Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Inherited IRA rules changed under the SECURE Act – For owners who died in 2020 or later, most non-spouse beneficiaries must empty the account within 10 years.

Annual RMDs now required – Starting in 2025, heirs must take yearly distributions based on what the original owner would have taken, in addition to the 10-year rule.

Poor timing of withdrawals can lead to higher taxes, making it important to plan distributions carefully.

Rules for required distributions from inherited IRAs have changed significantly in recent years.

For several years, there was uncertainty regarding how recent tax laws, such as the SECURE Act, applied to inherited IRA RMDs. Now in 2024, we have some more guidance from the IRS for how much those who inherit IRAs are required to take out each year.

First, know that If the original IRA owner passed away in 2019 or earlier, the SECURE Act does not impact your distributions. You still have your annual distributions you must take out each year, but those have not changed. You can continue what you are doing.

If the original IRA owner passed away in 2020 or later, the SECURE Act applies, introducing additional distribution rules. There are a lot of different rules here depending on your relationship to the original owner, but in this video we’re going to cover just the most common scenario in which a non-spouse beneficiary who is more than 10 years younger than the original owner, inherits an IRA.

So this is inherited from your parents, grandparents, or likely aunts and uncles.

If this applies to you, then you have 2 requirements to be aware of:

First, the entire account must with withdrawn in 10 years.

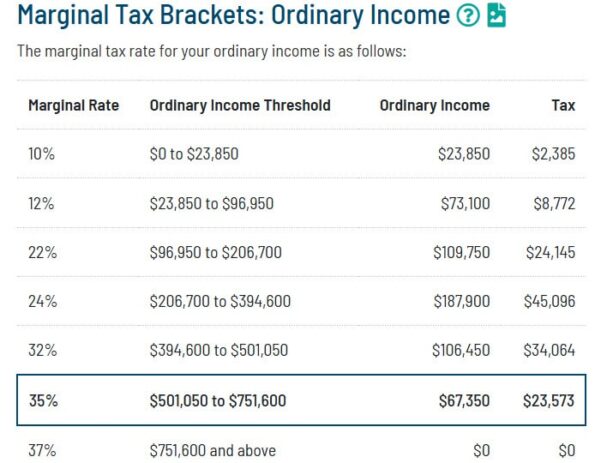

This was a major change from the SECURE Act, creating potential tax pitfalls for those who do not plan their withdrawals strategically. Waiting until year 10 to withdraw the entire account could push you into a higher tax bracket, potentially reducing your after-tax wealth.

Starting in 2025, beneficiaries must take an annual RMD based on the original IRA owner’s age, in addition to following the 10-year rule.

Essentially, you must take the RMD that the original IRA owner would have taken had they lived. There are some RMD calculators online that can help you calculate this amount. The key challenge is determining when to withdraw more than the minimum to avoid large future tax bills.

Like I said, there are a lot of caveats to this rule that you need to be aware of. If you are a surviving spouse or within 10 years of age to the original owner, you have a few other options.

Likewise if you are a minor or disabled, you can delay required withdrawals a bit longer.

But for most heirs, this new rule requiring annual distributions is going to apply.

This makes strategic planning essential to maximize tax efficiency when withdrawing funds. A tax-focused financial advisor can help ensure you minimize taxes today and avoid large tax bills in the future.

If you are looking for help managing your inherited accounts and the tax implications, please reach out to a Financial Planner like Arnold and Mote Wealth Management.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.