Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

A key strategy for most retirees is figuring out when to start Social Security. Here’s a few things to think through as you decide whether to delay your benefit, or begin benefits sooner.

Delaying Social Security can be a great way to improve your long term financial plan.

First, know that delaying Social Security improves your benefit by about 8% per year. You can delay all the way to age 70. After age 70 you must begin to take your benefits.

That increase means that a retiree who is due a $2,200 per month Social Security benefit at full retirement age would receive a monthly benefit of about $3,000 – $3,200 if they delay to age 70. That added income will last throughout the rest of your retirement.

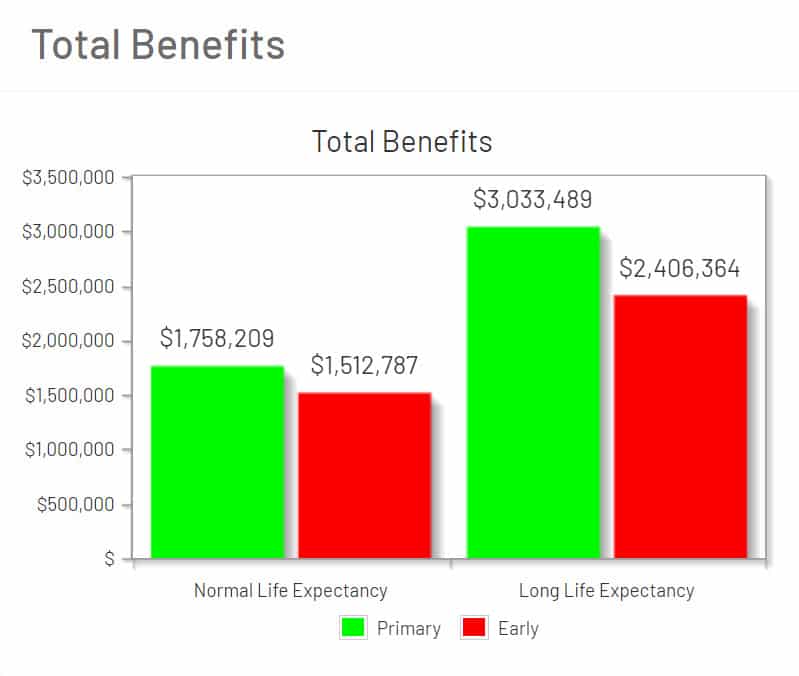

For a retiree that lives a long life, delaying your benefits will result in you receiving a significantly higher total benefits over your life.

When we work with clients making this decision, we often begin with a quick comparison of their current benefits and their maximum Social Security benefit. We help analyze not only just your Social Security benefit, but how your Social Security strategy fits with your overall financial plan.

For example, delaying Social Security is often a great strategy for those needing to do significant Roth conversions in early retirement.

Longevity is a very significant risk for retirees today. A retiree who lives to age 90 or higher has an increased chance of outliving their assets. Delaying Social Security is one of the best ways to protect against running out of assets late in life.

Before delaying, think about your own family and your personal health history and what it tells you about longevity. The whole point of delaying Social Security is to take advantage of it later in life.

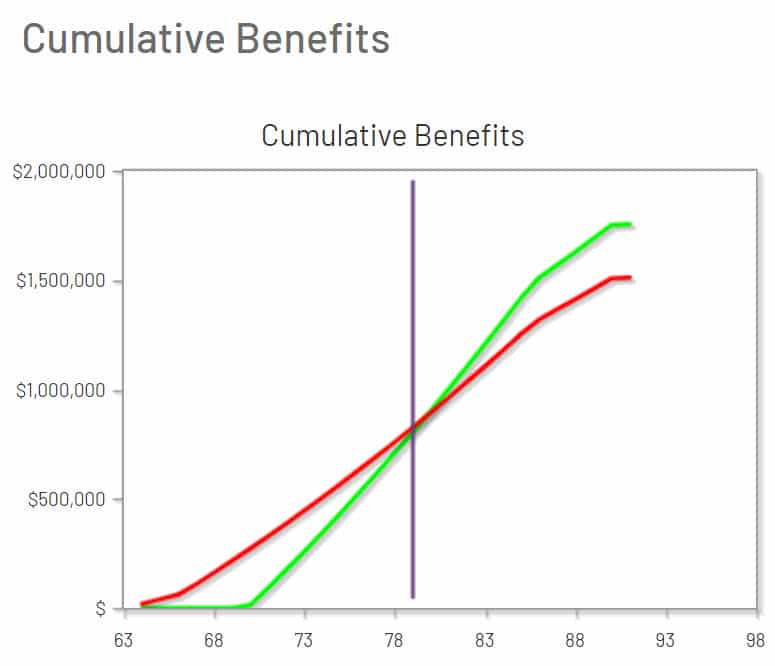

If you don’t expect to live a very long time, it may not make sense to delay your Social Security benefit.

This is another scenario where we can help clients determine their best course of action. A breakeven analysis is relatively easy to do, and can help you visualize the trade offs in delaying or beginning your benefits early.

Delaying Social Security also requires that you have the assets available to live on until you begin your benefits. For some, delaying benefits may simply not be possible.

Married couples have an added option. One spouse may delay their benefits, while another claims at full retirement age.

For some, this strategy provides the flexibility to get some income sooner, while allowing one spouse’s benefit to continue to grow.

In this scenario, the larger benefit would also be available to the surviving spouse if one spouses predeceases another by a significant margin.

Deciding when to begin Social Security is not a decision to take lightly. For many, the difference in delaying benefits or claiming early can mean a difference of $100,000 or more in total benefits.

We’re here to help.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.