Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Inflation is a retirees worst enemy. Here’s how to allocate your investments to protect yourself from inflation:

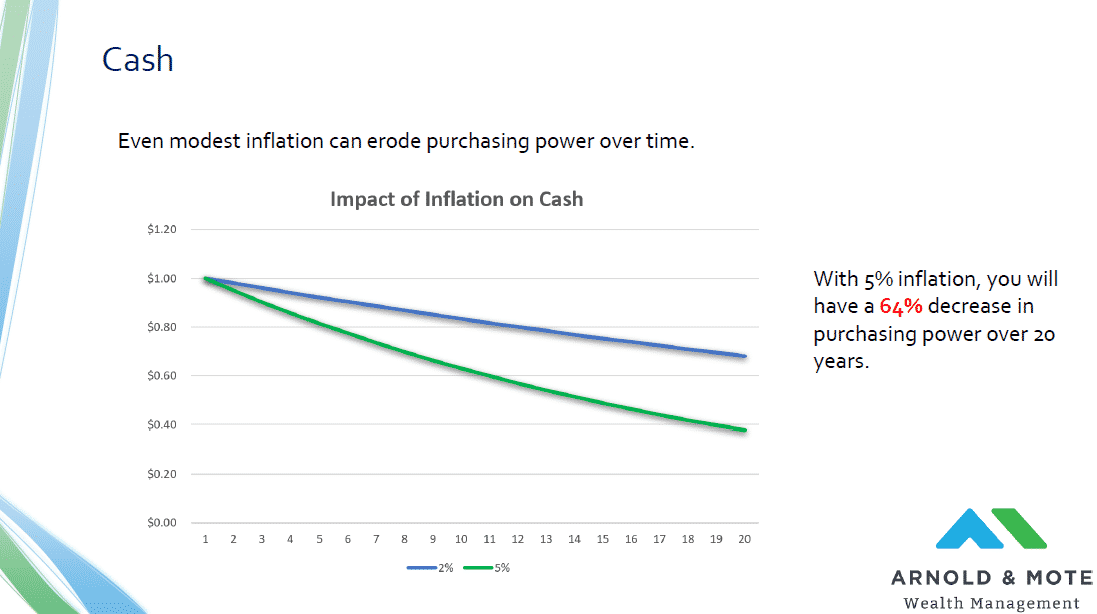

While it rarely makes big impacts in any single year, over time even modest inflation results in significant reduction in purchasing power of your savings.

Even with just 3% inflation, the value of a dollar will be reduced by more than half over a 30 year period.

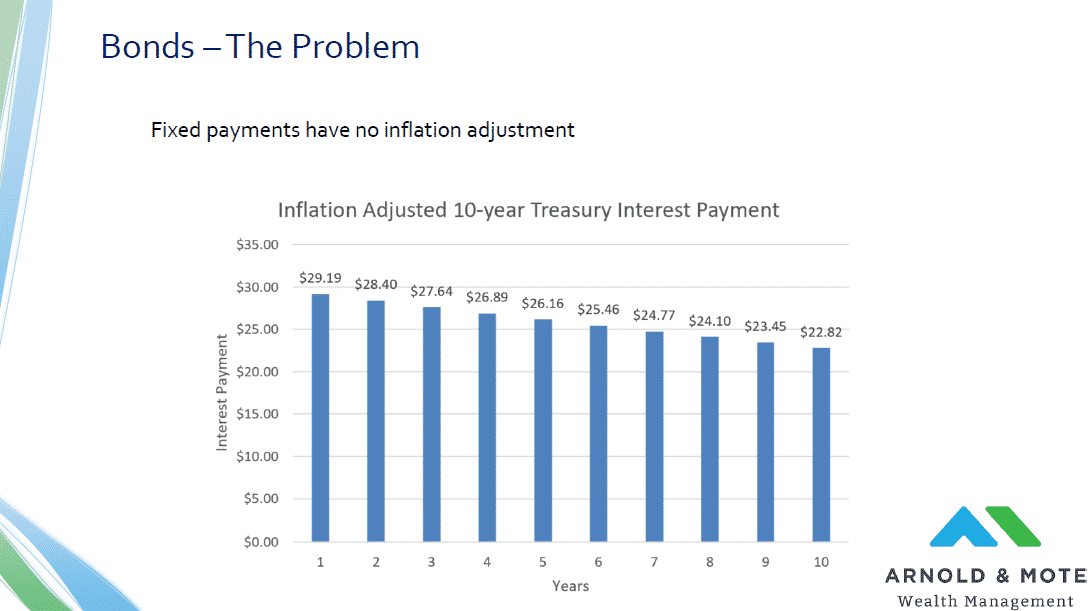

Inflation is particularly damaging to retirees because they are the ones usually more reliant on fixed income, such as pensions, Social Security, and savings instruments like CDs, bonds, and savings accounts. These assets produce an income stream that has little or no inflation adjustments, meaning that their real value to you declines significantly over time.

There are a few things you can do to make sure your retirement portfolio is positioned as well as it can be for handling rising inflation.

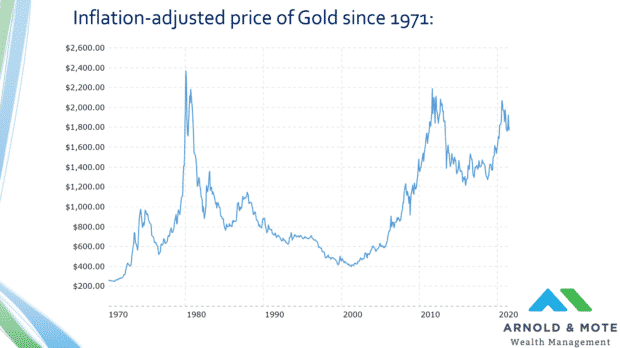

Many retirees thought gold would be a good inflation hedge in the early 1980s. However, the metal’s price declines more than 80% adjusted for inflation over the next 20 years.

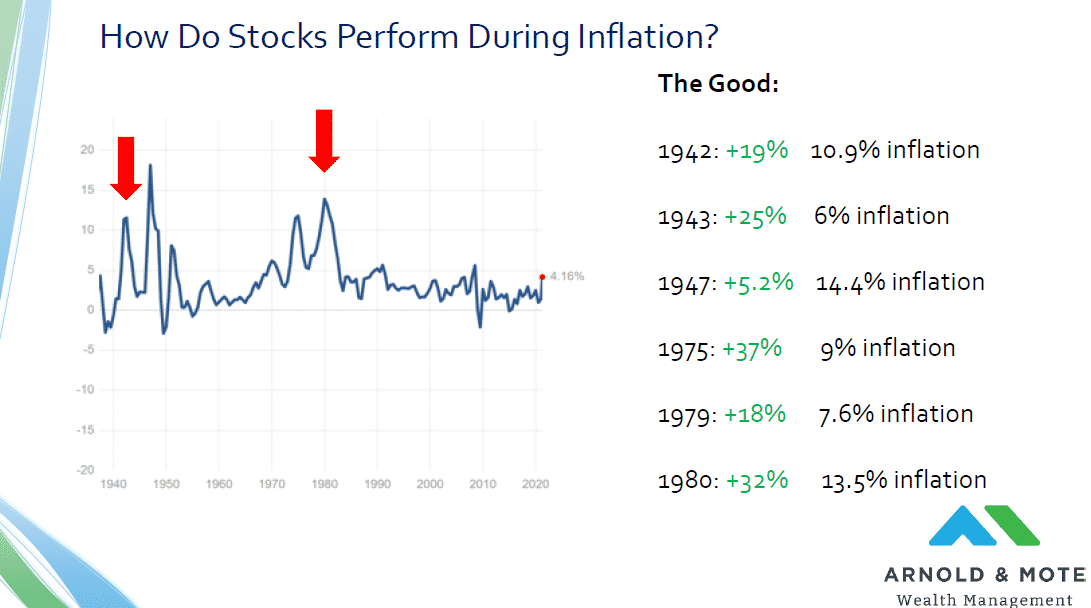

What worked better than gold? A diversified basket of stocks had a much higher return and was much less volatile.

Want to know more about investing in Gold – Watch our webinar

Long term bonds, where your money is locked up for 10 years or more, will see much more negative impact from inflation than shorter term bonds. A portfolio of shorter term bonds will also let you invest at higher interest rates more quickly than if you had longer term bonds.

Inflation is certainly not a risk to ignore. As fiduciary financial advisors, we can help you create a financial plan and stress test that plan through various scenarios, like rising inflation.

Looking for more on inflation? Here’s a webinar we did for clients with much more detail on how to invest with inflation in mind