Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Private credit is a relatively new type of investment that has grown rapidly, and is aggressively sold to investors and advisors with the promise of higher returns. Investing in private credit funds is incredibly risky and we believe it has no place in most retiree investment portfolios. Here’s why:

Private credit is loans made to small companies, typically companies that can’t get traditional financing through a bank.

Investors in private credit are often attracted to very high interest rates, which may make these funds initially seem very appealing.

But there are risks to Private credit, risks that make us believe they are not good investments for just about everyone.

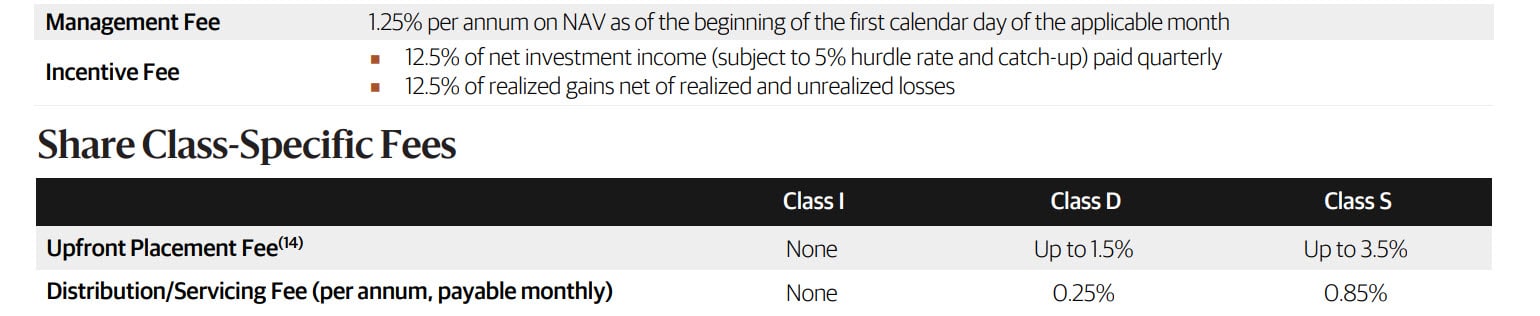

First, just know that these are typically very high-fee investments. You will likely pay a percentage or more in fees annually. That fee eats away at your annual returns and compounds over time. Traditional fixed income investments have fees that are 90% less than the fees that are common in these private credit funds.

This fee will be noted in the fund fact sheet or prospectus. You’ll want to find the fund’s management fee, along with any potential performance-based, or incentive, fees, and any placement fees

This image above shows the fees from a Private Credit Investment Fund managed by Blackstone. Notice the many layers of fees that will impact your performance!

Consider a $1,000,000 investment into this fund’s S Class shares. This investor would be hit right away with a $35,000 upfront placement fee. Then, the investor would be subject to up to $21,000 (2.1%, or 0.85% + 1.25%) in annual fees. Lastly, the fund’s managers will take up to 12.5% of the interest and gains the investor would receive as an incentive fee!

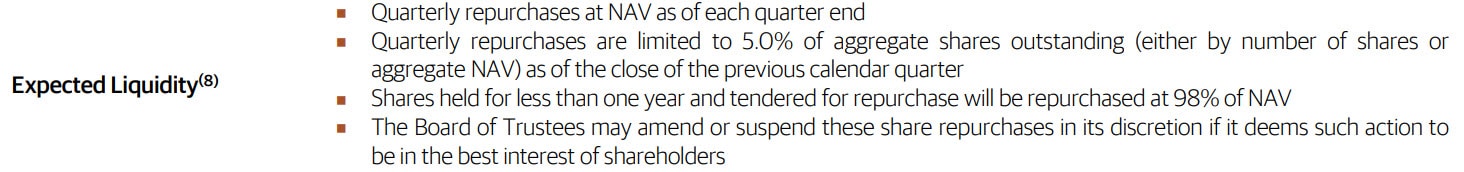

Second, investments are generally very illiquid. Mutual funds are available that invest in private credit, and they tend to have very restrictive withdrawal options. For example, you may only be able to get your money out quarterly, and only a certain amount of money can be withdrawn from all clients at a time. That means that if there is a lot of selling in a fund, it may be quite some time before you can sell and get your money back.

Lastly, these investments have much higher risk than the standard fixed income options you might be used to. Remember, Private credit is made to small companies, and ones that very likely couldn’t receive favorable financing from traditional lenders. That means higher potential for defaults, and you not getting your money back.

These risks mean that these private credit investments are not alternatives for treasury bonds or investment-grade corporate bonds in your asset allocation. Instead, it should be thought of more like stocks.

And when we compare Private credit to stocks, we find that stocks have a lot of advantages, like liquidity, low fees, and a proven history that make them a much better fit for our clients.

If you are being pitched a private credit investment, talk to us. As a flat fee, fee-only, fiduciary advisor we can provide an honest second opinion on if this is a good investment for you.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.