Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

When mortgage interest rates fall, refinancing your mortgage can be a great way to save you thousands in interest over time. However, there’s a few items to consider before you rush ahead to refinance.

Depending on the bank or credit union doing your refinance, closing costs on a mortgage refinance can vary greatly. You may want to at least get a couple offers to ensure the costs being shown to you are in line with what others charge.

Also beware, you might be presented with a no closing cost option, but those offers come with a higher interest rate and may not be in your best interest in the long run.

How long do you plan on staying in your house?

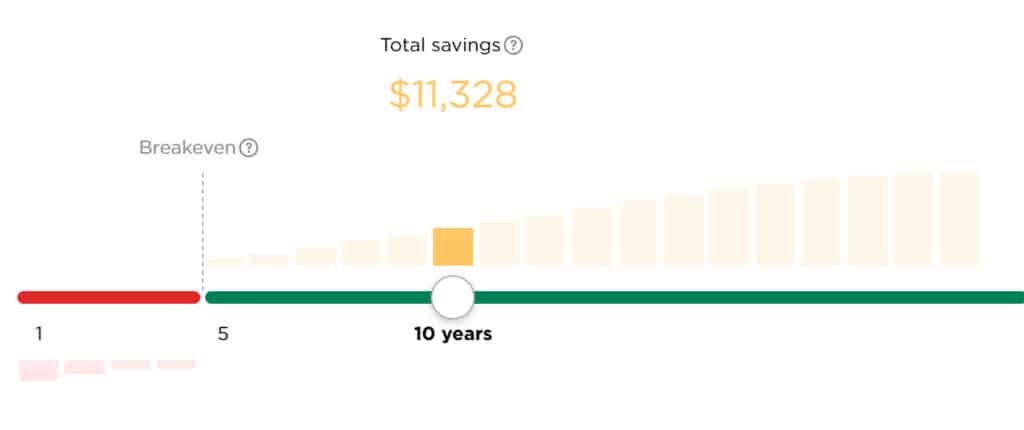

Because of the closing costs, refinances typically take a few years to break even, to when the small amount of interest saved every year makes up for the large one-time expenses of closing costs.

Although your exact break even will depend on many factors, we normally see a breakeven around 3 to 5 years. That means, if you are planning to move in a year or two, it is probably unlikely it is worth it to refinance your mortgage regardless of whether mortgage interest rates are lower or not.

Lastly, be sure not to add too many years to your mortgage. Be sure you refinance into a new mortgage with similar terms to what’s remaining on your current mortgage.

For example, if you have 12 years left on your current mortgage, refinancing into a new 30 year mortgage will add many years of interest payments a lot to your total cost. In this case, you may end up paying more in interest over time despite the lower interest rate, simply because the interest will now need to be paid for a decade longer.

Depending on how many years you have remaining on your mortgage, it may not be worth it to refinance, even if you can get a much lower interest rate.

We have also seen examples from several clients who are close to paying off their mortgage entirely, where it did not make sense to refinance to a lower rate because of closing costs.