Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

You can review and change your Medicare Part D plan each year between October 15 and December 7, which could save you money if your prescriptions or plan costs have changed.

Even if you’re happy with your current plan, it’s smart to compare options annually since premiums, drug coverage, and copays can change.

The Medicare.gov website makes it simple to review plans in about 10–15 minutes, and choosing wisely could save you hundreds of dollars per year.

Between October 15th through December 7th , you are able to change your Medicare Part D plan. While your Medicare supplemental plans will likely remain unchanged for most of your retirement, your Part D Prescription Drug Plan can be changed every year – and it could save you money to shop for plans each year!

If you want to keep your current plan, you don’t need to do anything. Your plan will automatically renew. However, we still recommend going through this process each year to see if new cheaper plans are available, if the coverages for your current prescriptions have changed, and especially if the prescription drugs you are taking have changed.

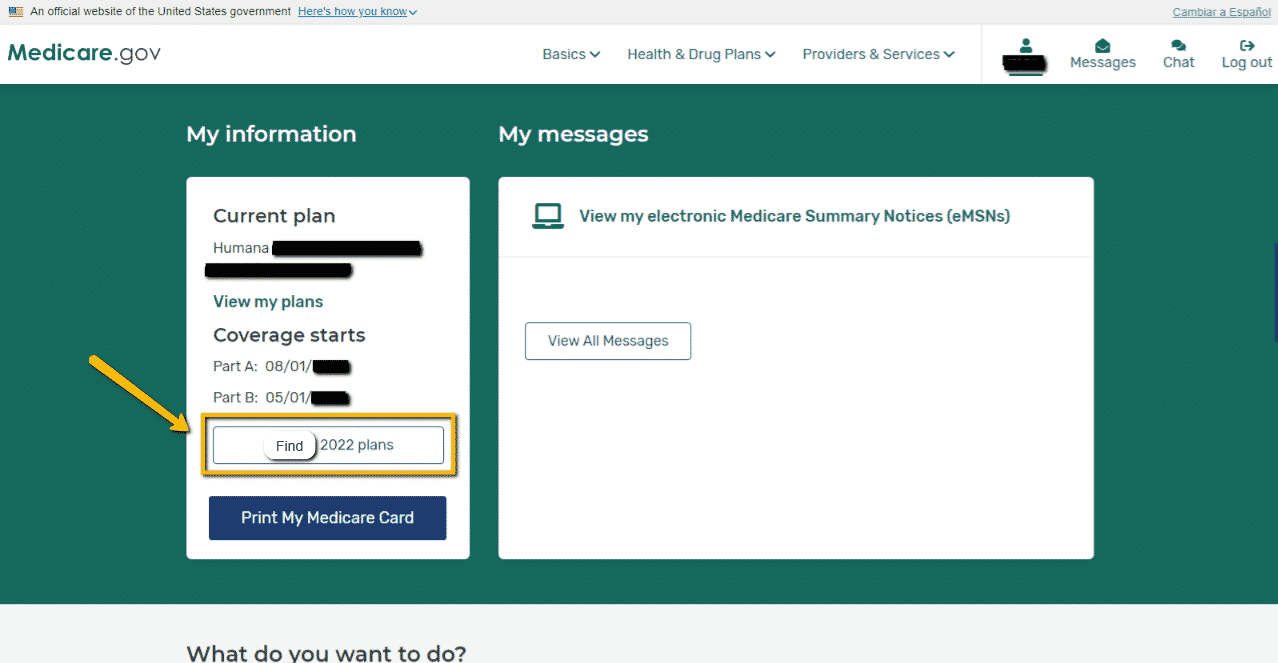

Below we have a series of screenshots walking you through the annual part D review on Medicare.gov, along with a recording of a webinar we did for clients to help them find the best Medicare Part D Drug plan.

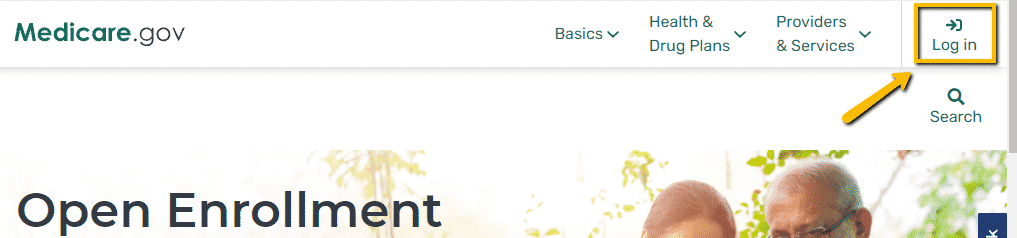

Go to www.medicare.gov and click “Log in” in the top right corner.

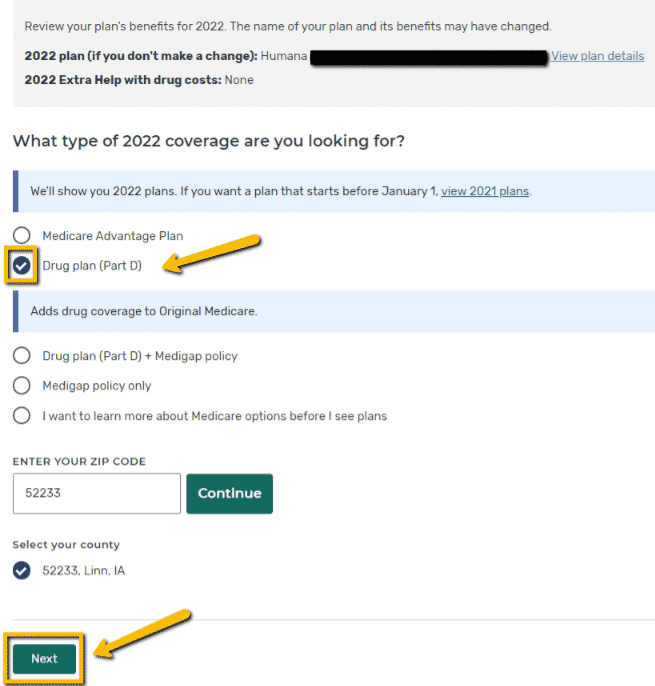

Select “Drug plan (Part D)” (or “Medicare Advantage Plan” if applicable).

If your zip code has changed since last year, enter your new zip and click “Continue.” Select your county.

Click “Next” at the bottom.

Tip: You can click “View plan details” for information about your current plan at the top of the page but you should still complete the next steps.

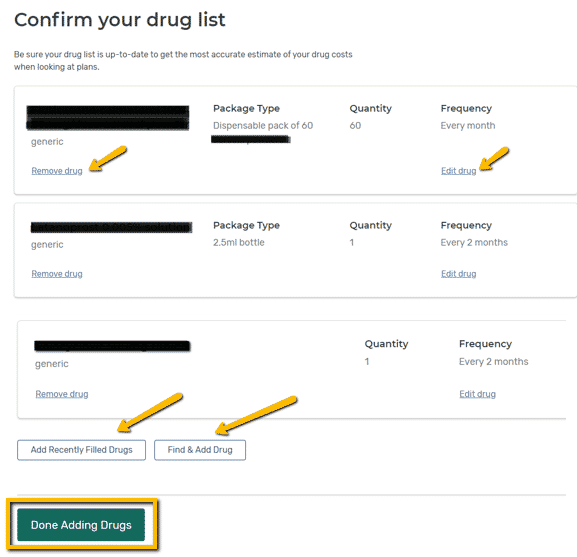

Review and edit your drugs, quantities, and frequencies. (Entering this information provides a more accurate cost estimate.)

Click “Done Adding Drugs.”

Select your preferred pharmacies.

Click “Done” in the lower right corner.

Tip: Select “Mail-order Pharmacy” as an option, it may cost less.

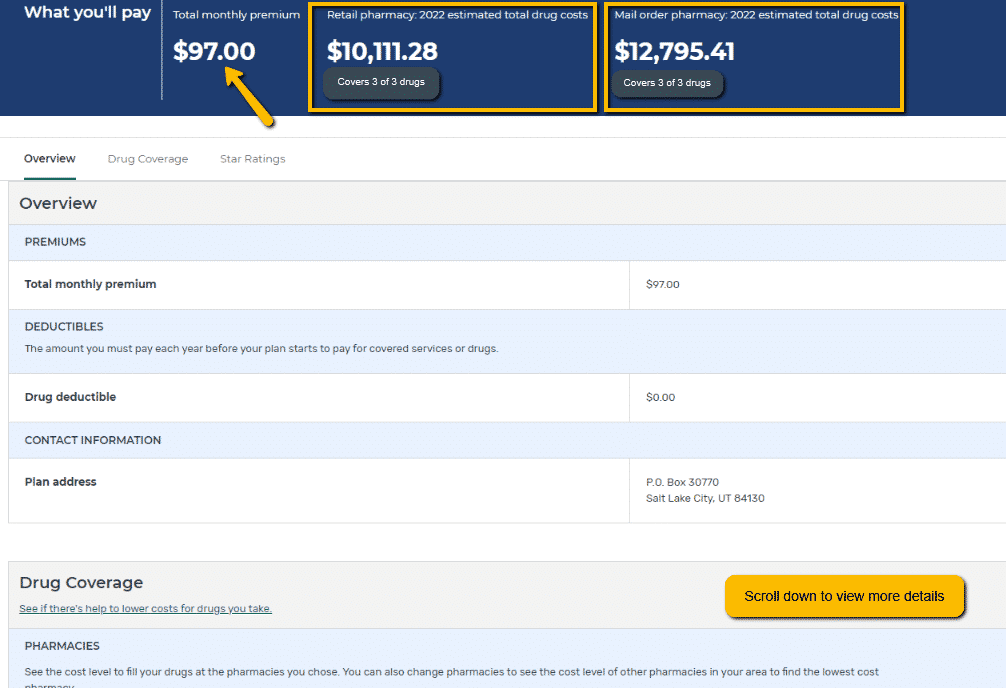

Click the blue “Plan Details” button for each plan you like.

Review the premium AND total estimated costs for each pharmacy at the top of each plan page (see right). Scroll down to view plan details.

Tips:

If you want to switch plans, enroll online if you can. Otherwise call 1-800-MEDICARE or the plan provider. Plans take effect January 1. You should be automatically removed from your previous plan.

Below is the recording and transcript for a webinar we performed for clients in 2020 that walks through the process you should go through each year. Please note that as the Medicare site is updated, a few of the screens may look different than what you see today. As always, if you have any questions about your Medicare, please contact us to see how we can help you.

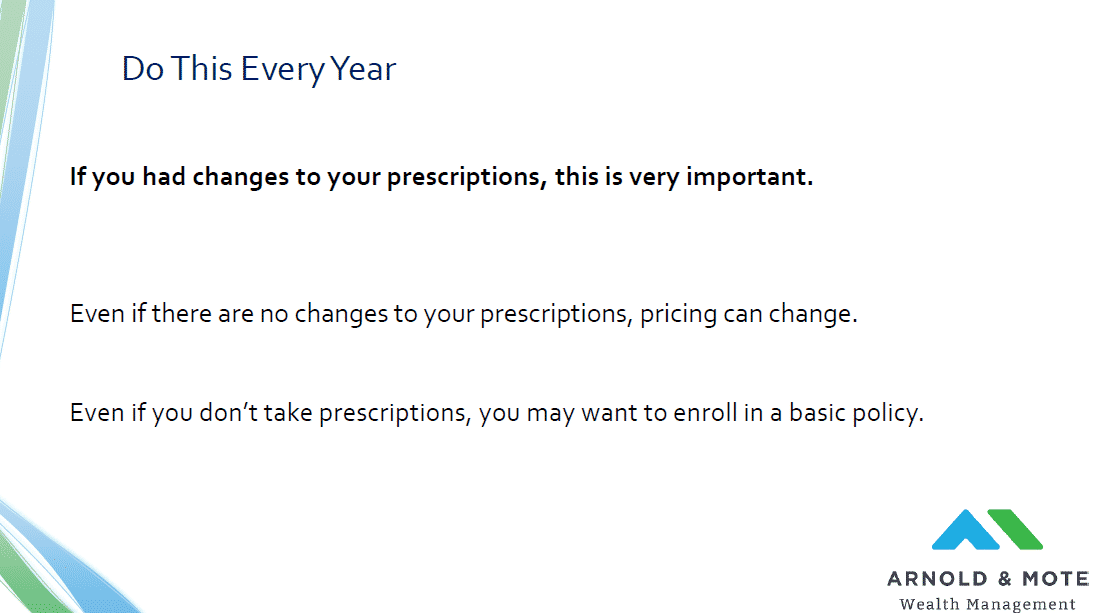

This webinar is for anyone who currently has a Medicare Part D plan. It is especially important for those who have had a change in their prescription drugs during the last year.

But, even if your Medicare Part D plan sent you a notice saying nothing was changing, and even if there were no changes to your prescription drugs, or even if you don’t take any prescription drugs at all – This is still really important.

That’s because these plans change every year. Insurance companies work out new deals with drug makers all the time, costs change, coverage changes, copays change.

And so we have seen clients be able to save a couple hundred dollars per year even without changes in their prescriptions. And Jessi is about to walk through the whole process of comparing Part D plans available, it can take as little as 10 or 15 minutes, so if you can save a couple hundred bucks in that time – its not a bad return.

Lastly, even if you don’t take any prescriptions right now, this can be a good thing to do. A more basic Part D plan costs around $12-15 per month and then will be there to protect you in case you need to start a prescription during the year. Obviously a lot of prescriptions can be very expensive without insurance, so the $15 per month can be a really important safety net in case there is a change in your health.

First we wanted to explain a few of the terms you will see as we go through the Medicare website, or a few terms you may have heard about or read about.

First, are some basic ones that you are probably familiar with from insurance before Medicare even.

Every Part D plan will have a deductible shown. This is what you pay every month for the insurance, but it does not include any drug costs. And so, this premium is the first thing you will see about any of these plans, but if you take a few prescriptions it is probably not the most important part of your plan. Instead your drug costs will be – So, as we’ll see in a minute, don’t get too fixated about just looking for a plan with the lowest premium, because it might not be the best for you once you consider drug costs.

Next, every plan has a deductible. However all Medicare Part D plans must follow rules set by Medicare, so the deductibles on Part D plans are pretty standard and don’t vary a ton. For 2021, the maximum deductible a plan can charge is $445. They can have a lower deductible, but there can not be a plan with a higher deductible than $445.

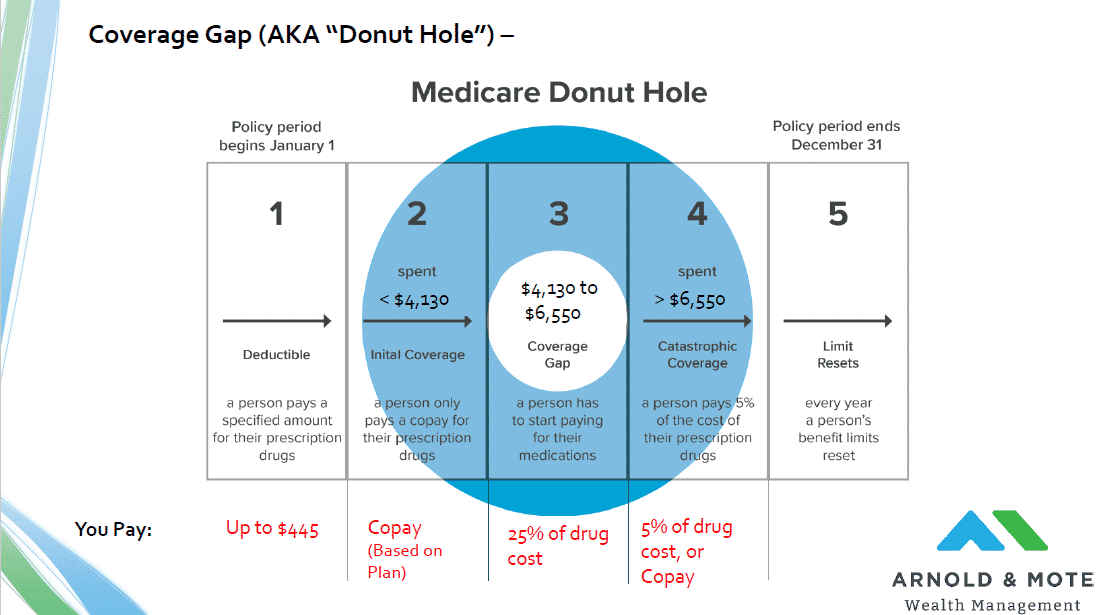

Medicare Part D Coverage Gap, or “Donut Hole”

Beyond the basic terms like we just looked at, the thing that gets the most questions about regarding Medicare Part D is the coverage cap, which has been called the donut hole.

First I will say that this used to be a much larger issue than it is today. 6 or 7 years ago, this coverage gap or donut hole was an area in Medicare Part D that led to people paying a lot out of pocket for their prescriptions. It was a problem for a lot of people who had a few high cost prescriptions. But, it has slowly been closed. It is still a thing today, but it does not have as big of an impact for most as it did years ago.

This donut hole is one of 4 phases of coverage in your Medicare part D plan. Every Part D plan has these 4 phases, but exactly how much you pay in each phase will depend on your plan and your prescription drugs.

But in general, the first phase is your deductible phase. Here, you are paying for your drug costs until your deductible is hit. For some who have a $0 deductible plan this phase doesn’t really exist, and for others it is up to $445.

Phase 2 is what is called the initial coverage phase. Here you are paying pretty set copays or fixed costs for your prescriptions. The exact amounts here are going to depend on the drugs you take and your plan, and will be clearly shown in your plan documents, as Jessi is about to show you.

Then, once you and the insurance company spend a total of $4,130 on drugs, you enter this infamous coverage cap. In this phase, you pay 25% of your prescription drug costs. Now, if you are on cheap generic drugs, this will not be a huge jump in your drug costs. If you are on very expensive drugs, this can still be a pretty steep jump, as 25% of the cost of some drugs can still be a lot of money.

But, this phase does not last long if you have those high cost prescriptions. Once you and the insurance company spend a total of $6,550 you enter the final phase, what is called the Catastrophic coverage phase. Here, you will pay 5% of your drug cost, or a very low copay, between 3 and 10 dollars depending on your drug.

Now this sounds complicated, but the nice thing about the Medicare website and these part D plans is that you will be shown exactly how much you will pay for each prescription you take, and how your monthly payments will change as you move between these payment phases.

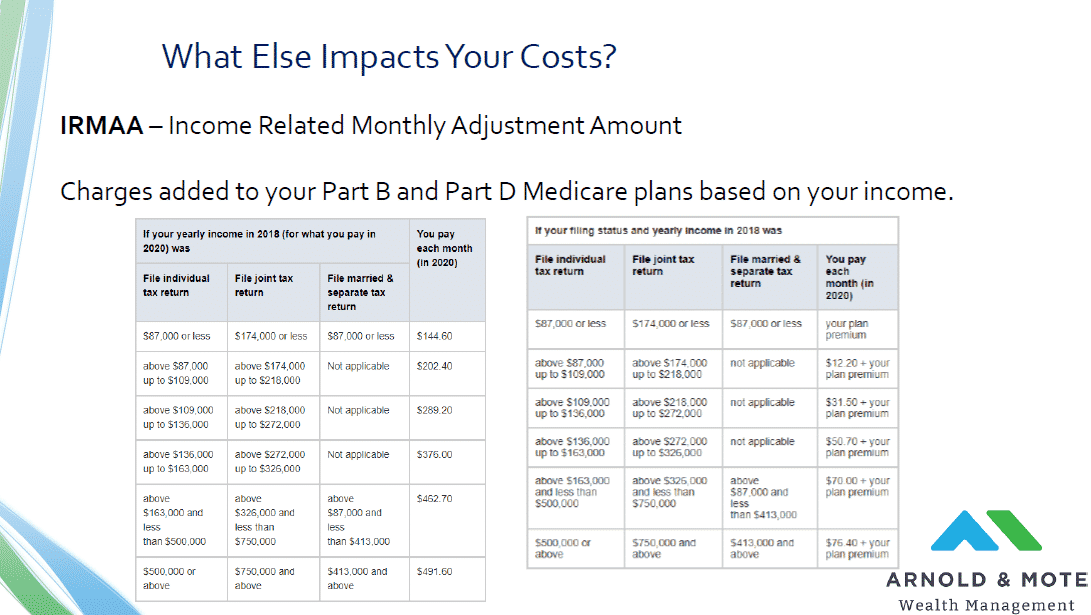

One last thing to consider that may have an impact on the cost of your Medicare Part D plan is what is called IRMAA. This is an added charge on your Medicare plans if your income is above a certain threshold.

This impacts your Part B premiums, but also your Part D premiums as well.

These 2 images here, the left one is Part B premiums based on income and the right is Part D.

So you can see the first bracket is for income above $174,000, and a married couple would each see their part B premiums rise about $60 per month, and part D premiums rise about $12 per month. That means in total, this married couple would see Medicare costs increase about $140 per month, or just under $1,700 per year.

We have talked a lot about this in terms of importance with tax planning, Roth conversions, and other topics. For more, see our blog post on IRMAA’s impact here.

It is somewhat common for some of our clients who just retired, received a severance offer, or who have large purchases in retirement such as a house or a car. We can try and control it with how we use your investment accounts, for example we might use a combination of your IRA, taxable brokerage account, or even Roth IRA for years where you might be approaching these limits.

You can also appeal these extra changes under certain scenarios, which we can help you with.

So, if this impacts you let us know if we haven’t talked about it already, and we will be sure to see how we can help.

If have have not already, watch the video above where we walk through exactly how to do all of this. Jump ahead to 11 minutes and 20 seconds into the video to pick up where this transcript leaves off. From that 11 minute mark on, we go through the Medicare site live showing you how to compare your Medicare Part D plan.

If you still have questions on your Medicare Part D Plan, and how it impacts your financial plan – Please reach out and see if we can help you.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.