Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

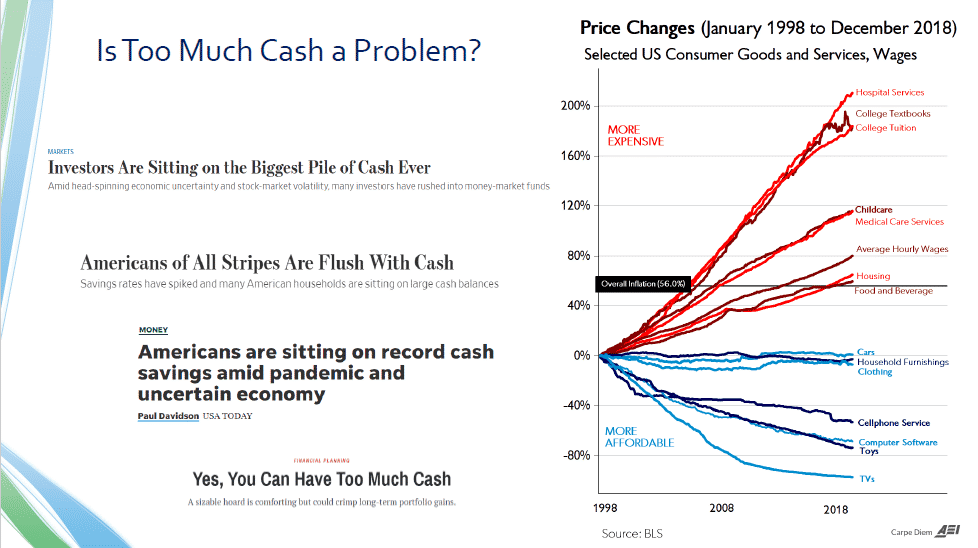

Having extra cash feels like a good problem to have. While the safety and security of cash is great in the short term, cash is not a very good long term holding, especially in times of higher inflation.

In this webinar we recorded for clients in August of 2021, we described the many options you have for where to put your cash for the best interest rate today, and what to know about all the various investment options for your large amount of cash today.

Our topic today is another that has come from several client questions and comments, and just increased interest in general about what to do with extra cash in today’s really low interest rate environment.

The webinar has 2 main sections. First, a look at your options for cash today. We’ll look at the pros and cons of various options like money market, CDs, savings bonds, and more to hopefully give you a better idea on the best places to save your cash today.

Then, we’ll step back and consider how much cash you should have, and how to think about when money should be in better long term investments compared to something ultra-safe like cash. Cash certainly has its place, but as you can imagine if you want to use only cash to save for your entire retirement it is pretty much impossible based on growth rates and inflation today.

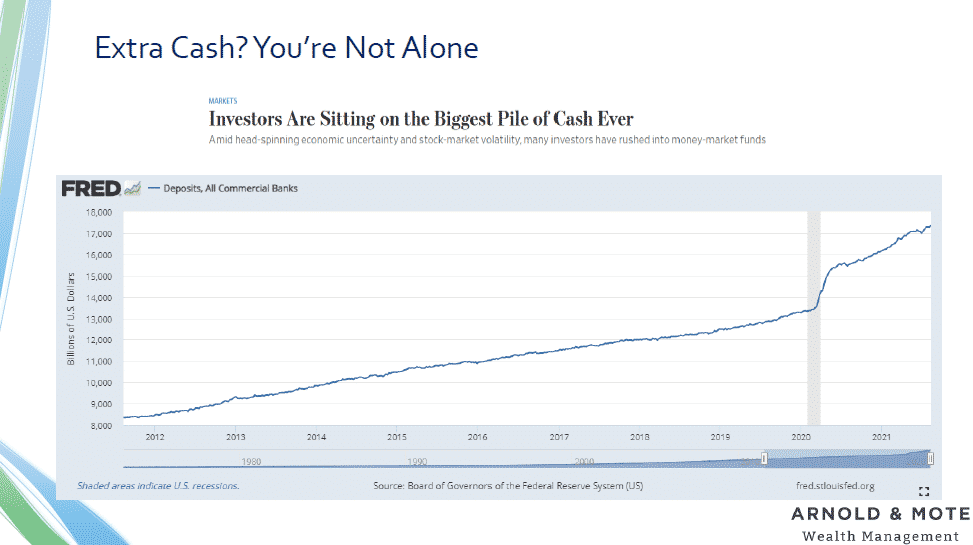

And if this webinar topic resonated with you, you are not alone. The news has covered this pretty heavily recently that consumers are currently flush with cash.

And we know this because the Federal Reserve actually keeps track of this data. This is a chart of cash deposits in the US banking system. And while it has consistently risen around the rate of inflation, notice the big jump up as the coronavirus pandemic unfolded in 2020. Consumers as a whole have added about 2.5 trillion dollars to their cash piles in the last year and a half or so.

So what are your options if you are like the millions of others with extra cash today?

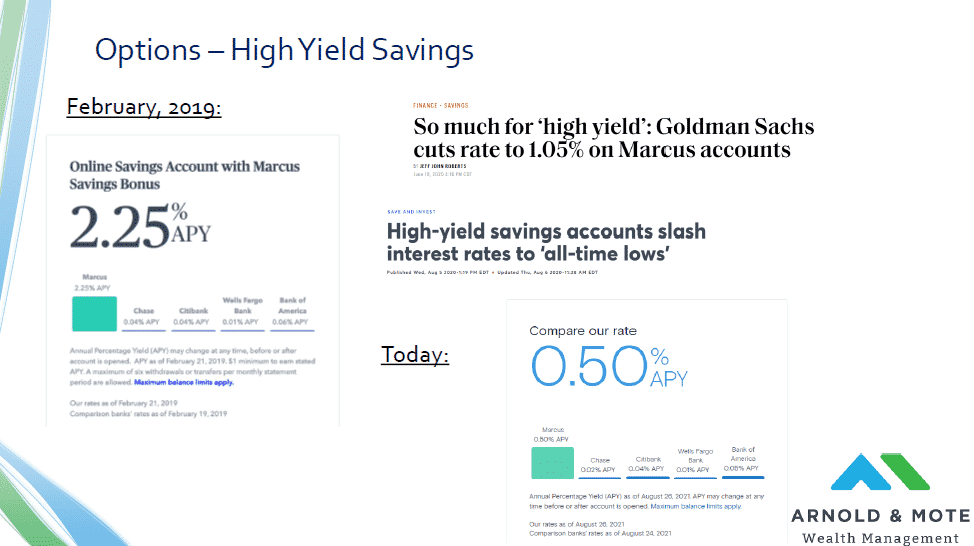

High Yield savings have been incredibly popular lately, and that is because until about a year ago, banks were really fighting for market share and some where offering really good interest rates.

I think everyone here is familiar with the concept of a savings account so I’ll spare you the details. But they come with 2 caveats to think about before moving your cash over.

First, the best rates seem to be with online only banks. So, if you like having a bank branch you can visit, you will have to decide if the added rate is important to you at the sacrifice of not having a local branch.

And more importantly, notice that these rates are never locked in. Right now banks aren’t really competing for deposits, but a couple of years ago they really were, and you saw lots of really good specials for high interest rates. But, many found out that those high rates didn’t last very long.

And just for example, Marcus bank which is owned by Goldman Sachs, was a new entrant to online banking recently. And they came out with really high interest rates initially to attract new customers.

And, after seeing rates like 2.25% percent, billions of dollars from consumers flowed into Marcus Bank.

But, the rate didn’t last. Today their interest rate is down to .5%. Maybe not terrible compared to some other banks, but most people did not even get that 2% rate for a year. It was cut down to 1% in early 2020, and reduced again in late 2020.

And so that is one risk with yield chasing between some of these banks. If getting the highest possible rate at these types of accounts is important to you, you might constantly be shopping around and moving accounts, which can be a bit more hassle than you intended.

CDs – Are CDs a Good Place to Keep Cash?

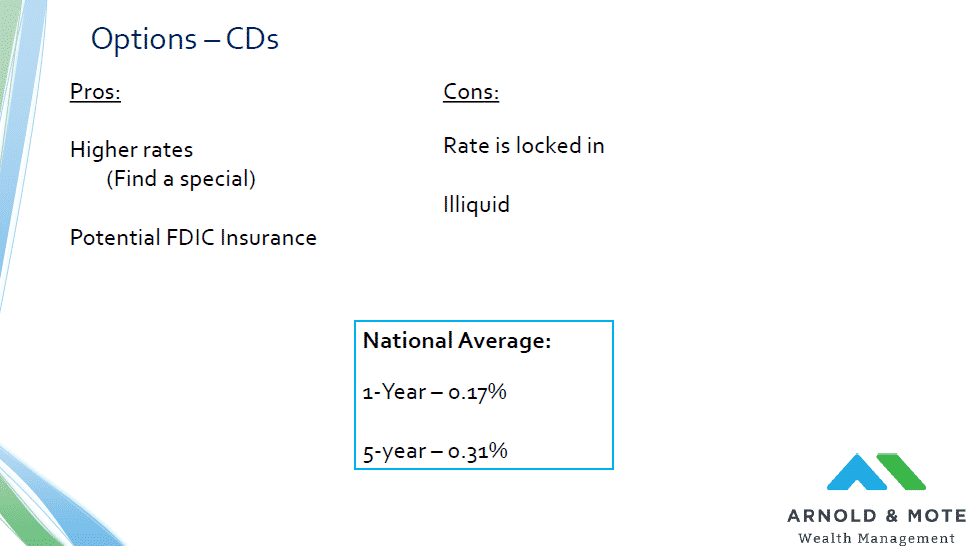

CDs are another thing that I think everyone is familiar with.

It can really be a pro or a con that your rate is locked in. If you get in before rates fall, CDs can be great. If you get in before rates rise, you are stuck in a lower interest account until you pay the penalty to break, or your CD matures.

So, that’s the one thing to keep in mind. If you’re worried about inflation for example – getting into a longer term CD is probably a much worse idea than some of these other options.

Nationally, CD rates are really low right now. Under a half of a percent unless you want to go out many year.

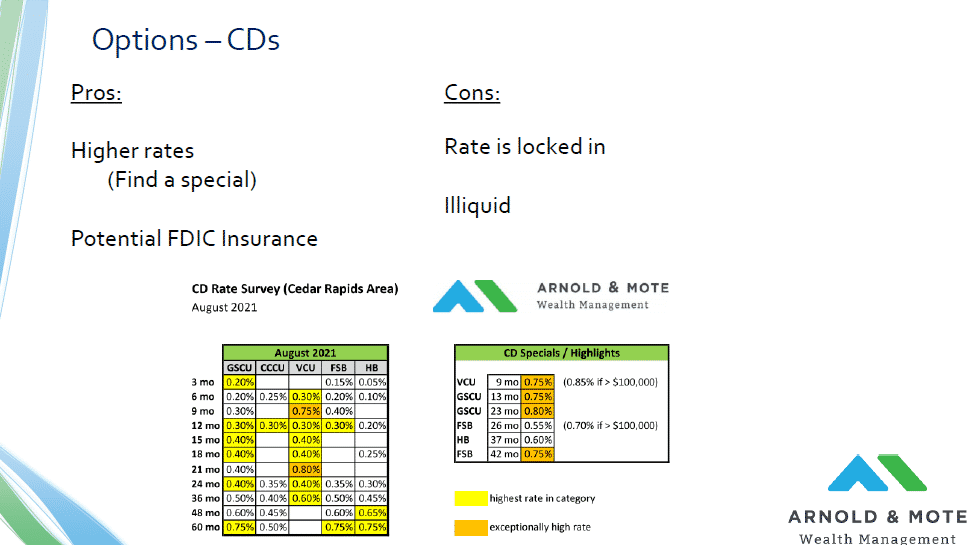

However locally, here in Iowa we are seeing a little higher rates. This is an image from our CD rate sheet that Nick puts together each month, and that we have linked to in the last couple of newsletters.

Where CDs can still be valuable is if you can qualify for special rates that banks seem to regularly offer. These might be set terms, for certainly amounts of money or maybe for only new clients. But, they can offer a little added interest rate for those looking for it.

And just for example, Green State is offering about 0.80% for 1 or 2 year CDs, and that is probably more than you will earn compared to today’s checking, saving, or high yield accounts today.

We are always happy to help you shop around for CD rates if you need. So please reach out to us if it is something you’d like a hand on.

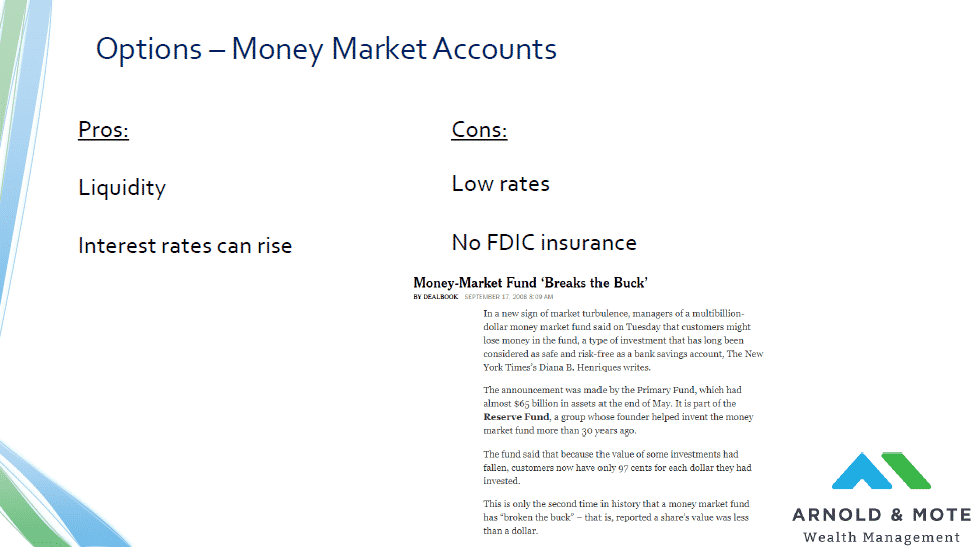

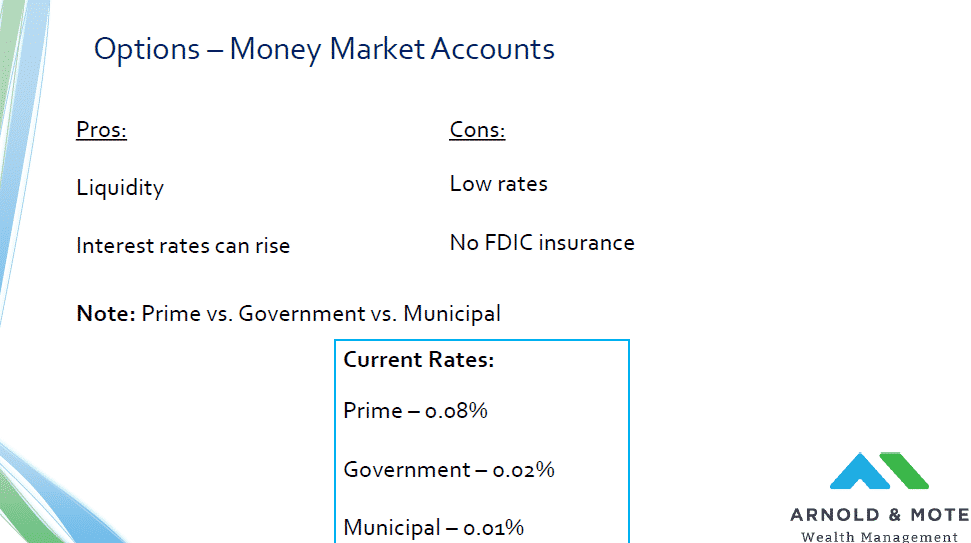

Another option that I think most will be familiar with is money markets.

The big difference in Money Markets compared to what we have discussed before is that money markets are actually investing in something. Money Markets buy really short term debt, usually debt due in 60 days or less.

This leads to some potential differences from other savings types that are just worth bringing up.

First, interest rates for money markets tend to respond to increasing interest rates faster than other savings types we are looking at here. And that is because their interest rates track what companies are actually paying to borrow, and those loans mature and can be reinvested in higher yielding loans very regularly since the investments are so short term.

So, at a time when many are worried about inflation, even thought rates for money market funds are low today, some may make the trade-off knowing they are not locked in to something at a fixed rate, like a CD or even some high yield savings accounts that may not rise quickly with interest rates.

However, because money markets are actually making investments, that means there is technically some risk. 2008 and 2009 saw a big stress on money market funds, and actually really a panic on a few of these funds when one of these funds lost money for their investors.

I have a snippet here of the news article here, but this ignited a pretty big outflow in money market funds, and actually forced the government to temporarily guarantee money markets to stop the bleeding and panic.

Today, that guarantee no longer exists for some money markets, and there was some legislation enacted that changed how money market funds operate.

Today, there are 3 types of money markets and it might be important to know what type of fund you are buying.

Money markets have historically been really popular investments. But right now actually literally have a problem of having too much cash. They have been the prime recipient of that surge in cash that consumers have today. So right now, interest rates are incredibly low. If rates rise that should correct itself, but there’s no telling when that will be.

And lastly I will just say that money markets as they are now regulated after the financial crisis haven’t really had a chance to operate in a high interest rate environment, so there’s not guarantee in my mind they will act like they did historically.

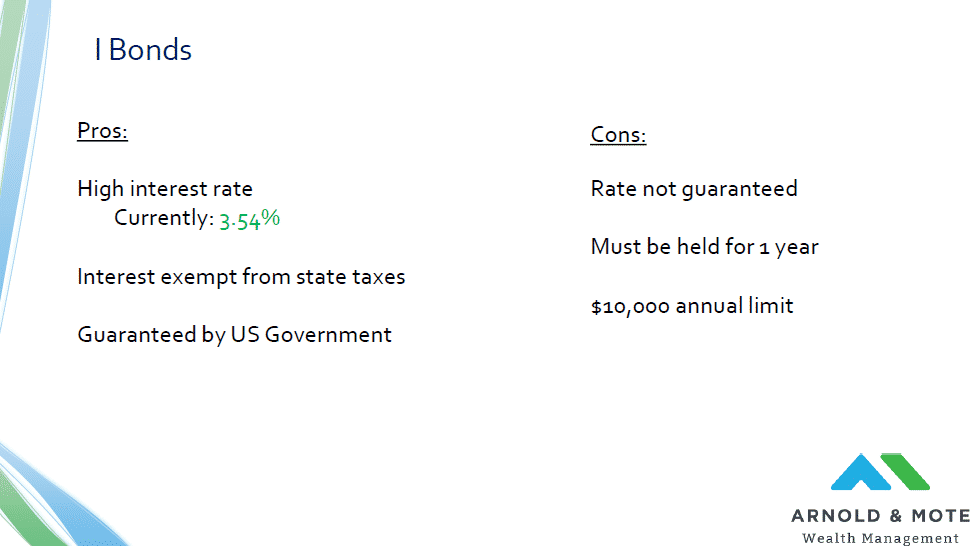

If we introduce anything new to you in this webinar, it may be I Bonds. These are floating rate savings bonds that are issued by the US Government, and guaranteed by the US government that have an interest rate that is pegged to the current inflation rate.

And the first thing that will jump out to you probably is the interest rate. Currently (As of August 2021 – Please note – This rate changes every May and November), I Bonds are paying 3.54%, which is many multiples better than anything else we have discussed so far.

I think I Bonds are great for cash savings, but they come with a couple features that you should know about that can make owning these a little complicated.

First, while that rate looks great right now, it can reset every 6 months. So, if inflation dies down these interest rates can and have historically gone to 0%.

Also, once you buy an I Bond you must hold for at least 1 year. It is not even that there is a penalty for selling in less than a year – it is that you simply can not sell them for a year. So, it might take some planning to ensure that you are comfortable parting ways with that money for at least a year.

There is also a limit to how much in I Bonds you can buy in a single year. Each individual is allowed $10,000. So a married couple can buy $20,000. And there are creative ways to have minors own these as well that could allow large families to buy even more. But, there are potential tax complications if minors are earning a significant amount of interest. So, this limit makes it a little more complicated to move your existing savings over into these bonds. You would need a plan to spread this out over a few years to utilize I Bonds for a large portion of your savings.

And lastly, these can only be purchased on treasurydirect.gov. That is the Treasury’s website where you have to create an account, connect your bank account, and buy the bonds. You can’t buy these through Schwab or other brokerage accounts. So, it will be another account to manage and keep track of.

All that said, if you can work around these caveats, right now the interest rate on I Bonds are the best you will find and I think certainly a good option for some amount of cash.

If we can help you with these, just reach out and let us know.

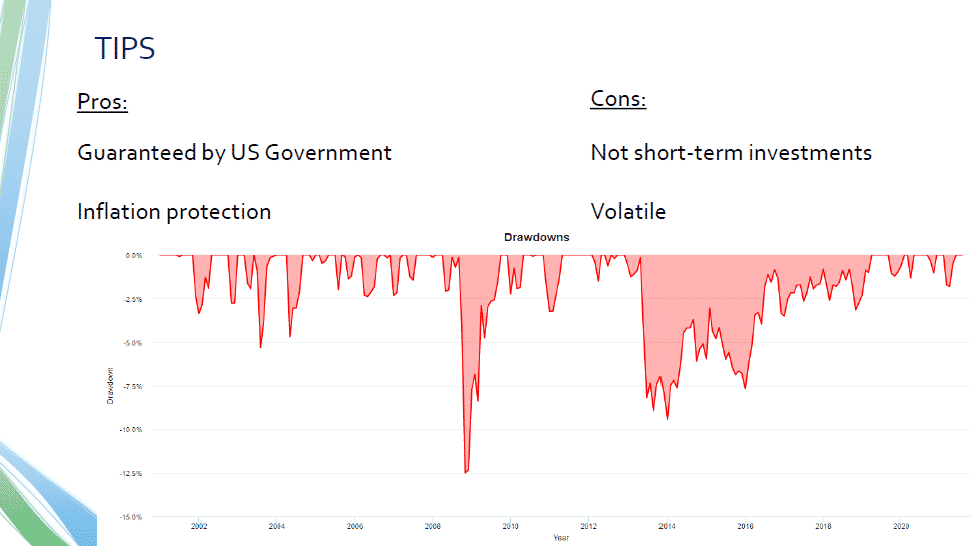

Another really popular investment lately that we have fielded a lot of questions about is TIPS. These are also treasury bonds that have an inflation adjustment. A lot of people think they work just like I Bonds, but they are really quite different.

For starters, TIPS are not really designed to be short term savings vehicles. And if you think about it, that is because inflation is usually not a big impact in any single year. It can make a big impact over a decade or more, and that is what TIPS are designed to protect against.

So, something like a 1-Year TIP doesn’t exist, usually 7 or 10 years is the shortest you can find on the primary market.

If you buy one of these with the intent to hold for only a short period of time, you can actually lose a good chunk of money.

TIPS can have double digit percentage drawdowns at any time as this chart here shows. While the government guarantees the originally owner of these bonds will not lose money over a 10+ year holding period, there is no guarantee that over a short period of time the owner does not lose money.

And also, right now these have negative interest rates, as we have discussed in other our webinar on inflation. So, if you only plan to hold for a short period of time, you would really need a big spike in inflation to come close to breaking even.

Ok, now we are going to move from discussing options for your cash into a look at the bigger picture. And that is looking at questions like how much cash should you have, and when should you use cash compared to longer term investments like stocks and bonds.

I think a worthy initial question to these headlines we are seeing today is that, “is this really a problem”. Perhaps it falls in the category of a good problem to have. But it actually can end up being a problem if this cash makes up a large portion of your net worth and retirement savings.

It’s worth mentioning that the chart on the first slide was only bank account cash, and did not account for cash in 401(k)s or IRAs, which surveys show cash makes up 15-20% of the normal account balance. And this is when a large cash holding can start to actually become a long term problem.

And that’s because while cash is nice in the respect that it is stable in value, it also does not do a good job in maintaining purchasing power over the course of your retirement.

I like this chart here which breaks down how different types of expenses have increased over time. And notice that whether you are a retired couple, or a young family, there are some major expenses here that have seen really high inflation.

Costs Rise Over Time – For Example: Health expenses

For retirees, health care can be one of the largest expenses in retirement. And notice that hospital and medical care has seen some of the highest levels of inflation.

A big part of retirement planning is making sure you have enough money for the next couple of decades. So, imagine knowing you need $38,000 in today’s dollars 20 years in the future, but wanting to use cash to save for that upcoming expenses Because you don’t want to be subject to stock market volatility, or whatever reason.

If you want to set aside cash today to pay for that $38,000 in today’s dollars for health care costs 20 years in the future, you would need to allocate about 3x that amount today if inflation continues at this pace. And if you think about needing to set aside as much as $115,000 for every year of your retirement, you will see that you need a lot of cash today. Its probably not possible unless you have just tens of millions of dollars in cash today.

Large Amounts of Cash Can Hurt Retirement

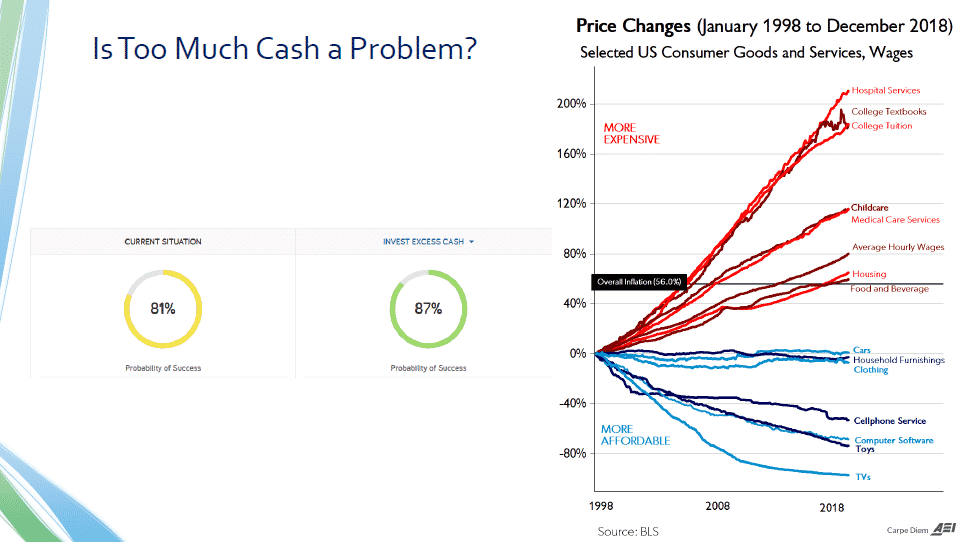

Maybe that was a bit of an extreme example since almost no one we see has a desire to be 100% in cash in their retirement accounts. But we do very often see high allocations, 20 or 30% of their net worth. And even that can have an impact in limited how much you can be projected to be able to comfortably spend in your retirement.

One thing we can do is show you the impact that holding cash can have on your retirement plan, and at least ensure that you are not harming your long term prospects by holding significant amounts of cash today.

Below is an example of our financial planning software, where we can run various scenarios and test the likelihood of success your retirement will have based on many different variables. For example, we can look to see if a large amount of cash would reduce returns enough to jeopardize your retirement:

And that brings us to our last question – When should you invest money compared to keeping it in a savings account.

The classic example is a home down payment, or payment for any other large expense you know you will have in the future.

We know from the last few slides that cash is not a great long term investments. When looking longer term, investing that money has a lot of benefits, mainly growth.

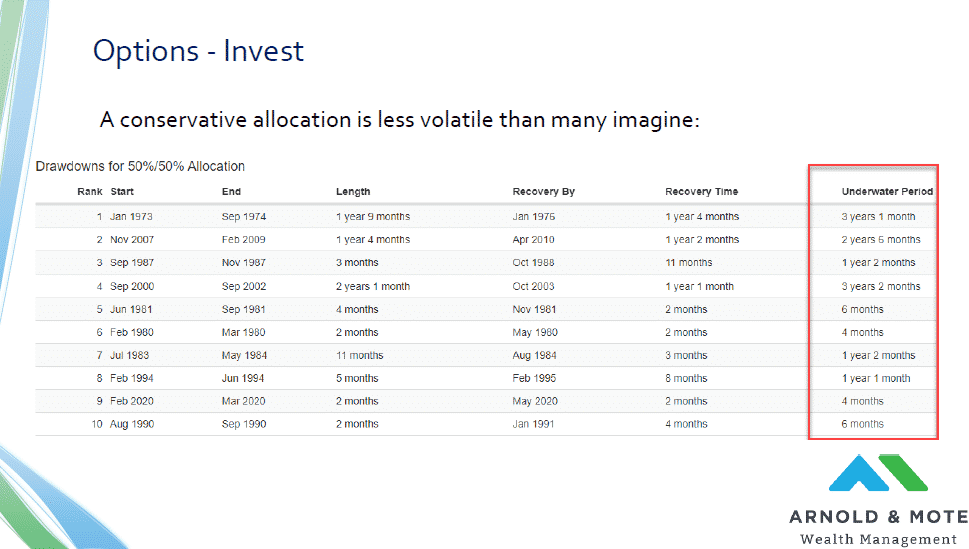

Of course, what is worrisome about investments is the volatility, so I thought it would be interesting to show how a pretty conservative allocation of 50% stocks, 50% bonds has performed at some of the worst periods in stock market history.

What I think we should focus on in this table is that this highlights the absolute worst performances in history for a moderately allocated portfolio. And worst case, an investor was underwater for 3 years.

So, while that is some volatility. You have historically been rewarded with growth.

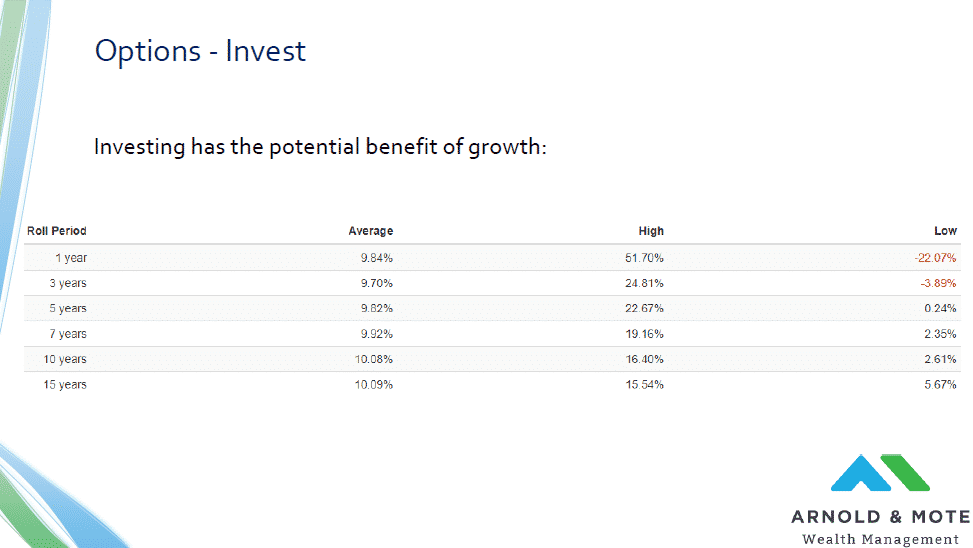

Here is the growth rate of that 50/50 portfolio over various rolling periods.

We can see that in the short term, it can be volatile.

But at periods of 5 years or more, much less so.

So I think this is a good framework to have about how to think about when to use cash for savings, and when it is OK to invest. For sure if you are 5 years out, investing seems sensible. Even 3 years might be ok. Then for shorter time period you are taking a bit of timing risk.

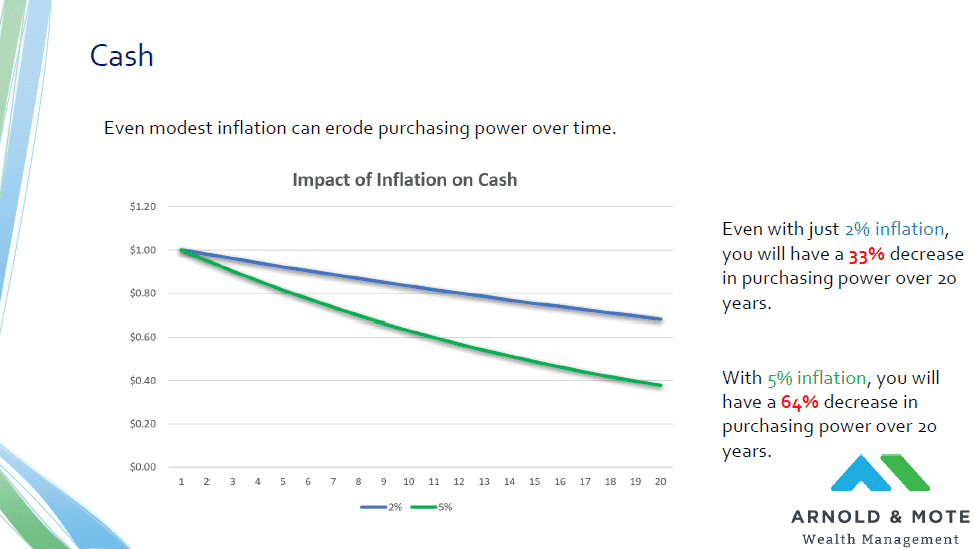

Cash is a Poor Long Term Holding

I just wanted to end with something that I don’t think a lot of people think about.

Everyone is worried about stock market volatility, but no one really talks about the near certainty of losing large amounts of money in a real sense with holding cash.

Even with modest 2% inflation, well below the historic average, 33% of your purchasing power will be eaten away by inflation over 20 years. I think of that as a guaranteed 33% loss on my cash holdings over a 20 year period.

Remember from our tables on the previous slide – a 50/50 stock/bond portfolio has never had a negative 5 year return, let alone a 20 year one! And over that time a 50/50 allocation has averaged nearly 10% annual returns!

How Much Cash Should I Have?

As a general rule, retirees tend to need more cash in their portfolio. This helps insulate them for short term volatile, and the long term impacts of inflation are less severe.

For clients where we are managing their assets – we keep 12-18 months of withdrawals in cash, plus potentially some extra for short term expenses like a car, vacation funds, etc.

Younger clients, especially households with 2 incomes, have the ability to keep a little less. Having an emergency fund is of course important. But getting that extra cash invested is really important to get that long term growth for retirement.

Have questions for us about the best place to invest your extra cash? We offer free, 30-minute meetings here: Schedule a Meeting

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.