Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Spousal benefits are based on your and your spouse’s Full Retirement Age (FRA), and claiming early will permanently reduce the amount you receive.

The higher-earning spouse delaying benefits does not increase the spousal benefit and can actually reduce the lower-earning spouse’s income in the early years of retirement.

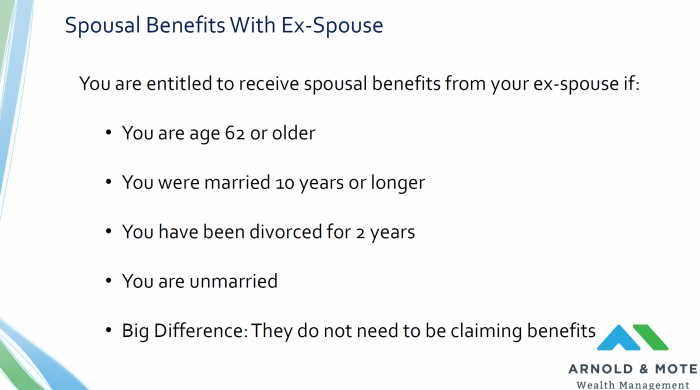

Divorced individuals may still qualify for spousal benefits if they meet specific requirements—including being married for at least 10 years and divorced for at least 2 years.

Although many of the complicated strategies around Social Security regarding spousal benefits have been eliminated, there are still options to consider regarding when to begin your, or your spousal, benefits with Social Security.

In this webinar we covered common questions we receive about Spousal Social Security benefits, and strategies to maximize your benefits.

Topics include:

Before we get into specific examples, a couple of points related to spousal social security benefits need to be cleared up which can potentially lead to some confusion.

The rules around Social Security and spousal benefits in particular changed drastically in 2015, that impact those who were born after January 1st, 1954.

There used to be more options for spouses that allowed you be to eligible to receive additional benefits or made more people eligible for spousal benefits.

We won’t go into detail on these, but prior to this law change in 2015, there were multiple ways to get spousal benefits while still being allowed to delay your own, or without requiring you to begin your benefits.

So, if you have heard from a friend or family member who was able to do some more complex Social Security planning around their spousal benefits, that may be why.

And also, just a note that if you were born before January 1st 1954, you may have more options available. But, we’re not going to go through all of those in this webinar since they are more complex and would turn this into a much longer webinar. If you were born before January 1st 1954 and don’t have a strategy for Social Security, reach out and we can help.

Also, Social Security benefits get more complicated if your spouse or ex-spouse passes away.

And in this webinar as we mention spousal benefits, it is not the same as survivor benefits that apply if your spouse has passed.

Like with the slide before, if your spouse has passed away, it opens up many different options that we are not going to cover here.

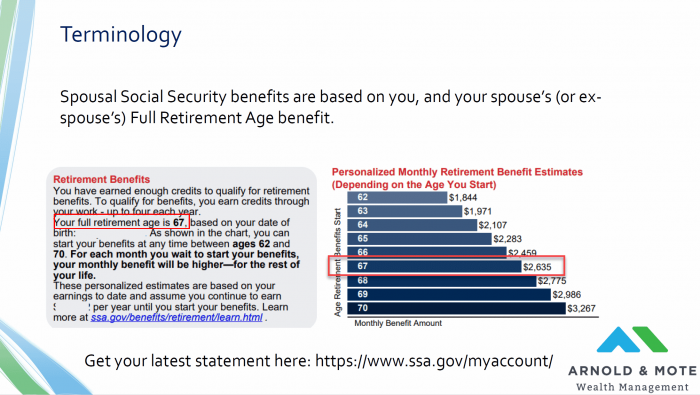

And lastly, all the calculations for spousal benefit rely on you and your spouse’s full retirement age benefit. Depending on when you were born this is probably between age 66 and 67.

And so a good start to knowing if spousal benefits will come into play with you is to be sure you find this information for both of you. If you haven’t looked at a Social Security statement in a while, you can access your most recent statement at this link.

Spousal Social Security benefits are not available to everyone. So, to know if this applies to you, check your and your spouse’s full retirement age benefit amount. If one of those benefits is less than half of the other, then you will be able to apply for spousal benefits.

For example, if your full retirement age benefit is $1,800 per month and your spouses is anything less than $900, then this applies to you.

And that is because with Social Security, you are entitled to receive the greater of either:

There’s an asterisk here because it is not necessarily that simple; we’ll get into the details later. But if you do everything right, you can get a spousal benefit up to 50% of your spouse’s benefit.

Then there are 2 basic requirements to qualify for spousal benefits:

Again, these were the changes that we talked about in the first slide. They have not always been requirements, but these are the rules as of now.

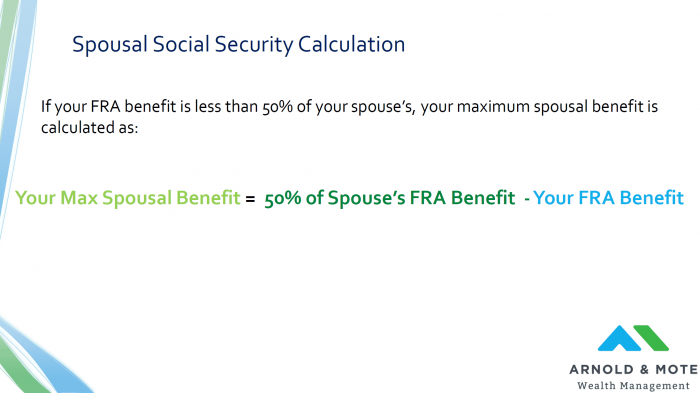

So how exactly does a spousal benefit get calculated?

What is important to understand is that the Social Security Administration calculates what is called a maximum spousal benefit.

The calculation for this is taking half of your spouses benefit, and then subtracting your full retirement age benefit.

This is the most that Social Security will pay you. This max benefit does not change if you or your spouse delay Social Security past your full retirement age, or if you or your spouse claim benefits early before full retirement age.

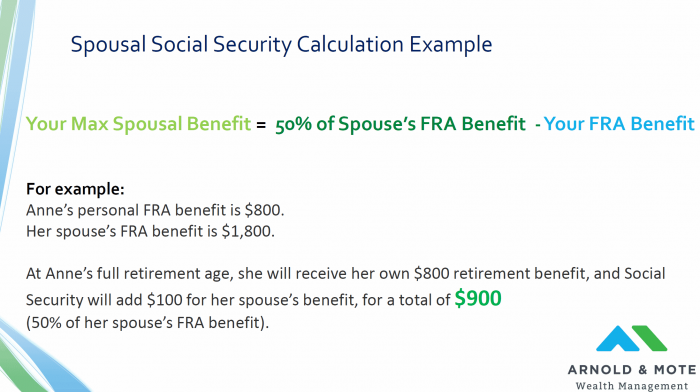

I just want to start with a very basic example.

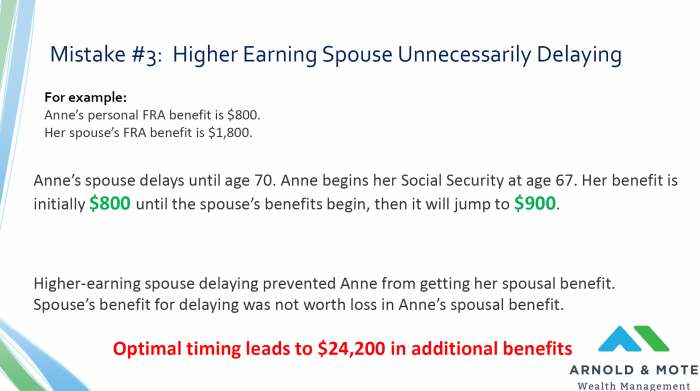

Anne has a personal full retirement age benefit from her own earnings of $800.

Her spouse has a full retirement age benefit of $1,800.

If Anne and her spouse both file for benefits at their full retirement age. Anne’s spouse will receive $1,800 per month. Anne will receive her $800 per month benefit and then be trued up by Social Security with her max spousal benefit of $100 per month, for a total of $900 per month for Anne.

So hopefully this is pretty straightforward.

But, as we are going to see there is some complexity that can come up with Spousal benefits, and there are also some common misconceptions around the spousal benefit.

For example, we have heard multiple times, and there is a lot of information on the internet that describes spousal benefits as “you will always receive a minimum of your spouse’s benefit.”

And that’s not the case, or at least that’s not the case since 2015.

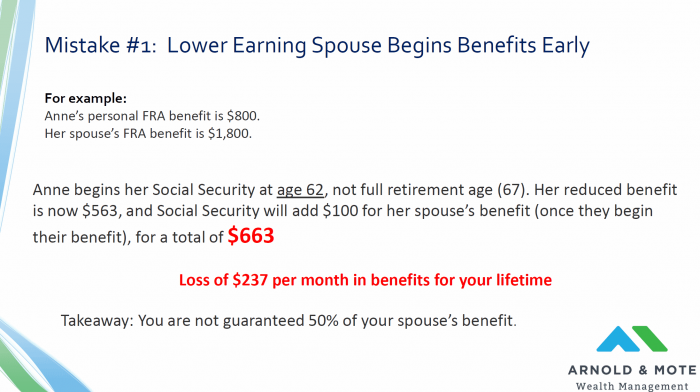

The most common variation of this we hear is that the lower-earning spouse might as well begin benefits as early as possible, since the spousal benefit will bring them up to 50% of the larger benefit later.

But this is not the case.

Remember, Social Security calculates a maximum spousal benefit based on your full retirement age. Anne is never going to get more than $100 per month in spousal benefits.

So, let’s say Anne begins her benefits at age 62. She will receive a sharply reduced Social Security amount because she claims early. In this case, her benefit would drop to $563 per month from the $800 full retirement age amount.

Then, remember the spouse has to be claiming benefits for Anne to receive spousal benefits. But even once the spouse begins benefits and Anne is eligible for spousal benefits, she will not be bumped up to $800 per month. She will only get the $100 per month added to her reduced benefit for a total of $663.

That means Anne loses out on $237 per month for the rest of her life. Perhaps she receives some added months of a $563 benefit. But the breakeven on this is not very good, in fact, it is just that if Anne lives past 71, she would get more total benefits by not claiming at age 62.

So, the key takeaway and really the most common misconception we see with spousal benefits is that the 50% spousal benefit is still dependent on the lower spouse waiting until Full Retirement Age. And in all but very unusual cases, its worth the lower-earning spouse to wait until Full retirement age.

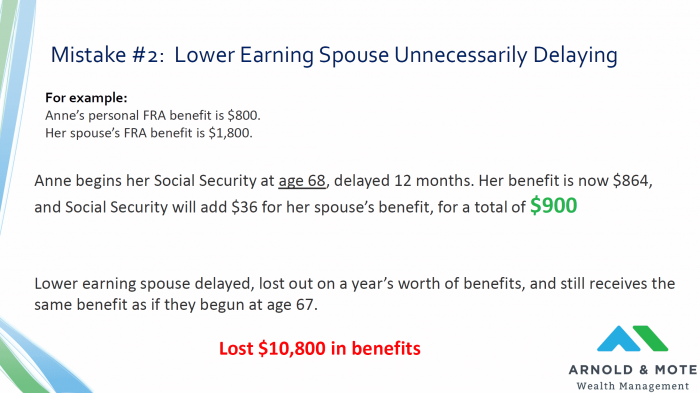

Another scenario here is understanding the relationship between how the delay credits on your personal benefit compare to the boost from spousal benefits.

So perhaps Anne has heard that you get a benefit in delaying Social Security, so she decides to delay her benefit a year to get that 8% boost.

Her new benefit will be $864. But she will not receive $100 in spousal benefits anymore, because remember the maximum benefit is 50% of her spouse’s FRA benefit.

So, she still gets capped at $900 per month going forward.

Ultimately, what this means is that by Anne delaying, she lost out on a year of benefits, and the credit for delaying wasn’t enough to offset the spousal benefit, so it really had no impact to her.

In the end, she gets $10,800 less in benefits. And that $10,800 is not over the course of her life, even, it’s all at the start in a single year early in her retirement. So, really a pretty big impact.

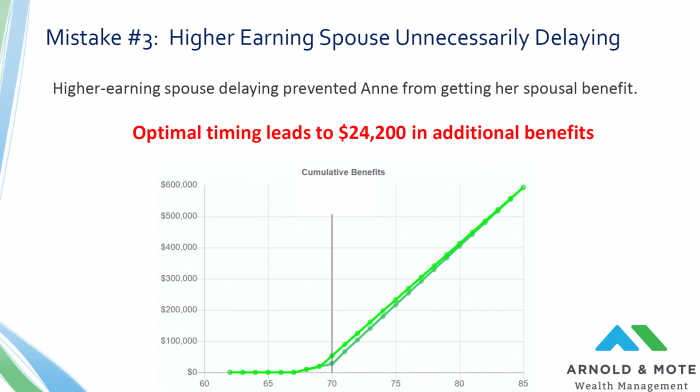

And one more example. I feel like we all know that delaying Social Security gets you an increased benefit. And that, very often, we find it worth delaying.

But that is not always the case when spousal benefits come into play. Because remember, the lower-earning spouse can not get spousal benefits until the higher-earning spouse claims.

So, while the higher-earning spouse delaying does increase their benefit, it also decreases Anne’s potential benefit!

And just for example here, if Anne’s spouse delays until age 70, Anne’s benefit will only be $800 per month until her spouse turns age 70.

This ends up resulting in $24,200 less in benefits in the early years of retirement compared to if the higher-earning spouse would have claimed at age 69.

Now, this scenario is a little more complex because there is technically a breakeven where the spouse delaying does end up benefiting them in the very long run. In this case, it doesn’t happen until their late 80s. For most, at that breakeven it’s worth getting more money early in retirement. But again. It will depend on their specific plan a little more than the previous 2 examples.

The big takeaway is just to understand how delaying will impact spousal benefits.

If Anne had no benefit of her own and relied on only spousal benefits, these numbers would be very different and it would greatly favor the higher-earning spouse claiming before age 70.

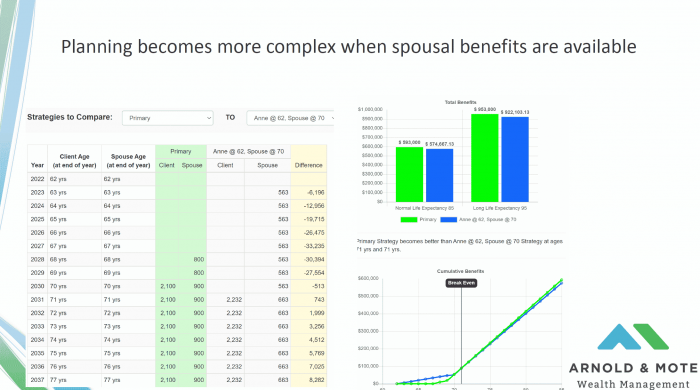

We try to give specific examples in these webinars to show you how the math behind these decisions works in real life. But what you may also be beginning to understand is that there is no certain answer when it comes to the right course of action regarding when to begin your Social Security.

Besides just the simple math in these examples, real life financial plans get even more complex.

What if we are creating a plan to do Roth conversions as well? How would that then impact the optimal Social Security strategy?

There are benefits to looking at these items holistically. That’s why we are here to help you analyze these options.

If you are divorced, spousal Social Security benefits work differently.

You are entitled to receive spousal benefits from your ex-spouse if:

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.