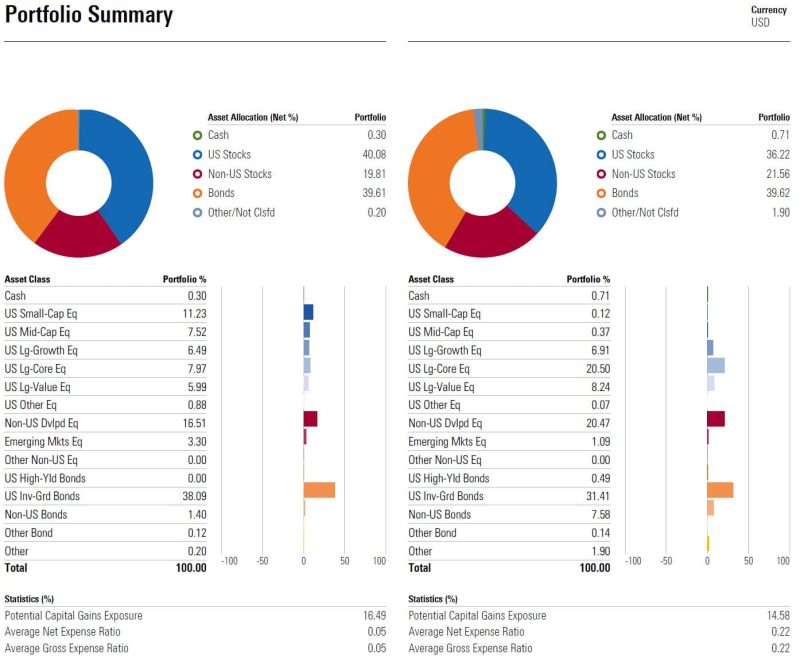

This mix of assets that protect against short term market volatility and inflation, while providing you long term returns is your asset allocation. This paper by Vanguard argues that this asset allocation is the most important driver of the rate of return and the volatility of your $2 million in retirement funds.

Lastly, with your level of assets, fund expenses matter. We recommend only low cost, passively managed index mutual funds and ETFs to help reduce investment related expenses.

Mutual funds and ETFs with high expense ratios are a hidden fee that may be costing you thousands of dollars every year.

We can help create a low cost, diversified portfolio that keeps money in your account.

We help clients with all these topics, and do so on a flat fee basis.

Don’t feel like you need to pay an advisor 1% of your account every year to help you with these topics. Reach out today and let us show you how we help families just like yourself prepare for retirement.