Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

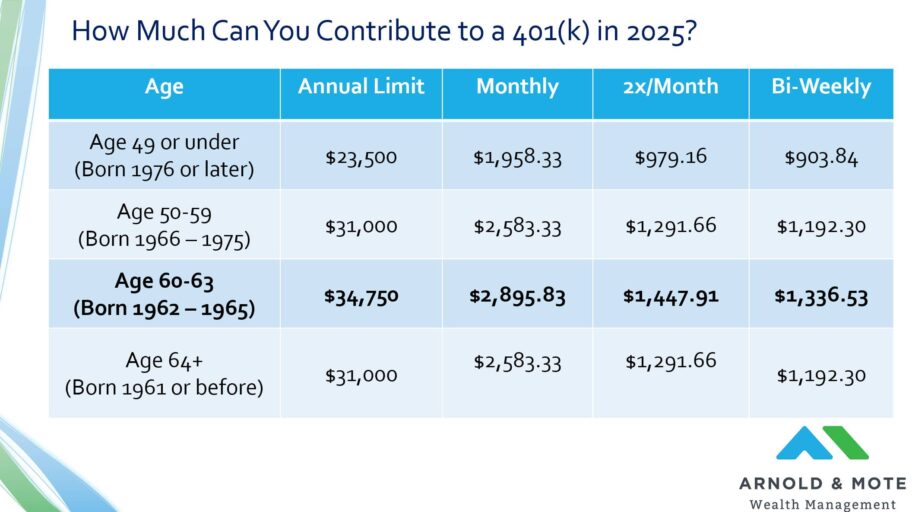

One of the most significant changes to 2025 is a new, extra catch-up contribution amount available for those between ages 60 and 63 in their 401(k), 403(b), or other employer retirement accounts.

For 2025, the regular contribution limit to these accounts is $23,500.

If you are age 50 or older, you get an extra $7,500 you can contribute, for a total of $31,000.

And now beginning in 2025, if you are between age 60 and 63 only, you get another $3,750, for a total maximum contribution of $34,750.

To be eligible for the new, extra, catch up contribution you need to turn age 60, 61, 62, or 63 during the 2025 calendar year.

Or said another way, you are eligible for this extra contribution in 2025 if you were born between 1962 and 1965.

There’s some confusion about eligibility for this because of how the law is written.

For example, If you are already age 63 at the beginning of the year, and turn 64 during the calendar year, you are not eligible for this extra catch up contribution amount.

This also creates scenarios where older workers have reduced contribution limits than their younger coworkers, which is a change from what we are used to.

At age 64, the ability to make this extra contribution ends and your 401(k) contribution limit will decrease back to where it was while you were age 50-59.

Although this extra catch up contribution is a very strange addition to the tax code, ultimately since this was part of the 2nd Secure Act, it is likely here to stay.

If you are near retiring and in your peak earning years, taking full advantage of these increased limits can help reduce taxes, and get your retirement accounts topped off before you begin withdrawing from them soon.

Likewise, if you are working part-time or in a lower income position between the ages 60-63, this gives you a great chance to get a little bit of extra savings into a Roth account, and grow tax free forever.

Ultimately, if you are able to take advantage of this opportunity to increase the savings to your retirement accounts, you should. This bigger question for most is whether to save this amount to the pre-tax side of your retirement account, or Roth. We call this Tax Planning, and is just one of the many services we offer to our clients.