Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

With proper management and investing, receiving a windfall inheritance is an opportunity to strengthen your financial plan and improve your progress towards financial independence.

However, this does not usually happen. On average, 1 in every 3 financial windfalls are spent down in 2 years or less. Here’s how to create a sustainable, successful plan around your inheritance and some pitfalls you may encounter. If you are unsure of how to navigate these issues, seek out a fiduciary, fee-only financial planner:

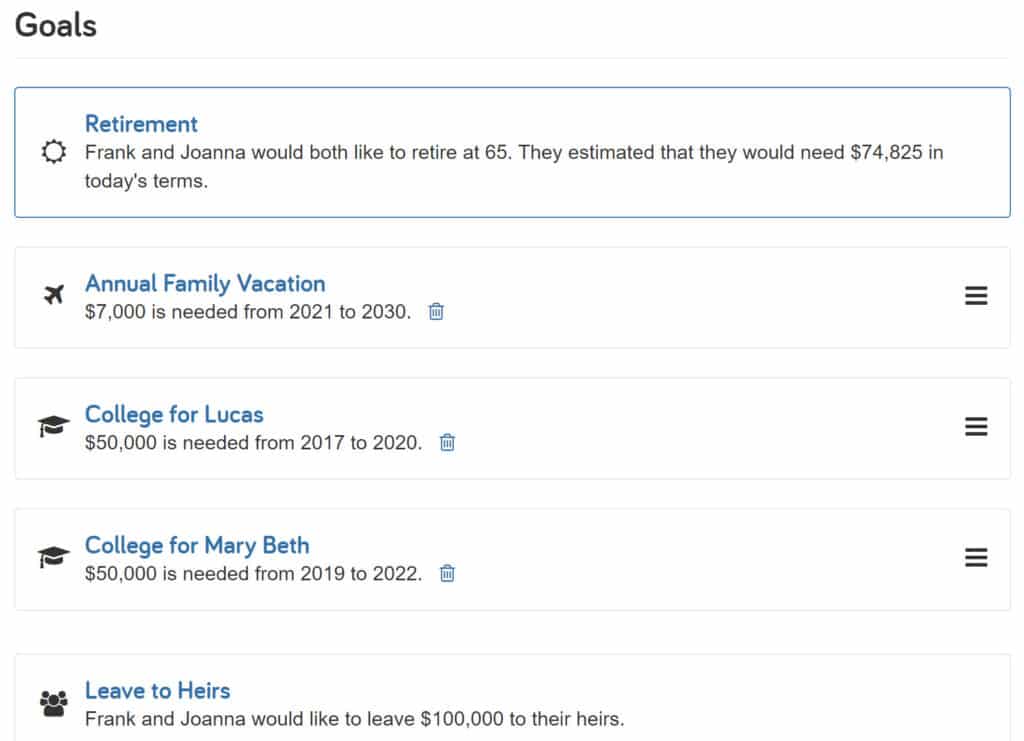

For most, sudden inheritances of wealth are treated very differently than their other savings, and that leads to money be wasted or spent differently than they would with other money. So, before you begin spending your inheritance windfall, its important to go back to your goals and see what needs help to fund.

For example, if you have a retirement plan, than that inheritance money should go towards maximizing long term retirement savings such as an IRA or Roth IRA. Don’t use this new money to buy a new car, a new house, or other items that will not contribute to your retirement goal.

Or, if you had a goal to pay for a child’s or grandchild’s college expenses, than using inheritance money to help start or fund a 529 should be a priority.

You may find that even after these goals are funded you have money left over. That is the time to consider adding new goals and expenses to your financial plan, not before.

Goal planning is just one part of a comprehensive financial plan that we help create for our clients. Here’s a look at everything that goes into our plans for clients.

This is how you begin to answer the common question of what to do with a $500k inheritance, for example.

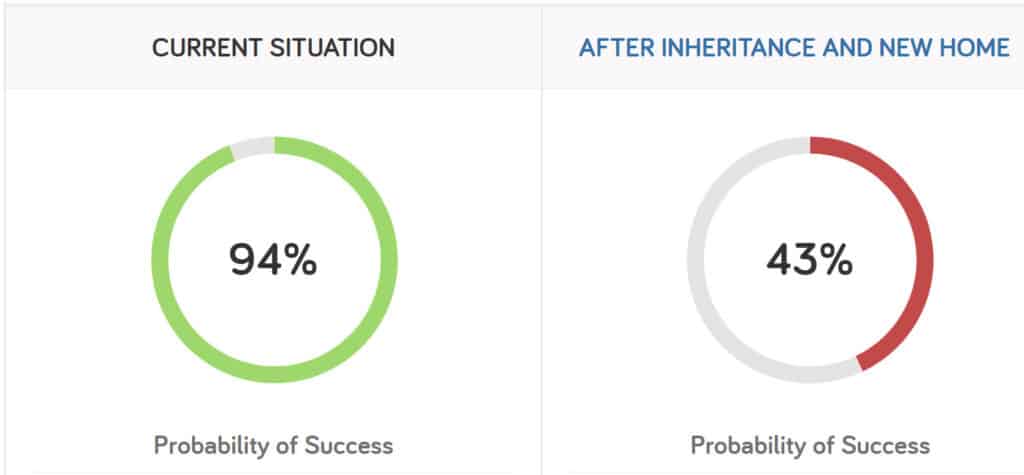

Why do so many inheritances get squandered? The problem is that many of the items frequently purchased with a windfall inheritance do not go towards improving net worth. Many of those who receive an inheritance windfall quickly imagine driving new cars or buying a new house. Besides just the initial purchase cost, these purchases add additional expenses to your budget such as taxes, upkeep, insurance, utilities, and more.

These ongoing expenses over the course of your life require significant savings to support. Unfortunately, these purchases and their ongoing expenses may instead quickly drain your entire windfall.

If financial independence or retirement is a priority for you, make sure your windfall follows an investment plan that ensures your desired lifestyle is sustainable.

When we talk with clients who have received money from an inheritance, we go through several goal planning exercises to make sure that there is a plan for the money to be invested, and spent, in a sustainable fashion.

Depending on the types of accounts and assets you inherit, you may be subject to new rules and taxes you were not familiar with before. Not being familiar with these can lead to larger chunks of inherited money being forced to pay for taxes or penalties rather than going towards your financial goals.

Each account type or asset will have its own rules, but here are a few common ones:

The taxes you are subject to from an inheritance will depend on what type of asset(s) you inherit. We cover those in detail below. But the taxes that an inheritance is subject to are confused by 2 other terms, Inheritance Tax and Estate Tax.

Inheritance tax is a special tax that the beneficiary of the windfall must pay. There is no Federal inheritance tax, but some states do apply inheritance taxes on certain levels of assets. If you are in a state that applies this tax, you (the beneficiary) will pay this tax. The value of your inheritance is taxed if you are a resident of one of these six states: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Each state has its own rules, so be sure to check the laws of your state and consult with a tax advisor if needed.

Iowa’s rules for its inheritance tax can be found here.

Estate taxes are federal taxes that can be levied on the assets of an estate. These taxes are applied and withheld before the assets are distributed to the beneficiaries. Estates are only subject to this tax at a federal level if they exceed $13.61 million (as of 2024 – this amount is subject to change each year) and that amount is doubled for married households! If an estate is eligible for Federal estate taxes, the tax will be paid by the estate on its tax return, and not directly by the beneficiaries.

Because the value of an estate must be in excess of $13.61 million, most estates and inheritances don’t apply. However, for those that do, planning and avoiding the estate tax is crucial because the tax rates can be 40% or higher! This is a complex topic on its own, and we won’t cover it in detail in this post.

With that quick discussion of inheritance tax and federal estate tax done, now lets look at how you will be taxed based on the assets you inherit:

If you inherit an Individual Retirement Account (traditional IRA) that is not from your spouse (making you a “non-spouse beneficiary” per IRS rules), you will be subject to new RMD, or required minimum distribution rules. The rules around calculating RMDs, the annual distributions that you must withdrawal over a set period of time, on inherited assets has recently changed. So, its important to make sure you understand how the current law is written.

For example, assume you receive a $500,000 inheritance in the form of an inherited IRA. You will have 10 years to withdrawal the money from that account. Not so hard right?

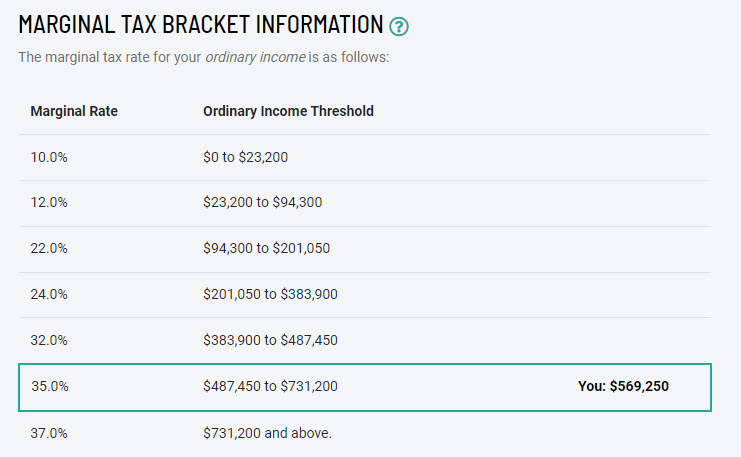

The problem comes when you consider the income taxes that you will have to pay from making those withdrawals. Because, withdrawals from inherited IRAs are taxed like ordinary income!

Any money your receive from an inherited IRA is taxed like normal income. So, if you were to withdrawal that entire $500k in a single year, your tax bill will likely be astronomical as you jump through higher and higher tax brackets.

Consider a $500,000 inheritance for a married couple with $100,000 in regular income located in Iowa.

If they would entirely cash out the $500,000 inherited IRA, they would pay a Federal tax rate as high as 35%, and also Iowa state’s tax rate of 5.7% for a total tax bill of over $150,000! That is because withdrawals from inherited IRAs are treated like taxable income.

So, you want to develop a plan to use any inherited money that is in an IRA is a responsible matter. You may want to space out distributions from inherited IRAs to reduce your tax bill. Or, you may want to match large distributions with years that you have a large tax deduction, such as a charitable donation, or deductions from tax loss harvesting.

Note: These rules and tax rates have changed over time and will continue to change. Depending on when you inherited the money, may not apply to you. Be sure to check with a financial advisor to ensure any advice received is relevant to you.

If you have questions about investing your inheritance, you are in the right place. Click here to schedule a free, no obligation 30 minute introductory meeting with us today to see how we can help set you.

These accounts, also known as individual brokerage accounts, usually do not present the same tax issues as inherited IRAs, but they do often cause other tax issues.

First, investments in these accounts produce taxes in 3 different ways; Capital Gains, Dividends, and Interest. Each of these 3 may be taxed at different rates depending on your income.

So, its important to understand where you sit in the Federal tax brackets to know if these assets will create a large tax liability for you.

For example, If you have low taxable income, under $82,000 if married, you may be able to take advantage of a special provision in the tax code to qualify for 0% tax rate for long term capital gains and qualified dividends. Likewise, if you have high income you may be subject to additional taxes on dividends!

Next, consider if the investments in that account that you inherited are appropriate for you. Taxable investment accounts can hold a wide variety of investments, from municipal bonds to high yield junk bonds.

Depending on your situation these may not be appropriate investments for you (and even lead to a high tax bill in some cases!)

A common source of sudden wealth from a windfall inheritance is life insurance proceeds. Death benefits from life insurance are normally sheltered from any taxes. So, if your father has a $500,000 term life insurance policy with you as the primary beneficiary, you should receive $500,000 tax-free if he passes.

However, there are a lot of complex insurance products that may lead to part of the death benefit being taxable to the beneficiary. For example, a variable universal life insurance policy that has a cash value that has increased due to investment gains, may create some taxes for the beneficiary. More often, this portion of the policy’s value is small compared to the death benefit of the life insurance. But, this may be a more significant issue for you if you inherited a very old whole life, or universal life insurance policy.

Roth IRAs are great in that they don’t result in the heir receiving any additional tax burden. For that reason, Roth conversions can often be a very valuable estate planning topic, in additional to a tax minimization strategy!

The “burden” for the heirs falls on knowing when and how to use that inherited money.

Inherited Roth IRAs also have the same RMD, or required minimum distribution rules, that traditional IRAs have. In general it is best to keep investments in these accounts for as long as possible.

Some exceptions may be during years of high spending or high income, when it may be worth using the tax-free Roth money to avoid withdrawals from your other investment accounts.

Once you have your goals established and your tax burden determined, now it is time to invest your windfall inheritance so that you can meet your goals in the future.

It is impossible to suggest how to invest your proceeds through just a blog post. Your investments depend on your risk tolerance, the time horizon of your goals, and the exact types of assets you inherited.

However we can offer general advice that we use in managing all of our client’s assets.

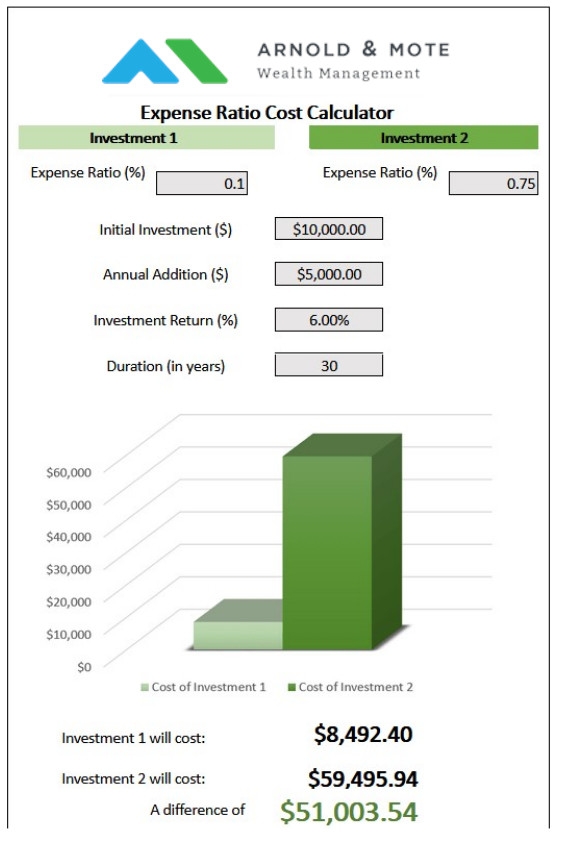

All investments have some sort of cost. For ETFs and Mutual Funds, most of these expenses come from a funds “expense ratio”. This is simply the annual fee that fund companies charge for investing your assets.

Over time, these expenses can really add up. Below is an example from an expense ratio calculator that shows the impact of these fees over time:

It is important that you are comfortable finding these low cost types of investments and building a portfolio and investment plan around them.

If you are investing your inheritance, choosing investments that will grow over time is important.

Choosing investments that are broadly diversified is an important step in meeting that need. Diversification means not having “all of your eggs” in a single basket.

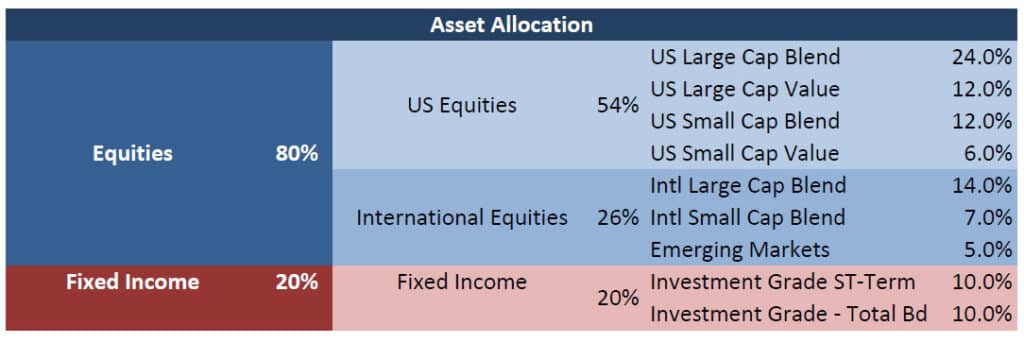

For investing, that means having a wide variety of different types of investments. You want large companies, small companies, and international companies. It might also mean adding bonds for safety.

Building a diversified investment portfolio does just this. When we work with clients and develop an asset allocation, it typically includes investments in many different areas:

Besides just finding your initial investment, there are numerous investment account maintenance items that you will now have to do.

We have separate blog posts and webinars that deal with some of these topics:

Tax Loss Harvesting – If you received an inheritance in the form of a taxable investment account, you may have the ability to get tax deductions when the value of those investments go down. This can be incredibly valuable if you take advantage.

Rebalancing – Over time, your investments will become overweight in the assets that have performed well recently. Rebalancing your investment accounts means ensuring that your investments stay diversified over time.

If you are unfamiliar with either of these topics, getting help from a financial professional is of utmost importance. Receiving an unexpected inheritance comes at a time when you may not be ready to devote substantial energy to learning new sections of the tax code that now apply to you. Unfortunately, not knowing or following these tax laws can lead to very costly mistakes.

For most, receiving a windfall inheritance can be life changing. For example, a $500,000 inheritance is big! It can provide stability in your finances, freedom in your work or lifestyle, and comfort.

If you are not confident in your ability to manage that money, seek help. A third of all inheritances are gone in 2 years or less. Don’t fall into the same problems that countless others have that leads to the squandering of their inheritance.

As fiduciary, fee-only advisors we help clients with this every day. From goals to investing to taxes, we will help create a plan for you that ensures your inheritance is used and invested in the best way possible.

We offer free, no-obligation meetings so that you have the chance to ask us questions about your windfall, our investment process, or whatever else is on your mind.

We will work with your estate attorney or tax professional to create the best plan for you.