Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

I Bonds are simpler, safer, and more predictable than TIPS, but their $10,000 annual purchase limit makes them hard to use in larger portfolios.

TIPS allow higher investment amounts and retirement account access, but they’re complex and carry interest rate risk if sold before maturity.

While I Bonds can play a valuable role, a diversified portfolio of stocks and shorter-term bonds has historically been a stronger long-term inflation he

As investors seek inflation protected investments for their savings, they are usually led to one of two options – Treasury inflation protected securities, also known as TIPS, or I Bonds.

We find that a lot of investors see these 2 options as very similar types of investments, but that is not the case.

Series I savings bonds are a very simple and straightforward investment. That’s a huge advantage from TIPS. I Bonds tend to perform exactly how savers expect and offer investors very few surprises.

Both investments provide both a fixed rate and a variable rate of interest that adjusts to inflation.

The fixed rate is determined at the time of purchase or auction and remains constant for the life of the bond.

For I Bonds, the variable rate changes every 6 months based on inflation as measured by the consumer price index (CPI).

For TIPS, the coupon rate is determined at auction, and the TIPS yields will depend on that coupon rate plus any future increases in principal value due to inflation.

We wont get into the complexities of how TIPS principal adjustments work exactly. But the U.S. Treasury has a good basic explainer here for those interested.

Those two rates combine to form a composite rate for the savings bonds that have historically led to a return much higher than savings accounts, bank CDs, and even short term Treasury bonds.

We think I Bonds are great and are one of the best protections against inflation for your savings.

The primary advantage of IBonds over TIPS is that IBonds are easy to understand, and make it very easy for a saver to know what return they will get. We’ll see as we look into the details of TIPS later how the complexity of Treasury Inflation Protected Securities can quickly complicate your expected returns.

Another big advantage to Ibonds is that investors can benefit from historical inflation. That is, you can get an interest rate on Ibonds today based on inflation that happened as far as 12 months in the past.

For example, consider an investor considering Ibond purchases in late 2022:

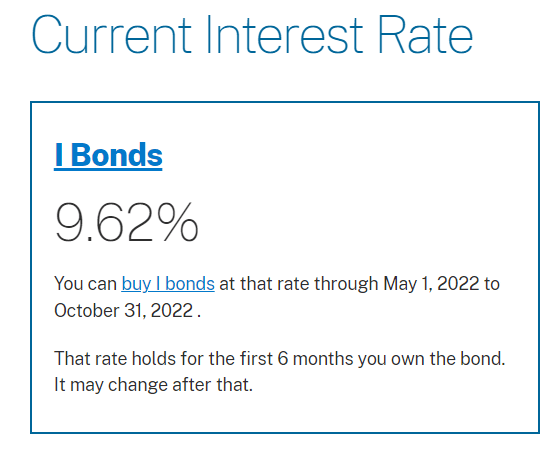

The May of 2022, the IBond rate was changed to 9.62%. This rate was based on inflation information from the 6 months prior, November 2021 to April 2022. However, investors had until October 2022 to purchase IBonds at that 9.62% rate.

This option was available even though inflation was falling and it became clear that the variable rate on the next round of IBonds was going to be lower than 9.62%. An investor considering Ibonds can watch nearly 11 months of inflation go buy and see if they would rather have yesterday’s rates, or future rates of inflation.

This is a big advantage for Ibonds compared to TIPS. When you buy TIPS, whether at auction or on the secondary market, you will only benefit from future inflation. The market prices in current and past inflation almost instantly. While TIPS will still protect you from future unexpected inflation, there is no guarantee of a return based on historical inflation like there is with IBonds.

Also unlike TIPS, you are guaranteed not to lose money in IBonds.

While a deflationary period is not usually a big concern for those investing in TIPS or IBonds, it is still a risk for TIPS. IBond’s are guaranteed to have at least a 0% return.

With TIPS, you are guaranteed to receive the original principal amount at maturity (or the inflation adjustment principal value – whichever is higher). Investors who pay over par value for these TIPS may see a reduction in the value of their bonds in a deflationary environment. An invest may actually see negative yield to maturity if inflation is negative and they were purchased at a time when the real yield on TIPS were negative.

Series I Savings Bonds have a couple added tax benefit compared to TIPS.

First, IBond interest is tax deferred. By default, you will not pay taxes on the interest earned from IBonds until you redeem the bonds. (You have a choice to recognize the interest annually as well if that is advantageous to you – This optional tax deferred interest flexibility could be another big advantage for a select few!)

Also, the interest rate on IBonds is tax free on your Federal tax return if the bonds are used to pay for qualified education expenses.

This can be a great benefit for younger families in particular who may want to be building up an emergency fund for themselves, but also know that they have educational expenses in the future. They can save in IBonds early on, and if an emergency cash need never comes, then they can cash the bonds in to make a 529 contribution (Yes, cashing out a savings bond to contribute to a 529 plan is a qualified expense!), or simply keep them until college tuition bills come due.

However, I Bonds aren’t perfect.

The major drawbacks to IBonds is that there are relatively low purchase limits. Each individual is limited to $10,000 per year in maximum purchases. (You may also be able to purchase an additional $5,000 per year in paper bonds by using your tax refund to make the purchase when you file your Federal tax return)

This annual purchase limit makes it hard to have IBonds become a significant portion of your retirement portfolio for an individual investor and essentially meaningless for larger investors, institutional investors, or corporations.

Another big disadvantage for investors is that you can not purchase IBonds in tax-deferred retirement accounts like 401(k)s, or IRAs.

You can only use after-tax money, and the interest from Ibonds will be taxable when you sell, and not able to be deferred like interest from bonds in your retirement accounts would be.

This limitation also makes for added complexity with your finances. Because the only way to purchase these inflation-protected bonds is by creating an account with the U.S. Treasury at Treasury Direct (TreasuryDirect.gov)

TIPS on the other hand are very complex, and function very differently than many investors expect.

The most common source of confusion we see regarding Treasury Inflation Protected Securities is around interest rate risk that these bonds have.

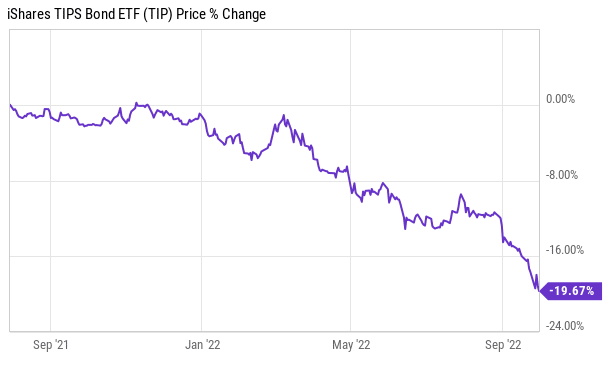

While you are guarded against unexpected rises in inflation, a general rise in interest rates will still negatively impact the value of your investment. We saw this in the first 9 months of 2022, which saw general TIPS mutual funds decline nearly 20%, despite having the highest inflation we’ve seen in 40 years.

If you are going to sell a Treasury Inflation protected bond before it matures, you are at risk for a decline in the principal value of your bond. For example, if you purchase a 10-year TIPS with a low coupon rate and negative real yield (like was available in 2021), and then go and sell that bond before it matures while real interest rates rise, you will face a potentially substantial loss.

Buying individual treasury inflation protected security bonds at auction in your treasury direct account or in a retirement account at your online brokerage is not a bad idea as long as you are confident that you will hold until maturity. Individual TIPS bonds can make a nice component of a “ladder” for retirement income that will be protected from inflation.

If you have to use a TIPS fund (mutual fund or Exchange Traded Fund) to purchase TIPS, shorter term TIPS funds are generally your best option for pure inflation protection. Longer term TIPS carry much more interest rate risk that will trump any potential inflation protection.

Regardless, we never know what the future holds. Even if you are fairly confident that your TIPS bond will not need to be redeemed early, the flexible maturity of IBonds is a big advantage, and valuable insurance policy.

One nice feature of TIPS is that they have essentially no practical limit for purchase amounts. You can buy much more than $10,000 per year (the annual limit for IBonds) if you desire.

Treasury inflation protected security investors can also utilize 401(k), IRA, and Roth IRA, and other investment accounts to purchase the bonds as well. Whereas purchases of IBonds on Treasury need to come from after-tax money, TIPS can be purchased with Pre-tax dollars in your retirement portfolios. Since these retirement accounts often are the largest source of savings for investors, this feature makes TIPS easier to implement into a financial plan.

Current yields and current inflation rates can periodically make TIPS more advantageous than Ibonds as well. For example in October 2022 the current fixed rate for Ibonds is 0%, while TIPS have a real yield of over 1.5%.

While Ibonds purchased at that time get a higher interest rate for the next 6 months, the TIPS will have a higher fixed interest rate over the life of the bond. Depending on future inflation, that may make TIPS a better option for long term investors.

| TIPS | I Bonds | |

| Buying and Selling | Highly Liquid – Can be bought and sold in the secondary market. | Not liquid. Can not be bought or sold in the secondary market. |

| How to buy | Through TreasuryDirect, brokerage accounts, IRAs, and Roth IRAs.

Also available in mutual funds and ETFs which may make them available in your 401(k) or 403(b) retirement account. |

Electronic Bonds: Online from TreasuryDirect.gov

Paper: Available only using your tax refund |

| Limits | For individual investors – practically none. | Electronic: $10,000 per person, per calendar year.

Paper (through tax refunds): $5,000 per person per year. |

| Minimum purchase amounts | TIPS have a minimum purchase of $100 if you are buying through Treasury Direct.

Larger minimums may exist on the secondary market through your brokerage account. No limit for ETFs or Mutual Funds. |

Ibonds have a minimum purchase of $25 on Treasury Direct.

The minimum for Ibonds purchased with your tax refund is $50.

|

| Inflation Indexing Adjustments | Inflation adjustments credited monthly based on CPI-U index. | Inflation rate changes semi-annually (announced in May and November of each year.) |

| Earnings Rates | Principal value of the bond is adjusted based on inflation.

Interest calculations are calculated by applying the fixed interest rate upon the adjusted principal. |

Earnings rate is based on the combination of 2 rates:

A fixed rate of return, set for the life of the bond at the time of purchase, and A variable semiannual inflation rate that changes every 6 months. |

| Interest | Interest is paid every 6 months | Interest accrues monthly and is paid out in a lump sum when the bond is redeemed |

| Tax Features | Semiannual interest payments and inflation adjustments that increase the principal are subject to federal tax in the year that they occur, but are exempt from state and local income taxes. | Tax reporting of interest can be deferred until redemption, final maturity, or other taxable disposition, whichever occurs first. Interest is subject to federal income tax, but exempt from state and local income taxes. Interest can also be claimed annually. |

| Maturities Available | 5, 10, and 30 years. | 30 year |

| Disposal before maturity | No penalty. Can be sold anytime on the secondary market, though you may receive a loss based on current yields and current interest rates. | Ibonds are redeemable anytime after 12 months with a penalty equal to the most recent three months of interest that has accrued.

No penalty for Ibonds sold after 5 years from original purchase. |

Ultimately, when comparing TIPS vs IBonds we find that TIPS, and long term TIPS in particular, are not a good fit for many of our clients. While IBonds are superior, it is difficult to amass enough to have a sizeable role in your asset allocation.

We typically find that there are other, better ways for most investors to protect themselves from inflation.

While have a portion of your nest egg in IBonds can be great for retirement, they have historically underperformed a diversified portfolio of stocks and bonds.

In addition to comparing TIPS vs Ibonds, consider investing the majority of your retirement portfolio in a mix of shorter maturity bonds, and diversified stock funds.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management, a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.