Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Iowa’s IPERS pension is financially strong and well-funded, making it a reliable long-term benefit.

Keeping your IPERS account allows you to build on past service if you return to an IPERS-covered job in the future.

Even a modest pension can strengthen your retirement plan by reducing how much you need to draw from savings like a 401(k).

You’ve just left your job and you’re wondering, “Should I cash out my IPERS benefit and take the refund?” We’re going to try to convince you not to do that for three reasons:

First, IPERS is a very well-run state pension system. It has adequate reserves and it’s going to be there for the long run for you.

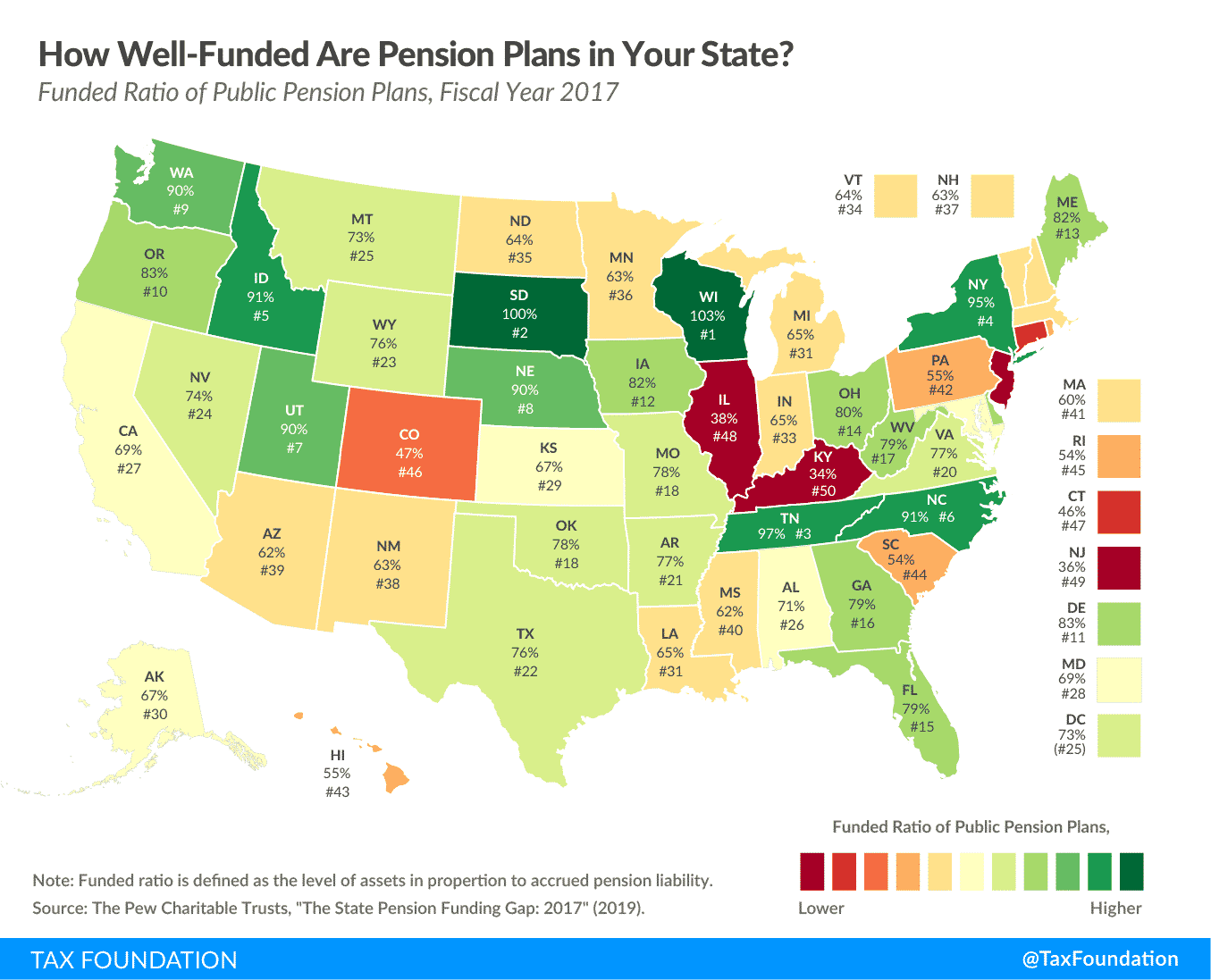

Below is data that comes from the Tax Foundation on the funding levels of various state pension programs. Notice that Iowa’s is well funded relative to many plans throughout the country.

Secondly, if you ever return to service – that means taking a job where you get an IPERS benefit in the future – you actually add that service on to what you already have and it builds up over time into something really valuable for you.

Third, a pension is an important piece to have in your long-run financial plan, even if it’s a small benefit. If you have that, it means you don’t have to take as much out of your 401(k) or other savings and you can make sure you have enough retirement income for the long run.

Need help navigating how your IPERS benefit works in your overall retirement plan? Contact us to see how we can help you!

Learn about our comprehensive approach to retirement planning – read a summary of the topics we advise our clients about.

More about IPERS:

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.