Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Iowa’s 529 plan offers 10 low-cost Vanguard index fund options, ranging from aggressive stock portfolios to conservative bond portfolios.

Your choice should balance growth potential with risk tolerance, adjusting from stocks to bonds as college age nears.

For most families, Iowa’s age-based tracks provide an easy, automated way to manage risk over time.

Choosing the right investment option in your Iowa 529 is one of the most important factors for the long term growth of your savings. Saving in an Iowa 529 college savings account is one of the best ways to save for future college and education expenses, and picking the best investment for you will allow those contributions to grow and compound to help you meet your college savings goals.

Iowa’s 529 plan has 10 individual investment options from Vanguard:

These are all low cost and broadly diversified index funds that make for great long term investments. But how do you know which option is best for you?

Typically, if you are getting started saving early, you want to use an allocation heavily weighted toward stocks, which have historically produced higher returns. For most, that means using any of the first 6 investment options in the list above.

Then, as your child or grandchild gets closer to college age, investing more in bonds so that you aren’t at risk of a big market drop and therefore a decline in your account value, just as you need to start paying tuition. That means adding investments in any of the bottom 4 investment options from the list above.

Though it’s important to recognize your tolerance for risk when choosing between the investment options in Iowa’s 529 plan.

A more aggressive portfolio will be higher in allocation to stocks. These have historically been most volatile, but also had higher returns.

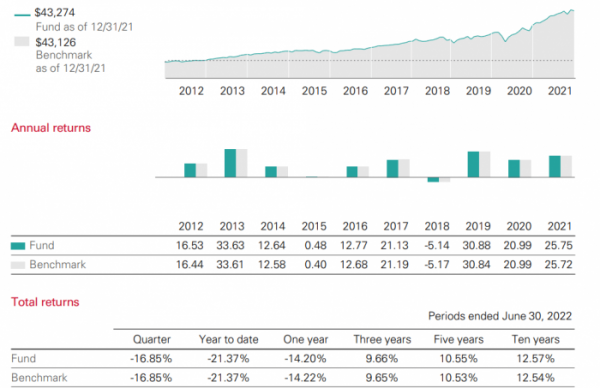

For example, in the 10-year period from June 2012 to June 2022, the Total Domestic Stock Index Fund has averaged an annual return of 12.57%.

However, the fund also fell 22% from January 2022 to June 2022. So you have to be ok with seeing regular 10, 20% or potentially even more periodically.

If you know the ups and the downs of the stock market make you uneasy, don’t choose an aggressive allocation that might see a lot of volatility.

More balanced portfolios will have a larger allocation to bonds. This may reduce long term returns, but will also create a more stable portfolio.

The most important thing is to choose an option that you can stick to for the long term.

If you are comfortable evaluating and choosing between these investment options yourself, you can find much more detail information on the 10 Vanguard investment options within the Iowa 529 college savings plan here.

You can select individual funds from the list above, manage the account over time, and do all of this yourself.

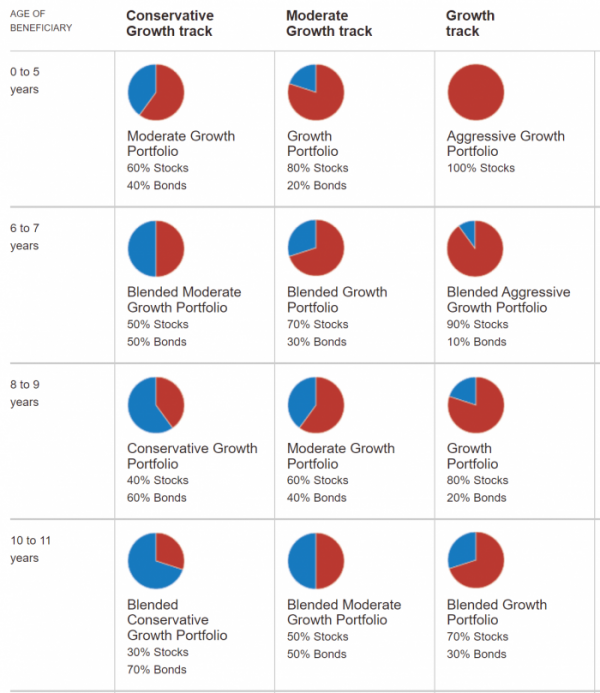

However, our default recommendation for most families is to use the age-based tracks that Iowa’s 529 plan offers. With this option, your investments will automatically be moved to lower-risk, less volatile investments as your child approaches college age.

Here is an example of how the investments change as your child or grandchild gets older with the Age-Based Investment options in the Iowa 529 plan:

This is a great option to put your college savings on autopilot and on a great long-term plan.

Creating a college savings plan is just one part of our financial planning services we provide to clients. If you are looking for help choosing the best Iowa 529 investment options for you and a more thorough college savings plan, please reach out and talk with us. We offer free 30-minute consultations for you to ask any questions that you have on college savings or any other financial planning topic.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.