Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

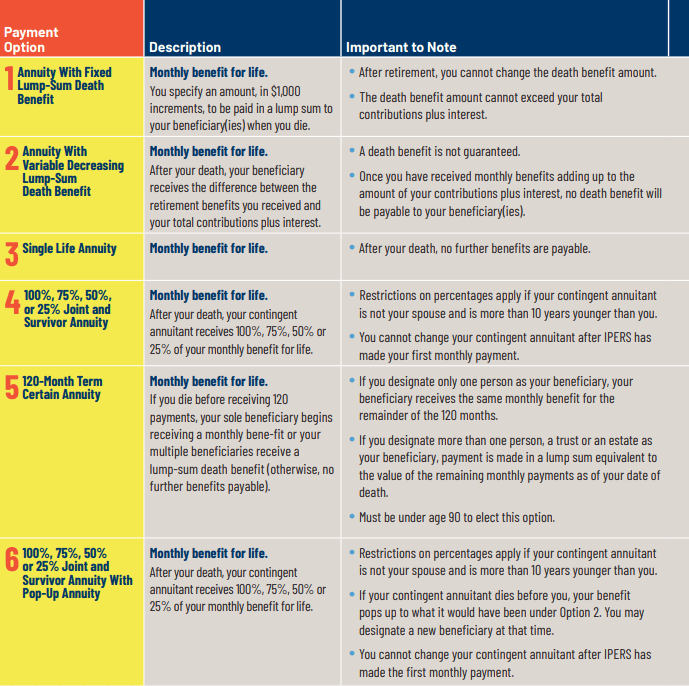

IPERS offers six payout options, mainly differing in how much income (if any) continues for a surviving spouse or beneficiary.

A single life annuity gives the highest monthly benefit but leaves survivors with nothing, while joint life annuities provide ongoing income at a reduced rate.

Choosing an IPERS payout is permanent, so it’s essential to weigh your retirement needs and your family’s future financial security before electing.

The IPERS pension system is a great option for many Iowa retirees. But there are some really important things to know about the payout options available for IPERS retirees before you make your election:

IPERS offers 6 different retirement options. It is important to know that the main difference in each of these options is the difference of what your surviving beneficiary receives after your death.

It is important to make this decision carefully as it can not be changed once you make the election and begin your IPERS retirement.

Some options pay out just for your lifetime, and stop once you pass away. This is called a single life annuity and is option 3 in the image above from the IPERS member handbook page explaining the retirement options available for IPERS recipients.

This option will give you the largest monthly payment, but leave your surviving spouse or beneficiaries with potentially nothing. If IPERS is only a minor piece of your retirement plan, or if your survivors would not be burdened by your passing and loss of IPERS, this may be a fine option.

However, if your spouse or dependent survive you and would be dependent on your IPERS income, this may be a very poor choice.

There are others that just pay a lump sum to your beneficiaries after you pass. With this option you may designate any amount in $1,000 increments to be paid out to your beneficiaries when you pass. The lump sum amount can be used to make sure your survivors have money needed for retirement living expenses, medical care, or a gift for family.

This is another option that requires planning to effectively put in place. How much of a lump sum would your surviving spouse need if you were to pass? How much will that lump sum designation impact your monthly benefits? We can help you craft a retirement plan that ensures you have a successful retirement with IPERS, and your spouse or beneficiary is protected as well.

And then there are options that continue to pay a pension payment to your survivors. That amount can be anywhere between 25% and 100% of your regular monthly retirement pension benefit. This is the most common option and one that we typically recommend to clients. However, there is still some planning that should be done to ensure the survivorship benefit is enough for your family.

Any of these options will pay you a monthly benefit for your retirement. What is important to understand when making this election is how much income you need in your retirement plan, and how much your spouse or family would need in your passing.

If you need to think through the long term income plan of your retirement, and how the 6 different IPERS payout options fit into that plan, please reach out and schedule a free 30 minute meeting with us. We will discuss how we help clients create a successful retirement plan, and manage that plan over time.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network. Arnold & Mote Wealth Management is a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas.