Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Deciding between paying down your mortgage early or investing can be a difficult choice for any household.

Historically, saving and investing has produced higher returns, but that is no guarantee that happens in the future.

Likewise, many households have a goal to get debt free, and a mortgage is typically a household’s largest debt.

The correct decision for you is dependent on a number of variables, but we will give you a few items to consider below to help you make your decision:

Today we’re talking about the decision between paying extra towards your mortgage, or saving and investing that money instead.

There are a few important items to consider before you begin aggressively paying down your mortgage.

The first thing to consider is liquidity, or the amount of savings that you have easily available available for emergencies, or other short term spending goals.

Savings that is put towards your mortgage becomes hard to access in the future.

While extra money that is put towards your mortgage certainly may be able to be accessed through HELOCs, or home equity loan, that can be expensive and that option might not always be available for you.

In fact, we were recently interviewed by Yahoo Finance about this very topic: Americans Struggle to Tap Home Equity During the Pandemic , where we said:

“It is always a good idea to build up a sizable emergency savings before paying any extra payments on your mortgage to ensure you have savings available when you need it most. If you are dependent on debt to make ends meet you should be aware that at times you need it most, debt financing may not be there for you.

We have seen recently during the 2008 housing crisis, and more recently in the coronavirus pandemic, that many banks have pulled back on home equity loans, which means that when you need this money the most, it might not be there for you.

If you do not have enough liquid savings on hand, and a home equity loan is not available at the time, you may be forced to use very high interest debt, such as credit cards or personal loans.

In addition, accessing money through a home equity line of credit is expensive. You will pay fees to set up the line of credit, and interest on any amount that you borrow against your house.

For many, this means you will pay thousands of dollars to access the money that you have put into your house. This very likely negates any benefit you received in interest savings by trying to pay down your loan ahead of time.

Money that is saved and invested in a Roth IRA or taxable brokerage account is much easier to access, and with no cost to you, unlike a HELOC.

Money can usually be moved from your brokerage account into your bank account in a matter of a few days.

How do you know what the best course of action is for you? Before paying extra towards your mortgage, make sure that you have an adequate emergency fund set up. We believe that you should have 6 months or more in a savings account, money market, or short term bonds before beginning to aggressively pay down your mortgage.

The other thing to consider is returns.

Historically, the returns of a portfolio that holds a diversified selection of stocks and bonds has returned higher than the interest you would be saving on interest by paying down your mortgage.

It is also important to remember that returns on your stock and bond investments compound over time, whereas the interest on your mortgage is a fixed interest rate. That means that, even if we have a period of very low returns in the stock market, you may see higher total returns over a long period of time by investing compared to paying down your mortgage.

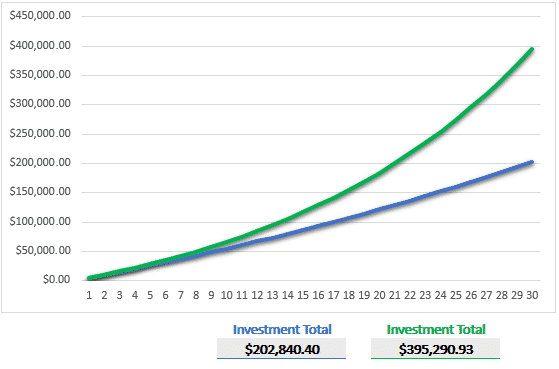

When we go through the numbers with clients, we often use a detailed calculator to help show the interest savings by paying down loans, and comparing that amount to what could be earned through investing.

Ultimately, paying down your mortgage ahead of time is rarely a terrible decision.

However, we find that for most people, investing that money into a Roth IRA or taxable brokerage account instead of towards your mortgage leads to higher returns over time.